Swap ráták

Credits or debits for rolling positions over to the next trading day

A kereskedés kockázattal jár

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

AVAILABLE

FREE DEPOSITS

AVAILABLE

FREE WITHDRAWALS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

AVAILABLE

FREE DEPOSITS

AVAILABLE

FREE WITHDRAWALS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

AVAILABLE

FREE DEPOSITS

AVAILABLE

FREE WITHDRAWALS

Overnight swaps

Bid

Kérdés feltevése

Különbség, terjedelem

*Az oldalon található árak tájékoztató jellegűek. Az alacsony likviditású eszközök, például az exotikus devizapárok, részvények és indexek árai nem frissülnek annyira gyakran, mint a gyakran kereskedett eszközök árai. Kérjük, ellenőrizze a MT4/MT5 platformon belül a legfrissebb élő árakat.

What are swaps in trading

The swap is a fee credited or debited to your open trades for carrying it overnight to the next trading day. When you roll a position over to the next trading day, you will either earn or pay a swap fee.

When swaps apply

Any open trades carried over to the next trading day may incur a swap fee. The close of the trading day is considered to be at the close of business New York time, or 22:00 GMT (London time). Open trades will continue to accrue swaps until they are closed.

How is the swap calculated

Central banks increase or decrease borrowing costs in accordance with their monetary policy. Each currency has its own interest rate set by the respective central bank. When you buy or sell currencies or assets, the swap is calculated based on the interest rate differential between the assets in the symbol. Swaps are calculated in pips or points based on the interest rate differential between these assets.

For example, suppose the US Federal Reserve (the Fed) sets an interest rate of 5% annually, while the Bank of Japan (BOJ) decides upon a 0% interest rate. This means that the US Dollar would yield 5% interest each year, while the Japanese Yen would not yield anything. Borrowing US Dollars would incur a 5% interest rate while borrowing the Japanese Yen wouldn't incur any yearly interest. So by simultaneously selling the Japanese Yen to buy US Dollars, it would incur a positive swap differential of 5% per annum. However by simultaneously selling US dollars to buy Japanese Yen, it would incur a negative swap of 5% per annum.

The annual swap differential is then divided by the number of days in the year and converted to the pip or point equivalent and is applied to open trades daily.

How swaps affect your trades

Depending on the direction of the trade and the interest rate differential between the two assets in the symbol, you may either earn or pay swaps. If the currency or asset you bought has a higher interest rate than the currency or asset you sold, you will receive the swap (positive swap). If the interest rate is lower, you will pay the swap (negative swap). Swaps affect the unrealized profit or loss of open trades for as long as they remain open and are being carried overnight to the next trading day.

Do swaps vary between markets?

Central banks set interest rates for their respective countries, and these rates can differ significantly. Swaps, especially in forex trading, depend on the interest rate differential between the two currencies in a currency pair. So varying interest rates across countries contribute to different swaps in different markets.

How to find the swaps for each symbol

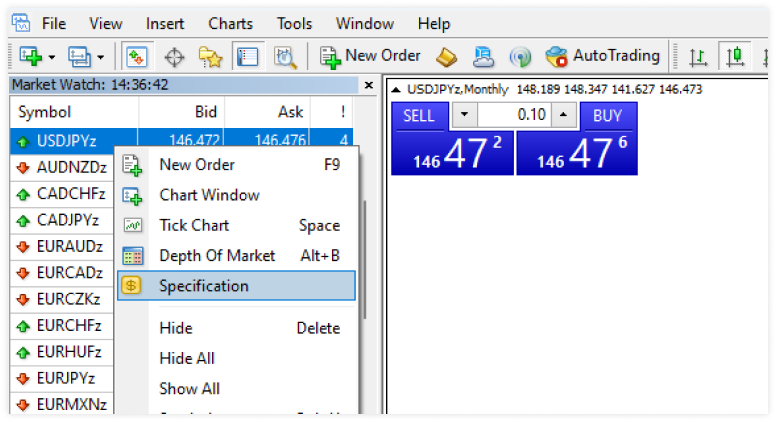

1. Go to the Market Watch window in the MT4 or MT5 trading platforms. MT4 or MT5 trading platforms.

2. Right-click on the financial instrument (symbol) you want to view the swap rates.

3. Select Specification from the menu that appears.

4. The symbol description window will open where you can find the swap rates under Swap long (for buy positions) and Swap Short (for short positions)

Válassza az Önnek megfelelő kereskedési számlát

Minden kereskedési stílusnak és stratégiának megfelelő

Különbség, terjedelem

Változó spread kereskedési számla jutalék nélkül

Spreadek ennyitől:

(Pip értékek)

1.2

Jutalék

(Round turn lotonként)

$0

Platformok

(Metatrader)

MT4 & MT5

Ennyitől indul:

(Deposit)

$10

A kereskedés kockázattal jár

Standard

Minden kereskedési stílusra és stratégiára alkalmas alapszámla

Spreadek ennyitől:

(Pip értékek)

0.6

Jutalék

(Round turn lotonként)

$5

Platformok

(Metatrader)

MT4 & MT5

Ennyitől indul:

(Deposit)

$10

A kereskedés kockázattal jár

VIP

Kereskedjen szűkebb spreadekkel és alacsony jutalékkal

Spreadek ennyitől:

(Pip értékek)

0.4

Jutalék

(Round turn lotonként)

$2

Platformok

(Metatrader)

MT4 & MT5

Ennyitől indul:

(Deposit)

$1,000

A kereskedés kockázattal jár

VIP Black

Kereskedjen szűkebb spreadekkel és jutalék nélkül

Spreadek ennyitől:

(Pip értékek)

0.4

Jutalék

(Round turn lotonként)

$0

Platformok

(Metatrader)

MT4 & MT5

Ennyitől indul:

(Deposit)

$3,000

A kereskedés kockázattal jár

A kereskedéshez kapcsolódó egyéb díjak is felmerülhetnek

Az indulás gyors és egyszerű

Csak néhány percet vesz igénybe, így működik

Register

Töltse ki profilját, és hozzon létre fiókot

Befizetés

Kényelmes finanszírozási módszereink segítségével azonnal befizethet

Trade

Jelentkezzen be a kereskedési platformra, és helyezze el kereskedését

A kereskedés kockázattal jár

Kényelmes finanszírozási módok állnak rendelkezésre

Beleértve az ingyenes be- és kifizetéseket

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.