Négocier sur le marché des Forex

Acheter et vendre des paires de devises majeures, mineures ou exotiques

Le trading comporte des risques

COMMERCE DE

0.0 ÉCARTEMENT DES PIPS

COMMERCE DE

$0 COMMISSION

JUSQU'À

1: LEVIER ILLIMITÉ

+

70 PAIRES DE DEVISES

COMMERCE DE

0.0 ÉCARTEMENT DES PIPS

COMMERCE DE

$0 COMMISSION

JUSQU'À

1: LEVIER ILLIMITÉ

+

70 PAIRES DE DEVISES

Négocier plus de 70 paires de devises sur le marché du Forex

Acheter ou vendre des actions majeures, mineures et exotiques

Symbole

Offre

Demander

Spread

*Les prix sur cette page sont indicatifs. Les prix des instruments avec une liquidité plus faible tels que, mais sans s'y limiter, les paires de devises exotiques, les actions et les indices ne sont pas mis à jour aussi fréquemment que les instruments couramment échangés. Veuillez consulter votre plateforme MT4 / MT5 pour les derniers prix en direct.

Qu'est-ce que le marché des changes ?

Le marché du Forex, ou marché des changes, est un marché mondial où s'échangent les monnaies nationales. Il s'agit du marché le plus important et le plus liquide au monde, avec un volume d'échange quotidien moyen de 7 500 milliards de dollars.

Le marché du Forex est ouvert 24 heures sur 24, 5 jours par semaine et est divisé en 3 sessions de négociation principales. Il offre des opportunités et un accès inégalés aux traders du monde entier.

Les opérations de change se déroulent principalement sur un réseau bancaire électronique décentralisé et jouent un rôle crucial dans l'économie mondiale. Il s'agit d'un moyen essentiel pour faciliter le commerce et les investissements internationaux.

Comment fonctionne le trading sur le marché des changes ?

Les opérations de change impliquent l'achat simultané d'une devise et la vente d'une autre. Par exemple, si vous pensez que la valeur de l'euro va augmenter par rapport au dollar américain en raison de la forte croissance économique dans l'UE, vous pouvez choisir d'acheter la paire de devises EUR/USD.

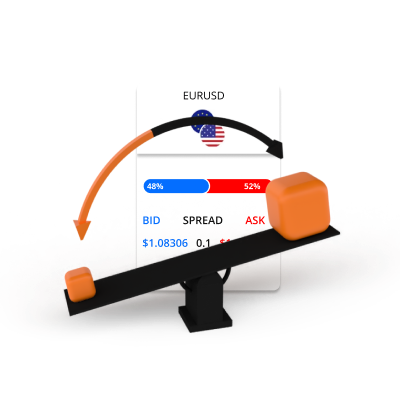

Prix d'achat et de vente

Soyez long ou short

Le Forex est négocié en lots

Les opérations de change impliquent un effet de levier et une marge

Exemple de trading sur le forex

Vous décidez d'acheter 0,1 lot d'EURUSD à 1,0800 en utilisant un effet de levier de 200:1. Les deux devises impliquées dans la transaction sont l'EUR et l'USD.

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

Vous avez maintenant ouvert une position longue de 10 000 euros sur l'EURUSD en vendant simultanément 10 800 dollars. Étant donné que le forex est négocié avec un effet de levier, seuls 54 USD ont été utilisés comme marge sur votre compte de négociation. Après un certain temps, le taux de change entre l'EURUSD évolue et vous décidez de vendre.

Scénario 1

Le taux de change passe de EURUSD 1,0800 à 1,0850.

C'est ainsi que sera calculé le bénéfice ou la perte sur la transaction.

P/L = ((Taux de change actuel - Taux de change initial)

x Valeur de la position) / Taux de change actuel

P/L = ((1.0850 - 1.0800) x 10000) / 1.0850

P/L = (0.0050 x 10,000) / 1.0850

P/L = 46.08 USD

Scénario 2

Le taux de change passe de EURUSD 1,0800 à 1,0750.

C'est ainsi que sera calculé le bénéfice ou la perte sur la transaction.

P/L = ((Taux de change actuel - Taux de change initial)

x Valeur de la position) / Taux de change actuel

P/L = ((1.0750 - 1.0800) x 10,000) / 1.0750

P/L = (0.0050 x 10,000) / 1.0750

P/L= -46.51 USD

Trading à forte valeur ajoutée avec un service haut de gamme

Voici pourquoi des personnes comme vous choisissent TIOmarkets

Spreads à partir de 0.0 pips

Négociez avec des spreads variables bruts sur notre compte Raw

Négociation sans commission

Tradez à partir de $0 par lot sur nos comptes VIP Black ou Standard

MT4 & MT5

Plateformes de négociation avancées pour ordinateur, web et mobile

Exécution rapide des ordres

Traitement efficace et fiable des ordres en quelques millisecondes

Leverage illimité.

Négociez avec un effet de levier illimité sur notre compte Standard

Bonus de fidélité de 30%

Obtenez un bonus à chaque dépôt sur notre compte Standard

Tradez sur les plateformes MT4 ou MT5

Depuis votre bureau, navigateur internet ou mobile

Commencez à trader en quelques minutes

Voici comment cela fonctionne

ÉTAPE 1

S’inscrire

Complétez votre profil et créez votre compte, cela ne prend que quelques minutes

ÉTAPE 2

Vérifier

Téléversez votre justificatif d’identité et de domicile, requis avant tout retrait

ÉTAPE 3

Approvisionner

Choisissez parmi des méthodes locales et internationales pratiques et déposez instantanément

ÉTAPE 4

Trader

Téléchargez la plateforme, transférez des fonds vers votre compte, connectez-vous et commencez à trader

Le trading comporte des risques