Komoditas Perdagangan

Perdagangan emas, perak, platinum, paladium, minyak mentah, dan gas alam

Trading mengandung risiko

DARI PERDAGANGAN

0.03 PENYEBARAN CENTANG

DARI PERDAGANGAN

$0 KOMISI

HINGGA

1: PENGUNGKIT TANPA BATAS

7 KOMODITAS

DARI PERDAGANGAN

0.03 PENYEBARAN CENTANG

DARI PERDAGANGAN

$0 KOMISI

HINGGA

1: PENGUNGKIT TANPA BATAS

7 KOMODITAS

Memperdagangkan komoditas global

Simbol

Penawaran

Tanyakan

Spread

*Harga-harga di halaman ini bersifat indikatif. Harga-harga untuk instrumen dengan likuiditas lebih rendah seperti pasangan mata uang eksotis, saham, dan indeks tidak diperbarui se sering instrumen yang umum diperdagangkan. Silakan periksa di dalam platform MT4/MT5 Anda untuk harga live terbaru.

Apa itu Komoditas?

Komoditas seperti emas, perak, platinum, minyak, dan gas alam adalah bahan mentah yang memainkan peran fundamental dalam ekonomi global. Harga komoditas ini terkait langsung dengan penemuan, ekstraksi, dan konsumsi, serta menentukan harga berbagai barang dan jasa. Anda bisa memperdagangkannya untuk mencoba memanfaatkan dinamika penawaran dan permintaan ini.

Komoditas populer meliputi

Minyak Mentah

Symbol: USOIL

Minyak Brent

Symbol: UKOIL

Gas Alam

Symbol: USNGAS

Emas

Symbol: XAUUSD

Perak

Symbol: XAGUSD

Cara kerja perdagangan komoditas

Trading komoditas memungkinkan Anda berspekulasi mengenai pergerakan harga komoditas tanpa harus memiliki komoditas fisiknya. Jika Anda merasa harga komoditas akan naik, Anda bisa membelinya. Jika Anda merasa harga komoditas akan turun, Anda bisa menjualnya.

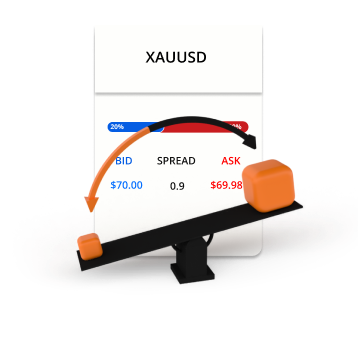

Harga penawaran dan permintaan

Ambil posisi long atau short

Komoditas diperdagangkan dalam lot

Perdagangan komoditas melibatkan leverage dan margin

Contoh perdagangan komoditas

Anda memutuskan untuk membeli 0,1 lot Minyak Mentah pada harga $70 dengan leverage 20:1.

0,1 lot = 100 barel Minyak Mentah

100 barrels x $70 = $7,000

USD 7,000 / 20 = $350

Sekarang Anda telah membuka posisi long pada Minyak Mentah senilai $7.000. Karena komoditas diperdagangkan menggunakan leverage, hanya $350 yang digunakan sebagai margin dari akun trading Anda. Setelah beberapa waktu, harga Minyak Mentah bergerak dan Anda memutuskan untuk menjual.

Skenario 1

Minyak Mentah bergerak naik dari $70 ke $80 dan Anda memutuskan untuk menjual.

Dengan cara inilah keuntungan atau kerugian dari perdagangan akan dihitung.

K/K = (Harga saat ini - Harga awal) x Kuantitas

K/K = ($80 - $70) x 100

K/K = $10 x 100

K/K = $1,000

Skenario 2

Minyak Mentah bergerak turun dari $70 ke $60 dan Anda memutuskan untuk menjual.

Dengan cara inilah keuntungan atau kerugian dari perdagangan akan dihitung.

K/K = (Harga saat ini - Harga awal) x Kuantitas

K/K = ($60 - $70) x 100

K/K = -$10 x 100

K/K = - $1,000

Mengapa TIOmarkets

Inilah sebabnya orang seperti Anda memilih TIOmarkets

Spreads mulai dari 0.0 pips

Trading dengan spread variabel kasar pada akun Raw

Trading tanpa komisi

Trading dari $0 per lot di akun VIP Black atau Standard kami

PLATFORM TRADING

Platform trading canggih untuk desktop, web, dan seluler

Eksekusi order cepat

Pemrosesan order yang efisien dan andal dalam hitungan milidetik

Leverage tak terbatas.

Trading dengan leverage hingga tidak terbatas pada akun Standard

Bonus Loyalti 30%

Dapatkan bonus setiap deposit ke akun Standard kami

Berdaganglah di platform perdagangan MT4

Dari desktop, browser internet, atau perangkat mobile Anda

MT4 dirancang dan dikembangkan untuk perdagangan valas dan berjangka. Untuk memungkinkan para pedagang menganalisis dan memperdagangkan pasar keuangan, menguji kembali strategi perdagangan, mengembangkan robot perdagangan, dan meniru pedagang lain.

Mulai trading dalam hitungan menit

Begini cara kerjanya

LANGKAH 1

Daftar

Lengkapi profil Anda dan buat akun Anda, hanya membutuhkan waktu beberapa menit

LANGKAH 2

Verifikasi

Unggah bukti identitas dan alamat Anda, ini diperlukan sebelum penarikan

LANGKAH 3

Kirim Dana

Pilih dari metode lokal dan internasional yang nyaman dan setor secara instan

LANGKAH 4

Trading

Unduh platform, transfer dana ke akun Anda, masuk, dan mulai trading

Trading mengandung risiko