Pershing acquired a billion-dollar stake in GOOG

BY Janne Muta

|maggio 17, 2023A securities filing published yesterday evening shows that billionaire Bill Ackman's hedge fund, Pershing Square Capital Management, has acquired a billion-dollar stake in Alphabet (GOOG, +2.68%) during the first quarter of the year. This rallied the stock further after the breakout above the 109.60 resistance level last week. Gold (-1.36%) and silver (-1.43%) traded lower as the rising yields supported the dollar. This pressured also the major dollar counterparts and kept the USDJPY bids firm. Today’s main risk event is the BOE governor Bailey’s speech. Heads up for those trading the Asian session: Get ready to trade the Australian employment numbers tomorrow.

DJ (-0.90%), DAX (-0.41%) and FTSE (-0.72%) failed to attract buyers yesterday while NAS (+0.29%) finished the day slightly higher. The technology index was supported by investors’ appetite for growth stocks. AMD (+4.19%), GOOG (+2.68%) and AMZN (+1.98%) were the best-performing trio among the big technology stocks.

GOOG

GOOG is bullish above 116.70. Below the level, the market could trade down to 133.50 (the lower end of the gap). The nearest major resistance level is at 123.30 (weekly resistance created in August last year.

EURUSD

EURUSD is bearish below 1.0905 and could move down to 1.0814 and then possibly to 1.0760 on extension. Above 1.0905, look for a move to 1.0950.

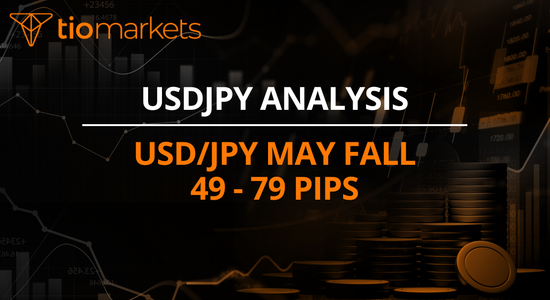

USDJPY

USDJPY is bullish above 135.65 and could trade up to 137.90 and possibly to 140.10 on extension. Below 135.65, look for a move to 135.10.

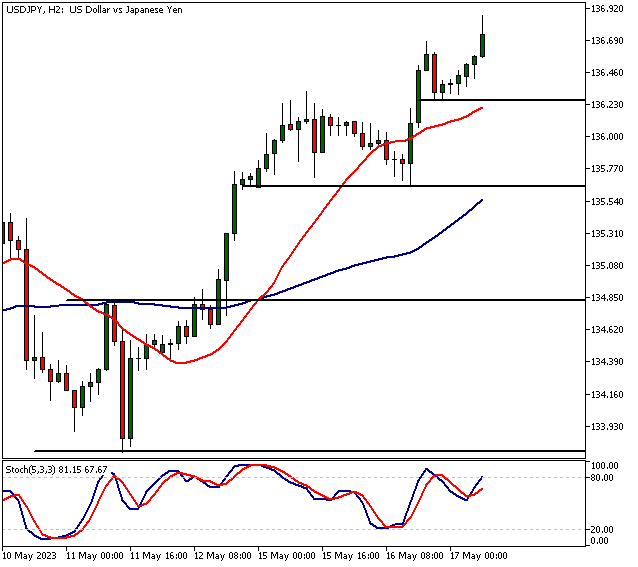

NATGAS

NATGAS could be turning bearish. If the market breaks the 2.475 support it’s likely to trade down to 2.420 and then possibly to 2.350 on extension. Above the 2.475 support, natgas probably tests the recent rejection candle high at 2.599.

AUDUSD

AUDUSD failed to penetrate the 0.6800 region and traded lower. So the market keeps trading in a range. Tomorrow’s employment numbers are expected to come in substantially lower than in April and are probably factored in already.

Therefore, unless there’s a sizeable deviation from the expected number the market is more likely to keep trading in the 0.6564 - 0.6818 range. At the time of writing the market is under pressure but trading at a minor support (0.6636).

Below the level, the next support to pay attention to is the range low (0.6564) and above 0.6636 the next resistance level is at 0.6710. On a decisive break below 0.6564, look for a move to 0.6390 and if there’s a decisive break above the 0.6818 resistance, the market probably trades to 0.7000 or so.

The Next Main Risk Events

- GBP BOE Gov Bailey Speaks

- AUD Employment Change

- AUD Unemployment Rate

- NZD Annual Budget Release

- GBP Monetary Policy Report Hearings

- USD Unemployment Claims

- USD Philly Fed Manufacturing Index

- USD Existing Home Sales

- CAD BOC Gov Macklem Speaks

- CAD Retail Sales

- USD Fed Chair Powell Speaks

- EUR ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.