Debt-ceiling talks to resume today

BY Janne Muta

|maggio 16, 2023Yesterday, stock markets (DJ, NAS, DAX and FTSE) closed slightly higher as investors awaited earnings results from retail giants Target and Walmart and assessed the ongoing debt-ceiling negotiations. The Nasdaq outperformed (+0.79%) the S&P 500 Index (+0.35%) and DJ (+0.29). Treasury yields rose from 3.470% to 3.508%, but they remained well below the March highs. Markets are predicting Fed rate cuts by September which has kept the bonds bid and the rates in check. Oil prices were slightly higher a bit (+1.53%), but still down 11% for the year.

Debt-ceiling talks in the United States are expected to resume, with President Biden and congressional leaders planning to meet today. There is optimism for reaching an agreement, as historical precedent shows Congress typically comes together in a last-minute deal. Since 1960, the debt ceiling has been raised 78 times, including 20 times since 2001.

While there may be some uncertainty in the interim, the debt-ceiling debate is likely to be resolved around the June deadline. It’s good to remember that historically the market performance has been driven by economic fundamentals and company earnings.

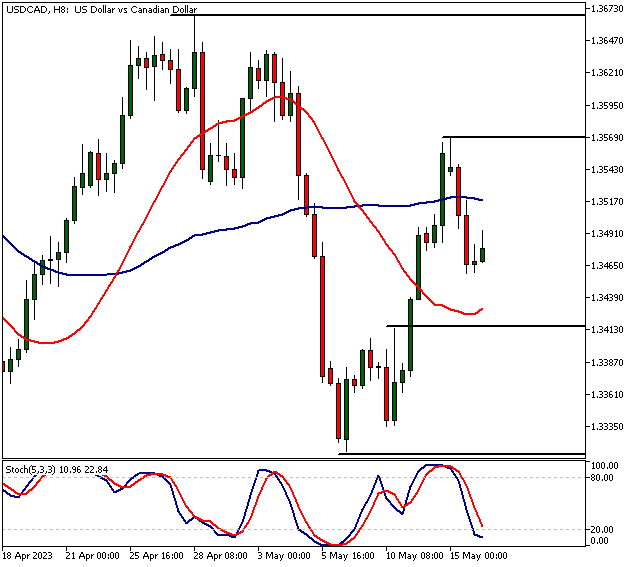

USDCAD

No rate hike (or cut) is expected from the Bank of Canada today. The bank announced a conditional pause in January. The announcement was made despite stronger-than-expected growth at the beginning of the year as the central bank remains confident that the economy will slow down in the coming months. Governor Macklem has talked about the possibility of raising interest rates to combat inflation should it be necessary. The market doesn’t believe this though and predicts a quarter-point cut later this year. The key price levels for USDCAD are 1.3315, 1.3414, 1.3567 and 1.3668

XAGUSD

Silver remains bearish 24.20 and is likely to trade down to 23.20. Above 24.20, look for a move to 24.50.

XAUUSD

Gold could turn bullish on a decisive break above 2022 and could then move to 2038 and perhaps to 2060 on extension. However, there’s not been a lot of momentum lately so we need to have a bearish scenario also. If the 1999.50 support is broken decisively, look for a move to 1985.

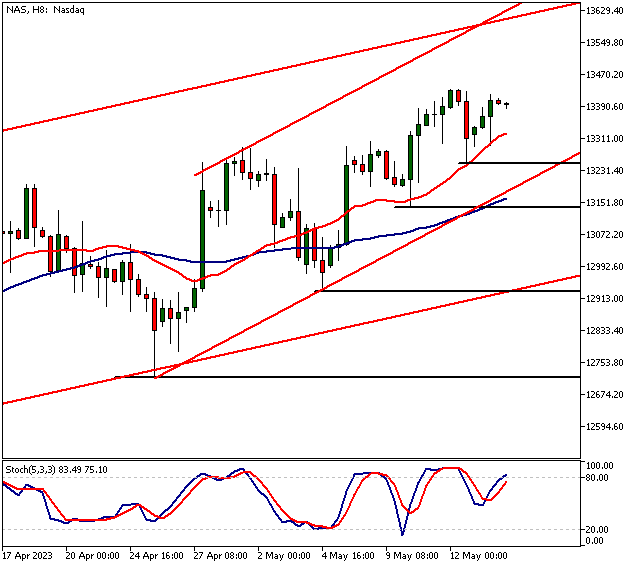

NAS

Nasdaq remains bullish above 13 138 and could move to 13 600. Below 13 138, look for a move to 13 000.

The Next Main Risk Events

- EUR German ZEW Economic Sentiment

- CAD CPI

- USD Core Retail Sales

- USD Retail Sales

- EUR ECB President Lagarde Speaks

- AUD Wage Price Index

- GBP BOE Gov Bailey Speaks

- AUD Employment Change

- AUD Unemployment Rate

- NZD Annual Budget Release

- GBP Monetary Policy Report Hearings

- USD Unemployment Claims

- USD Philly Fed Manufacturing Index

- USD Existing Home Sales

- CAD BOC Gov Macklem Speaks

- CAD Retail Sales

- USD Fed Chair Powell Speaks

- EUR ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.