Minimal progress in debt-ceiling talks

BY Janne Muta

|May 22, 2023The main US equity indices lost some ground on Friday and finished the week with a down day after Congressional negotiators reported minimal progress in the debt-ceiling talks. S&P 500 closed down by -0.1% while Dow and Nasdaq Composite lost 0.3% and 0.2% respectively. The percentages are tiny but they show some hesitation from investors part. Nasdaq rallied strongly for four days in a row and now investors took some money off the table as the debt-ceiling negotiations didn’t progress.

Powell said on Friday that reduced lending (by banks) after the regional bank crisis could add friction to the economy and might slow down growth. This would eventually cool inflation further and prompted Powell to estimate the central bank might not have to raise rates as much as it otherwise would have. Despite Powell’s comments The T-Bond market kept on sliding which pushed the yields higher.

Rising yields supported the dollar last week and weakened EUR and gold while commodity currencies and oil managed to gain some ground. DAX traded into new all-time highs last week making the market the strongest among the indices we follow. This week the main risk events include the PMI numbers from Europe and US tomorrow, the RBNZ rate decision and the FOMC meeting minutes on Wednesday, the US GDP release on Thursday and the US PCE numbers on Friday.

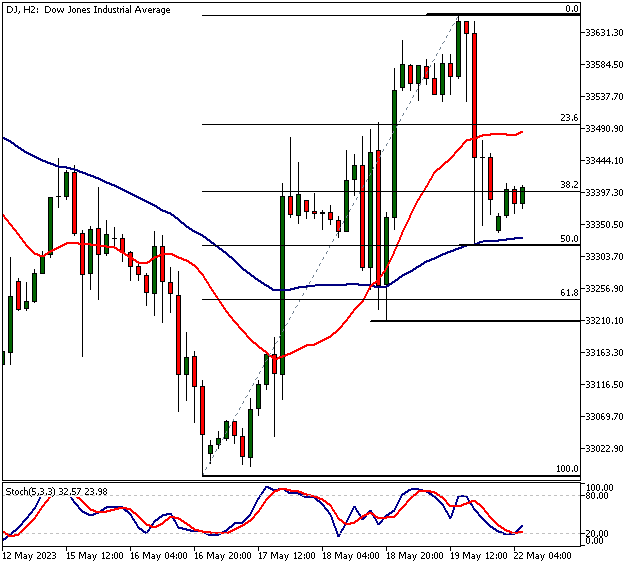

DJ

DJ is bullish above 33 530 and could trade to 33 650. Below 33 530, look for a move to 33 210.

USDJPY

USDJPY remains bullish above 137.29 and could trade to 138.80 and then to 142 on extension. Below 137.29, the market is likely to trade down to 136.50.

EURGBP

EURGBP turns bullish if the bulls manage to push the market decisively above the 0.8734 resistance level. This would open the way to 0.8760. If the EUR bulls fail to take out the 0.8734 level, the market is likely to break the 0.8660 support. Below this level, a move to 0.8625 would look likely.

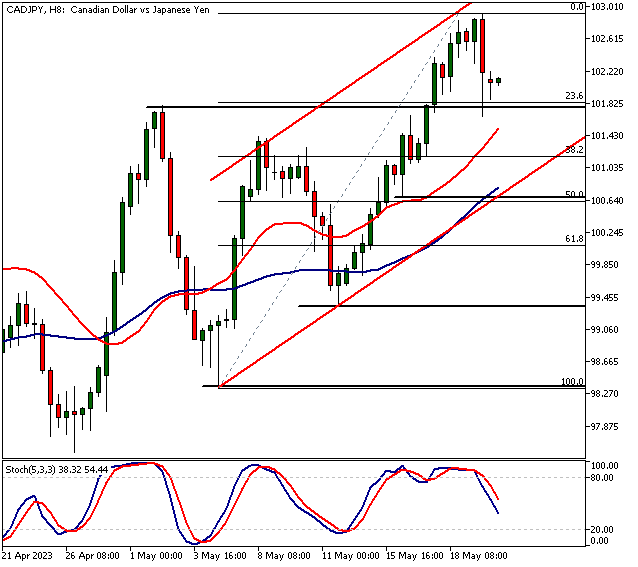

CADJPY

CADJPY is trending higher but is currently overbought. If the nearest support (101.11) breaks and the market pulls back it could provide buying opportunities near the channel low (currently at 100.60). Look for price action confirmation near the channel low before considering long positions in CADJPY. Below 100.60, the market probably trades down to 99.20.

The Next Main Risk Events

- EUR French Flash Manufacturing PMI

- EUR French Flash Services PMI

- EUR German Flash Manufacturing PMI

- EUR German Flash Services PMI

- EUR Flash Manufacturing PMI

- EUR Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

- USD Richmond Manufacturing Index

- NZD Retail Sales

- NZD Official Cash Rate

- NZD RBNZ Monetary Policy Statement

- NZD RBNZ Rate Statement

- NZD RBNZ Press Conference

- GBP CPI

- EUR German ifo Business Climate

- GBP BOE Gov Bailey Speaks

- GBP BOE Gov Bailey Speaks

- USD Treasury Sec Yellen Speaks

- USD FOMC Meeting Minutes

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.