Bond traders prepare for rate hikes

BY Janne Muta

|May 19, 2023US equities gained yesterday following House Speaker Kevin McCarthy's announcement that a vote on a debt-ceiling deal could occur as early as next week. The S&P 500 (+0.9%), DJ (+0.47%), NAS (+2.02%) all gained ground in a broad market rally that helped the DAX (+1.07%) to break out of a trading range it’s been in since early May. Gold (-1.23%) kept trading lower as the T-Bond market sold off sending yields higher.

The sell-off in bonds came after the jobless claims dropped more than expected and the continuing claims reached their lowest point since the beginning of March. This was yet another sign of strength in the labour market that’s causing some traders to reconsider their predictions about the Federal Reserve halting rate hikes.

It was expected the Fed wouldn’t need to hike the rates anymore but now the rising dollar and falling treasury prices (and higher yields) suggest otherwise. The yield on the 10-year Treasury note increased to 3.647%, marking its fifth consecutive day of closing higher. Today's main risk event is Fed Chair Powell's speech.

EURUSD

EURUSD remains bearish below 1.0810 and could trade down to 1.0710. Above 1.0810, look for a move to 1.0860. EURUSD remains bearish as the bond markets expect to see higher rates and push the yields and the dollar higher.

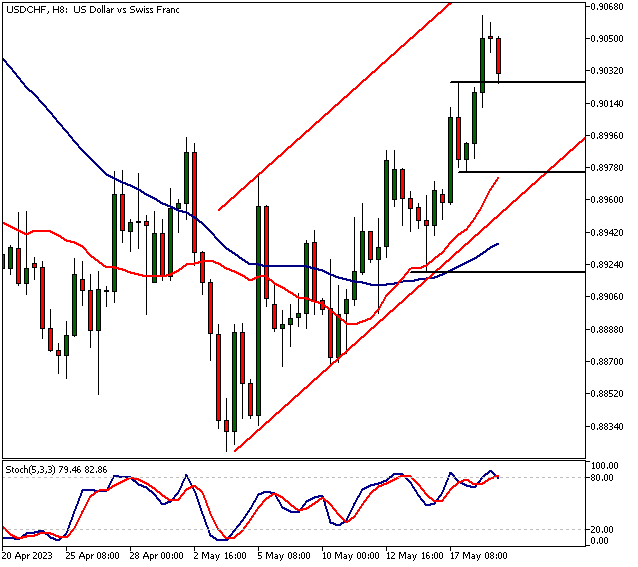

USDCHF

USDCHF bullish above 0.8976 and could trade to 0.9100. Below 0.8976, look for a move to 0.8950. The market is trending higher in the 8h timeframe and the bull channel low is currently at 0.8976 which suggests the bulls might be interested in engaging the market in the proximity of the channel low (if USDCHF retraced back to the level).

DAX

DAX broke out of a trading range it’s been in since May 2nd and reached levels that are very close to the January 2022 high (ATH = 16 297). So with DAX almost at an all-time high level, the upside could be now limited. If there’s a retracement back to the range high (16 009), look for a potential bounce from the level.

If DAX keeps on pushing above the current ATH, there are no reference points that would help us to determine potential target levels. Therefore above 16 297, the only option is to follow the price momentum.

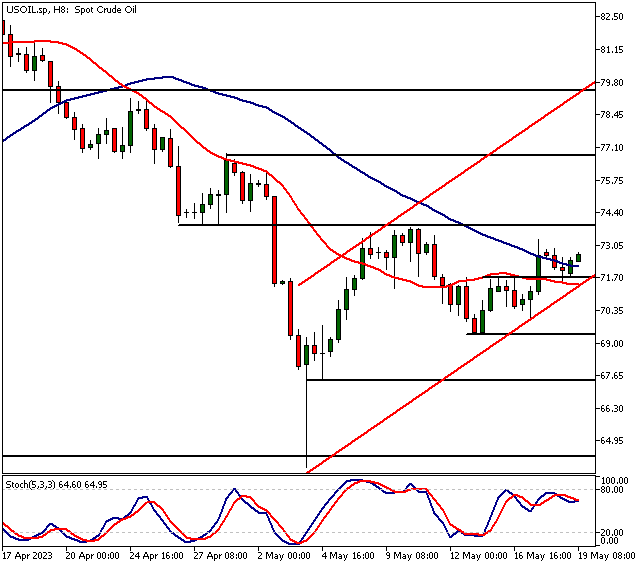

USOIL

USOIL remains bullish above 69.37 and could move to 75.80 and then possibly to 78.30 on extension. Below 69.37, look for a move to 67.80.

The Next Main Risk Events

- CAD BOC Gov Macklem Speaks

- CAD Retail Sales

- USD Fed Chair Powell Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.