Gold rallies on lower yields

BY Janne Muta

|juin 9, 2023Gold (1.31%) rallied nicely as treasury yields declined, with the 10-year yield falling to 3.714%. The decline in yields comes as investors buy government bonds, possibly driven by the expectation that the Fed isn’t going to raise rates next week.

It’s likely that market participants are already focusing on next week with several key events that are probably going to have a high impact on the markets. The release of US inflation numbers, and the FOMC, and the ECB, BOJ meetings will be closely monitored for any policy announcements or indications of future actions. Today’s main risk event is the employment data release from Canada. Analyst consensus expects to see 21.2K new jobs (41.4K prior).

S&P 500 (0.56%) and Dow Jones Industrial Average (0.38%) gained modestly. In contrast, the Nasdaq Composite outperformed, surging by 1.42%. The move higher was boosted by the likes of AMZN, TSLA and NVIDIA. In Europe, DAX index rose by 0.45%, while FTSE 100 saw a slight decline of -0.27%.

USOIL declined by 2.10%, despite recent production cut announcements. This lacklustre performance can be attributed to global growth concerns, particularly related to the Chinese manufacturing slowdown and lowered demand projections.

The recent surprise rate hikes by the BOC and RBA have served as a reminder that globally the inflation fight isn’t over yet and there could be more rate hikes ahead. The ECB is expected to hike by a quarter-point while the expectation that the Fed will hike the rates by the same 25 bp is only 27.6% at the time of writing this. The expectation has increased from 21.2% a month ago.

Most traders expect to see no change to the current target rate so a surprise move higher by the Fed would bring about significant adjustments to institutional positions and thus open the way to a significant increase in market volatility.

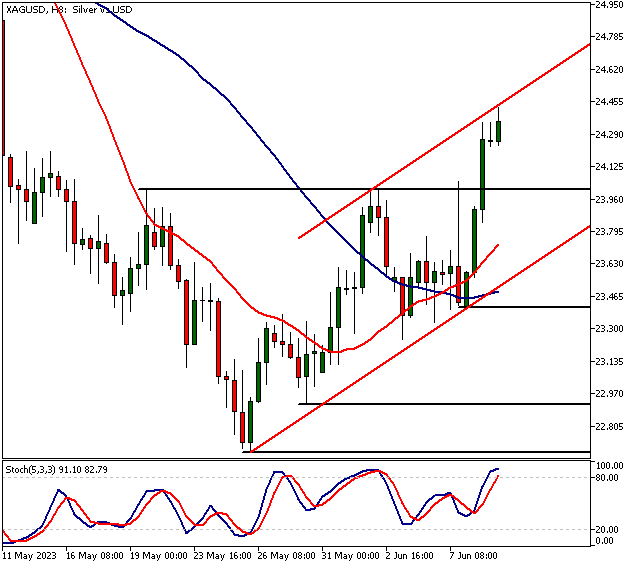

Silver

Silver is bullish above 24.00. Below the level, look for a move to 23.80. The market has been building a base for two weeks and has now broken above it. The neckline of the bottoming formation is at 24.00. Mind though that the recent short-term market top and the bull channel high are right above the current market price. This could slow price advances or even push the price lower before the uptrend in the 8h chart can continue.

S&P 500

S&P 500 is bullish above 4 256. If there’s a decisive break above 4 300, look for a move to 4 375. Below the 4 256 level, the market could move down to 4 240. It’s Friday, however, and traders might not be too keen on pushing the market into new highs today, taking the weekend gap risk. And, we have the FOMC rate decision coming up on Wednesday. Therefore, let’s keep a close eye on how the market reacts above 4 260 as 4 300 is a major resistance level.

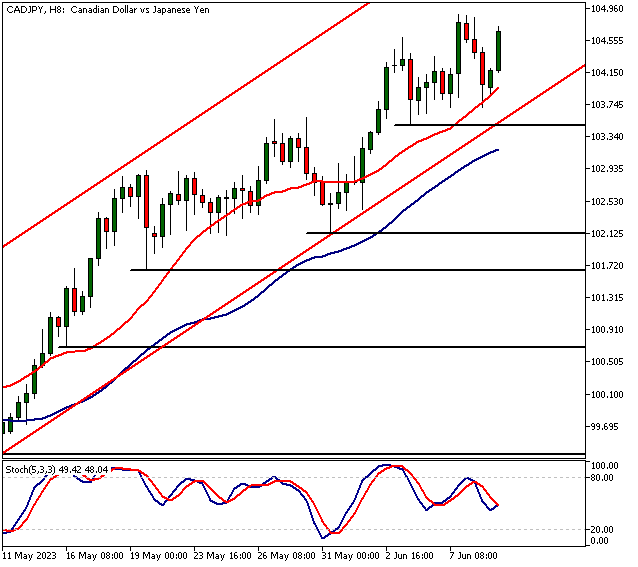

CADJPY

CADJPY is bullish above 103.50 and could move to 104.50 and then possibly to 105.30 on extension. Below the 103.50 level, a move to 103.20 would be likely. The market is trending higher and has lost some momentum this week. Market reaction to employment numbers (21.2K expected, 41.4K prior) later on today hopefully shows us what the balance between the CAD bulls and bears looks like.

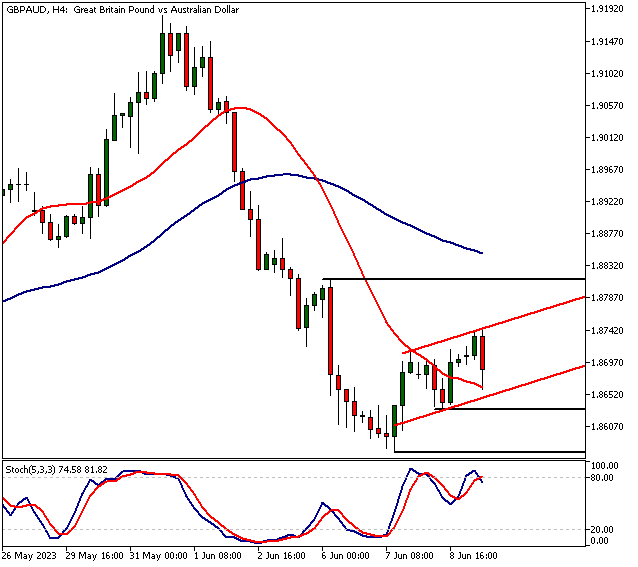

GBPAUD

GBPAUD is bullish above 1.8629 and could trade higher to 1.8770 and then perhaps to 1.8880 on extension. Below 1.8629, look for a move to 1.8600. The market has been trending lower in the 2h chart but is now trying to reverse the trend.

The Next Main Risk Events

- CAD Employment Change

- CAD Unemployment Rate

- USD 10-y Bond Auction

- AUD NAB Business Confidence

- GBP Claimant Count Change

- GBP Average Earnings Index

- EUR German ZEW Economic Sentiment

- USD CPI

- GBP BOE Gov Bailey Speaks

- GBP GDP

- USD PPI

- USD FOMC Economic Projections

- USD FOMC Statement

- USD Federal Funds Rate

- USD FOMC Press Conference

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.