Opera con CFDs sobre acciones

Vaya long o short en más de 170 acciones con bajas comisiones

Hacer trading es riesgoso

TRADING DESDE

0.01 DIFERENCIAL POR TICKS

TRADING DESDE

$0 COMISIÓN

HASTA

1: APALANCAMIENTO 20

+

170 ACCIONES

TRADING DESDE

0.01 DIFERENCIAL POR TICKS

TRADING DESDE

$0 COMISIÓN

HASTA

1: APALANCAMIENTO 20

+

170 ACCIONES

Opera acciones de grandes compañías

Símbolo

Oferta

Preguntar

Spread

*Los precios de esta página son orientativos. Los precios de los instrumentos con menor liquidez, como, entre otros, pares de divisas, acciones e índices exóticos, no se actualizan con tanta frecuencia como los instrumentos negociados habitualmente. Consulte dentro de su plataforma MT4/MT5 para conocer los últimos precios en vivo

¿Qué son las acciones?

Las acciones, también conocidas como valores, representan una participación de propiedad en una empresa. Cuando compras acciones de una compañía, estás adquiriendo una pequeña parte de ella, incluyendo el derecho a una porción de sus beneficios. Las empresas emiten acciones para recaudar capital con el fin de expandir su negocio, y estas pueden comprarse o venderse. Sin embargo, con el trading de CFD sobre acciones, puedes especular sobre los movimientos del precio sin necesidad de poseer las acciones reales.

Cómo funciona el trading de CFD sobre acciones

Operar con CFD sobre acciones te permite especular sobre los movimientos de los precios de las acciones de una empresa sin tener que poseerlas realmente. Si crees que el precio de las acciones subirá, puedes comprar (ir en largo). Si piensas que el precio bajará, puedes vender (ir en corto).

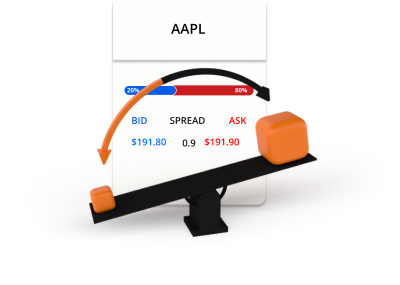

Precios de compra y venta (bid y ask)

Entra largo o corto

Las acciones se negocian en lotes

El trading de acciones implica apalancamiento y margen

Ejemplo de trading de acciones

Decides comprar 0.1 lotes de Apple (AAPL), que tiene un precio de $200 por acción, utilizando un apalancamiento de 20:1.

0,1 lotes = 10 CFD de acciones de AAPL

10 CFDs sobre acciones x $200 = $2000

$2,000 / 20 = $100

Ahora tienes una posición en largo en AAPL por un valor de $2000. Dado que los CFDs sobre acciones se negocian con apalancamiento, solo se utilizan $100 de tu cuenta de trading como margen. Después de algún tiempo, el precio de AAPL se mueve y decides vender.

Escenario 1

AAPL sube de 200 $ a 250 $ y decides vender.

Así es como se calcula la pérdida o ganancia de la operación:

P/G = (Precio actual - Precio inicial) × Cantidad

P/G = ($250 - $200) x 10

P/G = $50 x 10

P/G = $500

Escenario 2

AAPL baja de 200 $ a 150 $ y decides vender.

Así es como se calcula la pérdida o ganancia de la operación:

P/G = (Precio actual - Precio inicial) × Cantidad

P/G = ($150 - $200) x 10

P/G = -$50 x 10

P/G = - $500

Trading de gran valor con un servicio premium

Por esto personas como tú eligen TIOmarkets

Spreads desde 0.0 pips

Opera con spreads variables sin alterar en nuestra cuenta Raw

Trading sin comisiones

Opera desde $0 por lote en nuestras cuentas VIP Black o Standard

MT4 Y MT5

Plataformas de trading avanzadas para escritorio, web y celulares

Ejecución rápida de órdenes

Procesamiento de órdenes eficiente y confiable en milisegundos

Leverage ilimitado.

Opera con un apalancamiento hasta ilimitado en la cuenta Standard

Bono de lealtad del 30%

Obtén un bono en cada depósito a nuestra cuenta Standard

Opera en las plataformas de trading MT4 o MT5

Desde tu escritorio, navegador de internet o móvil

Empieza a hacer trading en minutos

Así es como funciona

PASO 1

Registrarse

Completa tu perfil y crea tu cuenta, solo toma unos minutos

PASO 2

Verificar

Carga tu comprobante de identidad y domicilio, esto es obligatorio antes de retirar

PASO 3

Depositar fondos

Elige entre nuestros cómodos métodos locales e internacionales y deposita al instante

PASO 4

Operar

Descarga la plataforma, transfiere fondos a tu cuenta, inicia sesión y comienza a operar

Hacer trading es riesgoso