Négocier des CFDs sur actions

Acheter ou vendre plus de 170 actions avec des frais réduits

Le trading comporte des risques

COMMERCE DE

0.01 ÉCART DE TICK

COMMERCE DE

$0 COMMISSION

JUSQU'À

1: EFFET DE LEVIER 20

+

170 ACTIONS

COMMERCE DE

0.01 ÉCART DE TICK

COMMERCE DE

$0 COMMISSION

JUSQU'À

1: EFFET DE LEVIER 20

+

170 ACTIONS

Négocier des actions de grandes entreprises

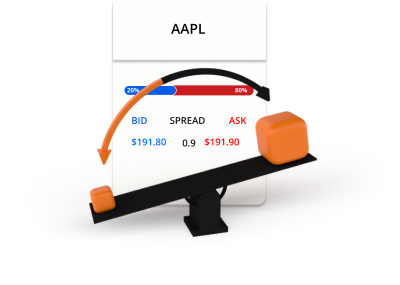

Symbole

Offre

Demander

Spread

*Les prix sur cette page sont indicatifs. Les prix des instruments avec une liquidité plus faible tels que, mais sans s'y limiter, les paires de devises exotiques, les actions et les indices ne sont pas mis à jour aussi fréquemment que les instruments couramment échangés. Veuillez consulter votre plateforme MT4 / MT5 pour les derniers prix en direct.

Qu'est-ce qu'un stock ?

Les actions, également appelées parts ou titres de participation, représentent une participation dans une entreprise. Lorsque vous achetez des actions d'une société, vous achetez une petite partie de cette société, y compris le droit à une partie des bénéfices de la société. Les actions sont émises par les entreprises pour lever des capitaux afin de développer l'activité, et elles peuvent être achetées et vendues. Toutefois, les CFD sur actions vous permettent de spéculer sur l'évolution des cours sans avoir besoin de posséder les actions elles-mêmes.

Comment fonctionne la négociation de CFD sur actions

Les CFD sur actions vous permettent de spéculer sur l'évolution du cours des actions d'une société sans détenir les actions elles-mêmes. Si vous pensez que le prix de l'action est susceptible d'augmenter, vous pouvez simplement l'acheter. Si vous pensez que le prix de l'action est susceptible de baisser, vous pouvez la vendre.

Prix d'achat et de vente

Soyez long ou short

Les actions sont négociées par lots

Les opérations boursières impliquent un effet de levier et une marge

Exemple de négociation d'actions

Vous décidez d'acheter 0,1 lot d'Apple (AAPL) à 200 $ en utilisant un effet de levier de 20:1.

0,1 lot = 10 CFDs sur l'action AAPL

10 CFDs x 200 $ = 2 000

$2,000 / 20 = $100

Vous avez maintenant ouvert une position longue sur AAPL d'une valeur de 2 000 $. Étant donné que les CFD sur actions sont négociés avec un effet de levier, seuls 100 dollars ont été utilisés comme marge sur votre compte de négociation. Au bout d'un certain temps, le cours de l'action AAPL évolue et vous décidez de vendre.

Scénario 1

AAPL passe de 200 à 250 dollars et vous décidez de vendre.

C'est ainsi que sera calculé le bénéfice ou la perte sur la transaction.

P/L = (Prix actuel - Prix initial) x Quantité

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Scénario 2

AAPL passe de 200 à 150 dollars et vous décidez de vendre.

C'est ainsi que sera calculé le bénéfice ou la perte sur la transaction.

P/L = (Prix actuel - Prix initial) x Quantité

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Trading à forte valeur ajoutée avec un service haut de gamme

Voici pourquoi des personnes comme vous choisissent TIOmarkets

Spreads à partir de 0.0 pips

Négociez avec des spreads variables bruts sur notre compte Raw

Négociation sans commission

Tradez à partir de $0 par lot sur nos comptes VIP Black ou Standard

MT4 & MT5

Plateformes de négociation avancées pour ordinateur, web et mobile

Exécution rapide des ordres

Traitement efficace et fiable des ordres en quelques millisecondes

Leverage illimité.

Négociez avec un effet de levier illimité sur notre compte Standard

Bonus de fidélité de 30%

Obtenez un bonus à chaque dépôt sur notre compte Standard

Tradez sur les plateformes MT4 ou MT5

Depuis votre bureau, navigateur internet ou mobile

Commencez à trader en quelques minutes

Voici comment cela fonctionne

ÉTAPE 1

S’inscrire

Complétez votre profil et créez votre compte, cela ne prend que quelques minutes

ÉTAPE 2

Vérifier

Téléversez votre justificatif d’identité et de domicile, requis avant tout retrait

ÉTAPE 3

Approvisionner

Choisissez parmi des méthodes locales et internationales pratiques et déposez instantanément

ÉTAPE 4

Trader

Téléchargez la plateforme, transférez des fonds vers votre compte, connectez-vous et commencez à trader

Le trading comporte des risques