3 Markets to Watch This Week

BY Janne Muta

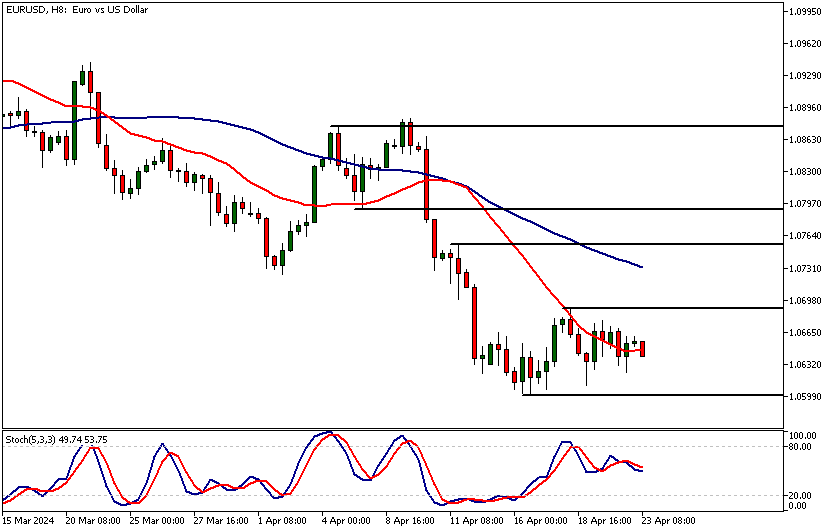

|April 23, 2024EURUSD

While traders wait for the updated GDP data, US economic expansion has been robust, with a notable increase in GDP growth at an annualized rate of 3.4% in Q4 2023. This growth has been underpinned by strong consumer spending and non-residential business investments, indicative of a resilient domestic economy. Furthermore, retail sales have consistently outperformed expectations, suggesting sustained consumer confidence and spending. Employment growth in the US has also been impressive, with significant job additions, notably the 303K jobs added in March 2024, showcasing the strength of the labour market.

Conversely, the Euro Area has experienced a more subdued economic environment. Inflation rates have been on a slight decline, moving from 2.8% to 2.4% from January to March 2024, possibly reflecting weaker consumer demand or more effective monetary policy interventions to curb price rises. The economic growth rate in the EA has generally been lower compared to the US, with a more cautious consumer and investment atmosphere prevailing across the member states.

Monetary policy settings have also diverged. The US Federal Reserve has kept interest rates high at 5.25%-5.5%, reflecting a strategy to manage inflation without stifling growth. On the other hand, the European Central Bank has maintained slightly lower rates (4.5%), indicating a different balance between fostering economic growth and controlling inflationary pressures.

Furthermore, the labour market conditions in the Euro Area have not been as robust as in the US, with slower job growth rates and varying levels of unemployment across the region. This difference may reflect structural variances in the economies and the responsiveness of the labour markets to global economic conditions.

Last week EURUSD consolidated after a sharp fall to the 1.0602 level. The market remains bearish below the latest reactionary high (1.0690) and could retest the 1.0602 level possibly pushing lower. If the support is broken decisively, look for a move down to 1.0530. Alternatively, a conclusive break above the 1.0690 level could move the market to 1.0728.

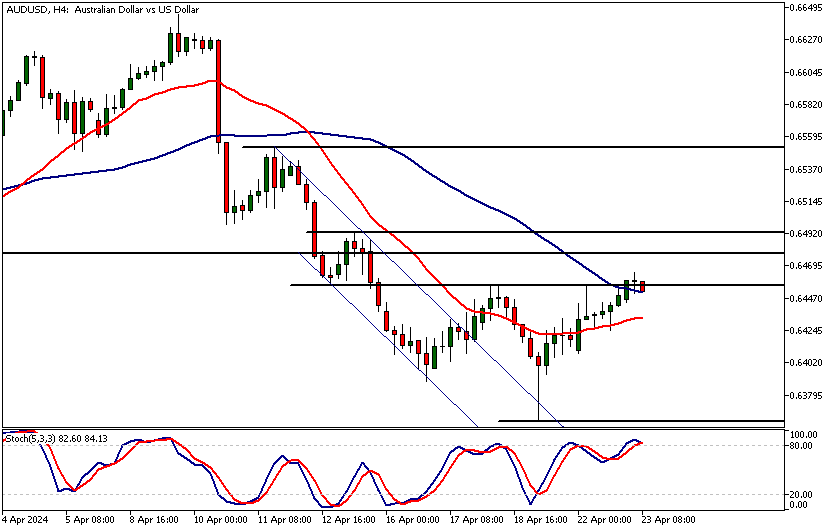

AUDUSD

The US has demonstrated robust economic growth, marked by a notable GDP increase of 3.4% annualized in Q4 2023. This growth is supported by strong consumer spending and business investment, reflecting a resilient domestic economy. In contrast, Australia has shown a more mixed performance. While the trade balance has consistently posted surpluses, indicating strong export performance, domestic indicators like retail sales have been volatile, with sharp fluctuations reflecting consumer spending variability.

The US labour market is particularly strong, with significant job additions such as 303K jobs in March 2024, underscoring a robust employment landscape. Meanwhile, Australia has experienced erratic employment changes, including a substantial job loss in December 2023 followed by recovery. However, the unemployment rates in both countries have remained relatively stable, with Australia maintaining rates around 3.9% to 4.1% and the US showcasing strong labour market resilience.

The Federal Reserve has maintained high interest rates at 5.25%-5.5%, aiming to manage inflation while supporting growth. Conversely, the Reserve Bank of Australia has kept the interest rate steady at 4.35%, reflecting a cautious approach to inflationary pressures and economic support. These interest rate policies directly affect the value of the USD and AUD, with higher rates typically strengthening the currency by attracting foreign capital.

Both economies are grappling with inflation, albeit with varying degrees of intensity. The US has managed to maintain relatively stable inflation levels despite robust economic growth, whereas Australia has seen a slight decrease in inflation rates, yet it remains a critical concern for monetary policy.

In summary, the US economy displays strength in consumer spending and labour market stability, bolstering the USD. Australia's economy, with its strong export sector and controlled inflation, supports a cautiously optimistic outlook for the AUD, despite challenges in domestic consumption and employment volatility. These dynamics offer insights into the factors driving the AUD and USD in global financial markets.

AUDUSD is trying to recover after the USD strength moved the currency pair down to 0.6362. The market has broken out of a bearish trend channel and yesterday’s bullish daily candle shows how the USD bullishness could have peaked, at least momentarily. The key resistance level (0.6477) that roughly coincides with last week’s high remains a challenge for the AUD bulls. However, if the 0.6477 level is penetrated decisively a move to 0.6538 could take place and then possibly to 0.6580. Below 0.6477, look for a move to 0.6410 possibly followed by a re-test of the 0.6362 low.

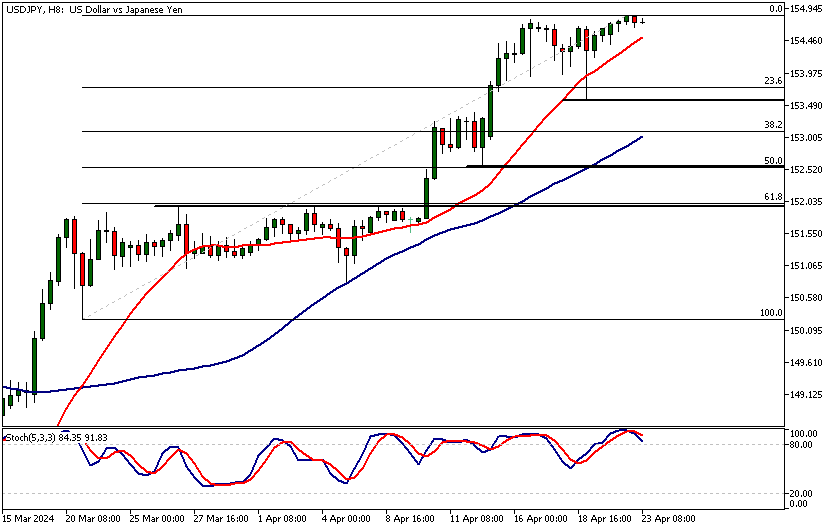

USDJPY

As the Bank of Japan (BoJ) prepares for its upcoming meeting this Thursday, all eyes are on Governor Kazuo Ueda and the central bank's strategic decisions in a complex economic landscape. The BoJ is anticipated to hold the current interest rates near zero (0.10%), maintaining its inflation projection around the 2% target for the next three years. This approach comes in the wake of the central bank's recent exit from an extensive period of radical stimulus, marking a cautious transition in its monetary policy framework.

Governor Ueda has emphasized a data-dependent and measured approach to any future rate hikes, particularly amid uncertainties surrounding wage increases and their potential to drive up prices in the service sector.

Additionally, the central bank plans to introduce its first inflation projection for fiscal 2026, indicating its long-term outlook and response to current economic challenges, such as rising living costs and a weakening yen. These challenges underscore the potential pressure on the BoJ to adjust rates sooner to manage the yen’s decline and mitigate the impact of imported inflation.

After breaking above the 152.00 resistance level USDJPY has rallied strongly. Only lately there has been some loss in the upside momentum but the recent buying that came in at 153.60 suggests the USD bulls are firmly in charge. The market remains bullish above this level and could be likely to push into new highs. Alternatively, below 153.60 we could see a move to 153.00. The nearest key confluence level below 153.60 is at 152.25 where the 50% Fibonacci retracement level is closely aligned with a support level.

How will you trade the markets this week?

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.