Fitch places the US on downgrade watch

BY Janne Muta

|maggio 25, 2023US equity indices continued trading lower yesterday, driven by growing concerns over the ongoing debt ceiling negotiations. The Dow Jones Industrial Average (DJIA) fell by 0.77%, the S&P 500 dropped by 0.73%, and the Nasdaq Composite slid by 0.61%. In UK FTSE 100 index sold off by 1.75%. In the commodities markets, USOIL (-0.35%) and gold (+0.36%) moved but only marginally. The USDJPY pair kept on rallying higher. The pair strengthened by 0.63%. The Euro weakened by 0.18% against the USD.

The lack of progress in US debt-ceiling negotiations weighed heavily on global equity markets, causing a notable downturn in investor sentiment. The ongoing stalemate between the White House and Republicans has created significant uncertainty and raised concerns about the potential economic consequences. As a result, equity markets experienced a considerable decline as market participants grappled with the potential impact of a potential U.S. debt default.

Adding to the prevailing market unease, Fitch, a prominent credit rating agency, took a proactive stance by placing the United States highly prized "AAA" rating on watch for a possible downgrade. Fitch was the first major agency to adopt such a cautious approach. The move by Fitch has intensified the stakes in the ongoing negotiations, further highlighting the urgency for policymakers in Washington to find a resolution before the June 1 "X-date" deadline.

Fed governor Christopher Waller stated that the Fed's next steps are uncertain, but officials may need to raise rates later this year to fight inflation. Yields on longer-term U.S. Treasurys initially climbed after Waller's comments but fell after the release of the Fed's May meeting minutes. The 10-year yield ended at 3.717%.The rise in the 10 yr. yield supported the dollar.

Today traders will be monitoring the release of German GDP data to gain insights into the performance of the largest economy in the Eurozone. Additionally, speeches from central bank officials, including Joachim Nagel and Philip Lane, will be closely scrutinized for any indications of future policy decisions. Later in the day, US jobless claims and the second estimate of Q1 GDP will provide insights into the health of the world's largest economy.

GOLD

Gold remains bearish below 1984 and could trade down to 1934 and possibly to 1918 on extension. Above 1984, look for a move to 1998.

EURUSD

EURUSD remains bearish below 1.0801. Below the level, the market probably trades down to 1.0680. Above 1.0801, a move to 1.0824 is likely.

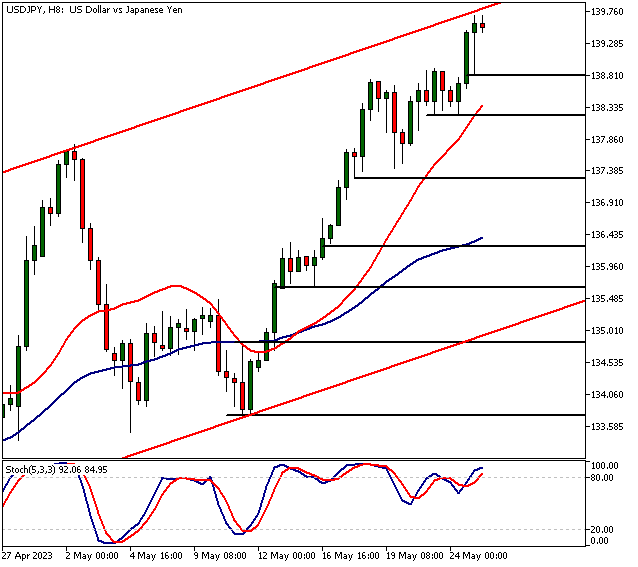

USDJPY

USDJPY remains bullish above 138.25 and could trade to 142. Note that the market is currently trading near the medium-term bull channel high which increases the risk of a retracement. Below 138.25, the market would probably trade down to 137.40 or so.

USNGAS

NATGAS is bullish above 2.484. Above the level, the market is likely to trade to 2.700 and then possibly to 2.761 on extension. Below 2.484, the market might trade down to 2.400.

The Next Main Risk Events

- USD Prelim GDP

- USD Unemployment Claims

- USD Prelim GDP Price Index

- USD Pending Home Sales

- JPY Tokyo Core CPI

- GBP Retail Sales

- USD Core PCE Price Index

- USD Core Durable Goods Orders

- USD Durable Goods Orders

- USD Revised UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.