NVIDIA rallies 24%

BY Janne Muta

|May 26, 2023Just a few days ago we wrote about the potential in AI-related stocks like NVDA. Now the 24% rally in NVIDIA shares was the biggest market-driving story yesterday. The stock rallied to new all-time highs after the company forecasted second-quarter revenue that exceeded expectations by over 50%. The company's strong performance was attributed to the growing demand for AI technology.

NVIDIA's outlook and the rally in AI-related sectors helped the Nasdaq Composite to gain while the DJ, DAX and FTSE remained soft. NVIDIA’s resilience, defensible business model, and robust balance sheet contributed to its positive performance during the earnings season. Investors are drawn to NVIDIA and the broader AI space due to its attractive growth potential. Heads up for the US PCE data release an hour before the New York open.

The DJ closed almost unchanged (-0.11%) while the AI-related tech rally helped the S&P 500 to gain 0.88%. The Nasdaq Composite saw a notable increase of 1.71%. However, the UK's FTSE 100 declined by 0.74% while USOIL shed 3.25%, while XAUUSD exhibited a decrease of 0.85%. The Yen depreciated by 0.42% against the USD, while the Euro slipped by 0.23%.

Debt ceiling negotiations continue as the June 1 deadline approaches. However, meaningful progress has yet to be made. Both sides continue to emphasize that a default is not an option. Spending limits remain a key point of contention. Despite the current impasse, a last-minute resolution is still likely.

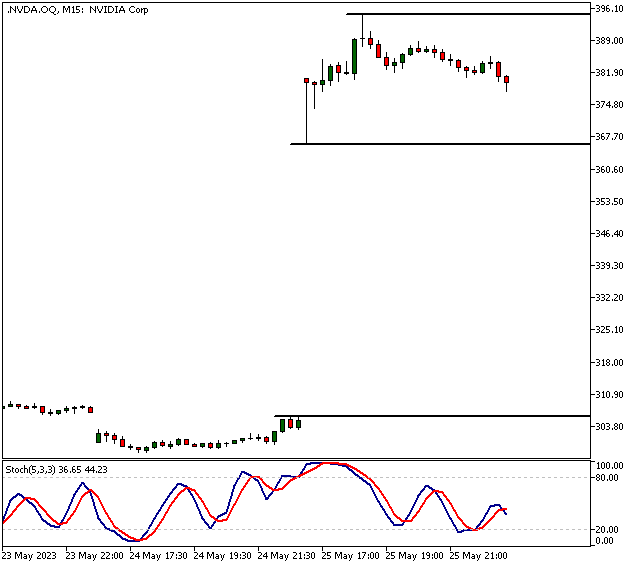

NVIDIA

NVIDIA rallied into new ATH value yesterday. The company's first-quarter performance exceeded expectations, with adjusted earnings per share of $1.09, surpassing the consensus estimate of 92 cents. Nvidia's first-quarter revenue soared to $7.19 billion, well above the consensus estimate of $6.52 billion. These impressive results have propelled Nvidia's share price to approach the coveted trillion-dollar valuation, a feat achieved by only a select group of companies such as Apple, Alphabet, Amazon, Tesla, and Microsoft.

Analysts raised their targets for the stock, reflecting the company's bullish prospects. The heightened optimism surrounding Nvidia can be attributed to its dominant position as an AI chip supplier and the projection of $11 billion in sales for the current period. Remember to keep your risk exposure conservative when trading in this stock. Stocks can move down as well as up. Yesterday’s high (394.75) and low (366.33) for the stock CFD are the nearest key resistance levels. Trade only the price action, not what you expect to see.

DAX

DAX goes on our watch list after the market lost downside momentum yesterday. Technically the market is still in a downtrend in the 8h chart but DAX trades relatively close to a major support level (15 658) and as such the expected value of short trades is considerably lower than a couple of days ago. In other words, the reward-to-risk ratio for short trades tends to be much lower when a market has already moved considerably and is trading near a major support level.

Today’s close will be significant though as it defines the weekly close as well. If the market closes below last week’s low we have a "Bearish Engulfing" pattern. It is a bearish reversal pattern that occurs after an uptrend and signifies a potential trend reversal. The pattern consists of a wide bullish candle followed by a larger bearish candle that completely engulfs the previous bullish candle, with a close below the bullish candle's low.

The fact that the candle highs are equal adds further confirmation to the bearish sentiment. Traders normally interpret this pattern as a sign of increased selling pressure and a potential shift in market sentiment from bullish to bearish. If the market rallies today, the key resistance levels above the current market price are 16 056 and 16 192.

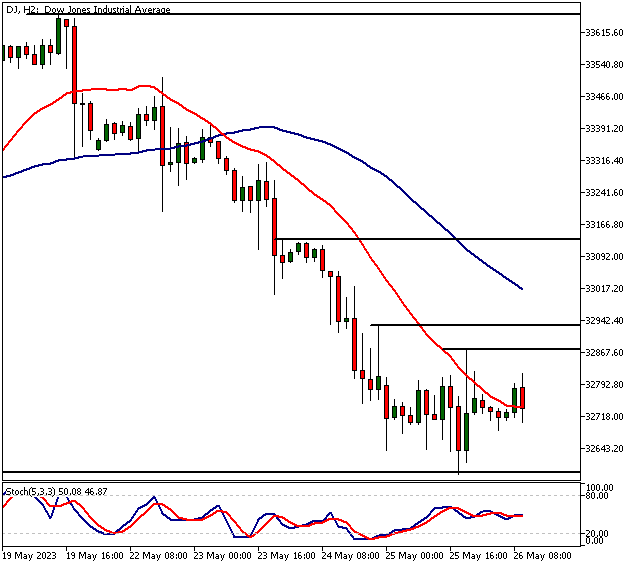

DJ

DJ also lost downside momentum yesterday. This could lead to a 2h trend reversal but we need to see a decisive rally above 32 929 first. Above the level, the market probably moves to 33 130. Below 32 929, look for a test of 32 360.

GBPUSD

GBPUSD is bearish below 1.2387 and might trade down to 1.2260. Above 1.2387, look for a move to 1.2440. Today’s release shows the UK April retail sales volumes increased by 0.5%, (0.3% expected, -1.2% prior). The 0.5% increase indicates a partial recovery from the previous month's decline. Non-food stores saw a notable rebound, and online retail trade also showed resilience with a slight increase.

The Next Main Risk Events

- USD Core PCE Price Index

- USD Core Durable Goods Orders

- USD Durable Goods Orders

- USD Revised UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.