Banking fears reduced by deposit growth

BY Janne Muta

|maggio 18, 2023Equities yesterday amid optimism for a debt-ceiling agreement and strong deposit growth in regional banks. Western Alliance Bancorp was previously troubled by stability concerns but reported now an increase in deposits this quarter. The bank's shares rose by 10%. This helped the KBW Nasdaq Regional Banking Index (+7.3%) to its most significant percentage rise since 2021.

Even though the US retail sales numbers came in a bit lower than expected, investors kept on buying stocks. Despite economic headwinds from Fed rate hikes and high inflation, consumer spending remains strong. The debt-ceiling issue is expected to be resolved as Congressional leaders said they were cautiously optimistic that a debt-ceiling deal can be reached within days. The benchmark 10-year yield increased from 3.540% to 3.570% and pressured gold (-0.35%) further. USOIL rallied almost 3% on demand expectations related to the US driving season.

DJ

DJ rallied strongly yesterday but could be trading lower today. The momentum loss candles suggest the support provided by the 23.6% Fibonacci level might break. If the market trades below 33 360, look for a move to 33 150. Above 33 360, it’s likely the market moves to 33 600.

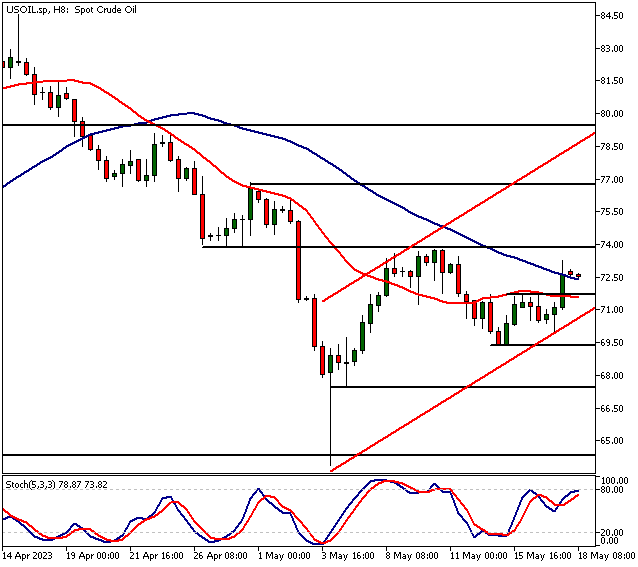

USOIL

USOIL is bullish above 69.37 and could move to 75.80 and then possibly to 78.30 on extension. Below 69.37, look for a move to 67.80.

NATGAS

NATGAS created a lower daily candle high yesterday indicating the bears might be taking control in this market. The potential strength in the USOIL could help the natgas bulls though. The two markets have been somewhat correlated in the past.

But even though the correlation broke up in July last year the correlation could return from time to time. If natgas breaks the 2.475 support decisively (and doesn’t bounce back like yesterday) it’s likely the market trades down to 2.420 and then possibly to 2.350 on extension. If there’s no decisive break below the 2.475 support, natgas probably tests the recent rejection candle high at 2.599

The Next Main Risk Events

- GBP Monetary Policy Report Hearings

- USD Unemployment Claims

- USD Philly Fed Manufacturing Index

- USD Existing Home Sales

- CAD BOC Gov Macklem Speaks

- CAD Retail Sales

- USD Fed Chair Powell Speaks

- EUR ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.