TRADE FROM

1 TICK SPREAD

TRADE FROM

0$ COMISIONES

UP TO

1:20 LEVERAGE

170+

ACCIONES

TRADE FROM

1 TICK SPREAD

TRADE FROM

0$ COMISIONES

UP TO

1:20 LEVERAGE

170+

ACCIONES

TRADE FROM

1 TICK SPREAD

TRADE FROM

0$ COMISIONES

UP TO

1:20 LEVERAGE

170+

ACCIONES

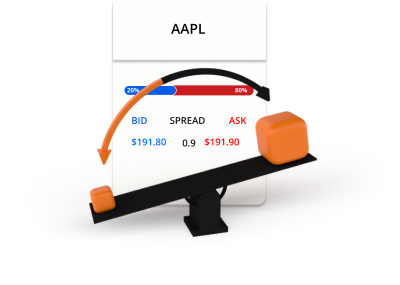

Trade stocks of major companies

Demanda

Ask

Diferencial

*Los precios de esta página son indicativos. Los precios de los instrumentos con menor liquidez, como los pares de divisas exóticos, las acciones y los índices, entre otros, no se actualizan con la misma frecuencia que los instrumentos negociados habitualmente. Compruebe en su plataforma MT4/MT5 los precios en tiempo real más recientes.

What are stocks?

Stocks, also known as shares or equities, represent ownership interest in a company. When you buy a company's stock, you're purchasing a small piece of that company, including the right to a portion of the company's earnings. Stocks are issued by companies to raise capital in order to grow the business and they can be bought and sold. However, with stock CFD trading, it allows you to speculate on the price movement without needing to own the actual stocks.

How stock CFD trading works

Trading in stock CFDs allows you to speculate on the price movements of company stock without owning the actual shares. If you think the share price is likely to rise, you can simply buy it. If you think the price of the shares is likely to fall, you can sell it.

Bid and ask prices

Entra largo o corto

Stocks are traded in lots

Stock trading involves leverage and margin

Stock trading example

You decide to buy 0.1 lots of Apple (AAPL) at $200 using 20:1 leverage.

0.1 lots = 10 share CFDs of AAPL

10 share CFDs x $200 = $2,000

$2,000 / 20 = $100

Now you have opened a long position in the S&P500 worth USD 22,250. Since futures are traded using leverage, only $225 was used as margin from your trading account. After some time, the price of the S&P500 moves and you decide to sell.

Scenario 1

AAPL moves up from $200 to $250 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Scenario 2

AAPL moves down from $200 to $150 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Operaciones de gran valor con un servicio de primera calidad

Por esto la gente como usted elige TIOmarkets

Spreads a partir de 0,4 pip

Nuestra liquidez agregada mantiene unos spreads bajos la mayoría de las veces

Cero comisiones

Opere desde $0 por lote en nuestras cuentas de trading VIP Black o de solo spread

Importe inicial bajo

Abra su cuenta desde solo 10 $ para empezar a operar

Atención al cliente 24/7

Estamos aquí para ayudarle, con un tiempo de respuesta promedio de 3 segundos en el chat en directo.

Ejecución rápida de órdenes

Las operaciones se ejecutan en milisegundos, con escaso deslizamiento, la mayoría de las veces

300+ Symbols

Opere con divisas, acciones, índices y mercados de productos básicos desde cualquier lugar y en cualquier momento

Plataformas fiables

Opere en los mercados financieros internacionales con las plataformas de operaciones MT4 y MT5 desde su ordenador o su dispositivo móvil

Operar con microlotes

Opere desde 0,10 $ por pip, ideal para cuentas pequeñas y para gestionar mejor su riesgo

Aprenda más acerca de trading con TIO Markets

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.