Perdagangkan CFD Saham

Ambil posisi long atau short 170+ saham dengan biaya rendah

Trading mengandung risiko

DARI PERDAGANGAN

0.01 PENYEBARAN CENTANG

DARI PERDAGANGAN

$0 KOMISI

HINGGA

1: PENGUNGKIT 20 KALI

+

170 SAHAM

DARI PERDAGANGAN

0.01 PENYEBARAN CENTANG

DARI PERDAGANGAN

$0 KOMISI

HINGGA

1: PENGUNGKIT 20 KALI

+

170 SAHAM

Memperdagangkan saham perusahaan-perusahaan besar

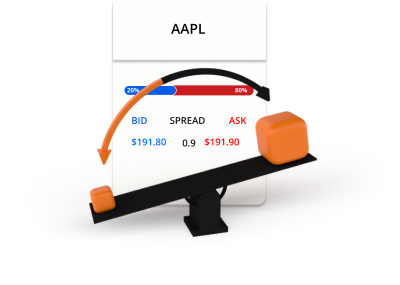

Simbol

Penawaran

Tanyakan

Spread

*Harga-harga di halaman ini bersifat indikatif. Harga-harga untuk instrumen dengan likuiditas lebih rendah seperti pasangan mata uang eksotis, saham, dan indeks tidak diperbarui se sering instrumen yang umum diperdagangkan. Silakan periksa di dalam platform MT4/MT5 Anda untuk harga live terbaru.

Apa itu saham?

Saham, juga dikenal sebagai saham atau ekuitas, mewakili kepentingan kepemilikan dalam sebuah perusahaan. Saat Anda membeli saham perusahaan, Anda membeli sebagian kecil dari perusahaan tersebut, termasuk hak atas sebagian pendapatan perusahaan. Saham diterbitkan oleh perusahaan untuk meningkatkan modal guna mengembangkan bisnis, dan saham dapat dibeli dan dijual. Namun, dengan trading CFD saham, Anda bisa berspekulasi mengenai pergerakan harga tanpa perlu memiliki saham yang sebenarnya.

Cara kerja trading CFD saham

Trading CFD saham memungkinkan Anda berspekulasi mengenai pergerakan harga saham perusahaan tanpa memiliki saham yang sebenarnya. Jika Anda merasa harga saham akan naik, Anda bisa membelinya. Bila Anda merasa harga saham cenderung turun, Anda bisa menjualnya.

Harga penawaran dan permintaan

Ambil posisi long atau short

Saham diperdagangkan dalam lot

Perdagangan saham melibatkan leverage dan margin

Contoh perdagangan saham

Anda memutuskan untuk membeli 0,1 lot Apple (AAPL) dengan harga $200 menggunakan leverage 20:1.

0,1 lot = 10 CFD saham AAPL

10 saham CFD x $200 = $2.000

$2,000 / 20 = $100

Sekarang Anda telah membuka posisi long di AAPL senilai $2.000. Karena CFD saham diperdagangkan menggunakan leverage, hanya $100 yang digunakan sebagai margin dari akun trading Anda. Setelah beberapa waktu, harga AAPL bergerak dan Anda memutuskan untuk menjual.

Skenario 1

AAPL bergerak naik dari $200 menjadi $250 dan Anda memutuskan untuk menjual.

Dengan cara inilah keuntungan atau kerugian dari perdagangan akan dihitung.

K/K = (Harga saat ini - Harga awal) x Kuantitas

K/K = ($250 - $200) x 10

K/K = $50 x 10

K/K = $500

Skenario 2

AAPL bergerak turun dari $200 ke $150 dan Anda memutuskan untuk menjual.

Dengan cara inilah keuntungan atau kerugian dari perdagangan akan dihitung.

K/K = (Harga saat ini - Harga awal) x Kuantitas

K/K = ($150 - $200) x 10

K/K = -$50 x 10

K/K = - $500

Perdagangan bernilai tinggi dengan layanan premium

Inilah sebabnya orang seperti Anda memilih TIOmarkets

Spreads mulai dari 0.0 pips

Trading dengan spread variabel kasar pada akun Raw

Trading tanpa komisi

Trading dari $0 per lot di akun VIP Black atau Standard kami

PLATFORM TRADING

Platform trading canggih untuk desktop, web, dan seluler

Eksekusi order cepat

Pemrosesan order yang efisien dan andal dalam hitungan milidetik

Leverage tak terbatas.

Trading dengan leverage hingga tidak terbatas pada akun Standard

Bonus Loyalti 30%

Dapatkan bonus setiap deposit ke akun Standard kami

Trading di platform MT4 atau MT5

Dari desktop, browser internet, atau perangkat mobile Anda

Mulai trading dalam hitungan menit

Begini cara kerjanya

LANGKAH 1

Daftar

Lengkapi profil Anda dan buat akun Anda, hanya membutuhkan waktu beberapa menit

LANGKAH 2

Verifikasi

Unggah bukti identitas dan alamat Anda, ini diperlukan sebelum penarikan

LANGKAH 3

Kirim Dana

Pilih dari metode lokal dan internasional yang nyaman dan setor secara instan

LANGKAH 4

Trading

Unduh platform, transfer dana ke akun Anda, masuk, dan mulai trading

Trading mengandung risiko