US bank stocks recover

BY Janne Muta

|March 15, 2023DJ and NAS rallied as bank stocks traded higher and T-Bonds lower. This was the first risk-on move after the bank stocks had fallen substantially over the last few days and money had flowed into safe havens like T-Bonds. Traders anticipated that the distress caused by the collapsed banks would be contained and wouldn’t spread to other parts of the financial sector. The move lifted the yields pressuring gold which was trading near a resistance area.

Commodity currencies NZD and AUD were likewise trading near resistance levels and have today corrected lower together with gold. Today we’ll get more inflation-related data as US PPI and retail sales numbers are released an hour before the New York session starts. Also, heads up for the UK Annual Budget Release that is due at the same time (12:30 pm GMT).

DJ is bearish below the 32 280

DJ remains bearish below 32 280. Below the level, the market is likely to trade down to 31 785. If there’s a sustained rally above 32 280, the market probably trades to the 32 400 - 32 450 range. The reaction to the CPI number was rather muted so we might not see a strong rally today but instead, a steady drift lower until we see what the PPI numbers tell us about future inflation trends.

NAS rallied to 12 200

Nasdaq managed to clear the resistance in the 11924 - 12 096 range and rallied to 12 200. Now for NAS to maintain the momentum I’d like to see the market putting in a higher swing low above 11 680 or alternatively a continuous push higher.

The market is, however, still vulnerable as traders don’t quite know what the Fed bankers will do next week. Some believe the Fed will not touch the rates this month (to calm the bank crisis) while others expect to see a 25 bp hike instead of the 50 bp Powell promised last week.

The Fed Funds futures traders price in an 82.5% probability for a 25 bp hike. Yesterday’s rally came on the back of the lower CPI y/y release and lower rate hike expectations. Now we’d need to see further evidence for the bulls maintaining their grip on the market.

However, if the evidence turns out to favour the bears we’ll just follow along and look for shorting opportunities. As it seems that the bank crisis is contained it’s the long-term rate path that will eventually dominate the fundamentals for technology stocks.

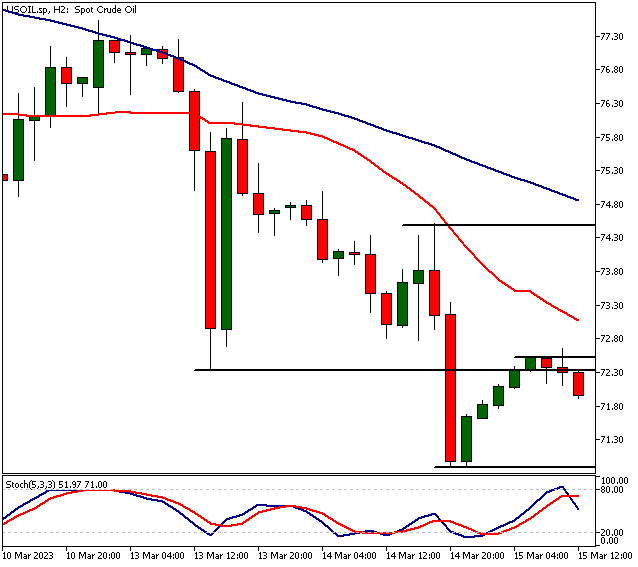

USOIL is bearish below 72.50

USOIL is bearish below 72.50 and could trade down to 70.90 again if the bulls can’t penetrate the level decisively. The market is trading relatively close to a major support level though. In September last year, USOIL rallied strongly from 70.24. Please take this into account when planning your short trades. Above 72.50 USOIL might rally to 73.50 or so and then to 74.20 or so on extension.

GBPUSD is trending higher ahead of the budget release

GBPUSD is trending higher. The uptrend is in force above 1.2135. Below the level, the market probably trades down to 1.2050 or so. For the budget release, keep an eye on what Jeremy Hunt proposes regards new increased spending and government debt. Currently, the UK debt to GDP ratio is nearing 100% which is a pretty high level for an advanced economy. Markets won’t like to see significant debt-funded increases in spending.

The Next Main Risk Events

- GBP Annual Budget Release

- USD Core PPI m/m

- USD Core Retail Sales m/m

- USD Empire State Manufacturing Index

- USD PPI m/m

- USD Retail Sales m/m

- NZD GDP q/q

- AUD Employment Change

- AUD Unemployment Rate

- USD Philly Fed Manufacturing Index

- USD Unemployment Claims

- EUR Main Refinancing Rate

- EUR Monetary Policy Statement

- EUR ECB Press Conference

- USD Prelim UoM Consumer Sentiment

- USD Prelim UoM Inflation Expectations

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets.com

DISCLAIMER TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval. FX and CFDs are leveraged products. They are not suitable for every investor, as they carry a high risk of losing your capital. Please ensure you fully understand the risks involved. All the prices in this report are CFD prices based on price charts provided by TIOmarkets unless otherwise stated.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.