Tech stocks rally on AI expectations

BY Janne Muta

|maggio 23, 2023Markets were in a wait-and-see mode as investors waited for more news on debt-ceiling negotiations. The Dow Jones Industrial Average slipped 0.42% yesterday while the tech-centric Nasdaq edged higher by 0.50%. S&P 500 (0.02%), being a composite index (includes both tech stocks and traditional blue chips) ended the day practically flat. FTSE 100 performance was also modest with a 0.18% tick higher.

Commodities showed mixed results. Crude Oil edged upwards by 0.37%, concluding the day at $72.32 per barrel while Gold slid 0.75%. In the currency markets the Yen and the Euro recorded slight losses against the US Dollar.

The technology index Nasdaq has been a strong performer lately. So far this year, Nasdaq and S&P 500 gained 22% and 9.2%, respectively. On the other hand, the Dow Jones Industrial Average retreated by 0.4%, or approximately 140 points, leaving its annual growth at a modest 0.4%.

This suggests investors are pouring money into technology in the hope of positioning themselves well in advance of the upcoming AI boom. We’ve seen a lot of hype about the generative AI but it certainly is still in the early stages. It’s quite likely that we’ll see the next investment bubble created around AI.

Those that catch the right stocks early are the winners in this race. The challenge obviously is that no one knows exactly which tech stocks will rally the most. So institutional investors purchase large baskets of shares betting on some of them being in this desired group.

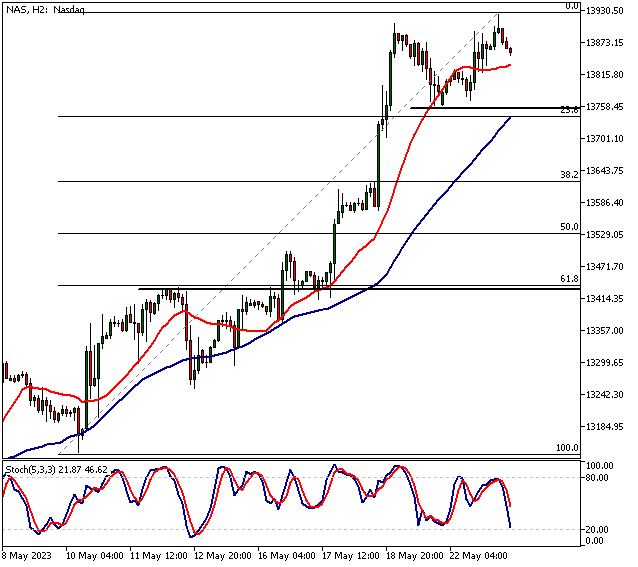

Nasdaq

NAS remains bullish above 13 760. If the level breaks, look for a move to 13 630. Nasdaq has been one of the strongest performers among the equity indices lately. The market took its time to start the recovery so the other indices are either at or near their all-time highs (FTSE and DAX) while Nasdaq still has some way to go. Therefore, relative to the other indices, the technology index has more value plays. Plus, the emergence of generative AI will create new hype and drive further investment into technology companies.

Nasdaq-listed companies like NVIDIA, Alphabet, and Adobe have invested heavily in AI technologies so they are on the radar of investors looking to invest in the leaders. Another group that always attracts new inflows when the Nasdaq rallies is the so-called FANG stocks. This group comprises of Meta (Facebook), Apple, Netflix and Alphabet (Google).

The group has had a strong performance lately. Being the behemoths they are, the companies are well-positioned to be among the leaders in the AI space. While the US debt-ceiling debacle could create temporary fluctuations in the markets, it seems unlikely that the inflows into these names would be over. Investors are likely to stay in buy-the-tech-dip mode.

Gold

Gold is bearish below 1984 and could trade down to 1934. Above 1984, look for a move to 1998.

EURUSD

EURUSD is bearish below 1.0832. Below the level, the market is likely to test 1.0760 and if it fails to bounce the price higher, we might see a move to 1.0680. Above 1.0832, look for a move to 1.0880.

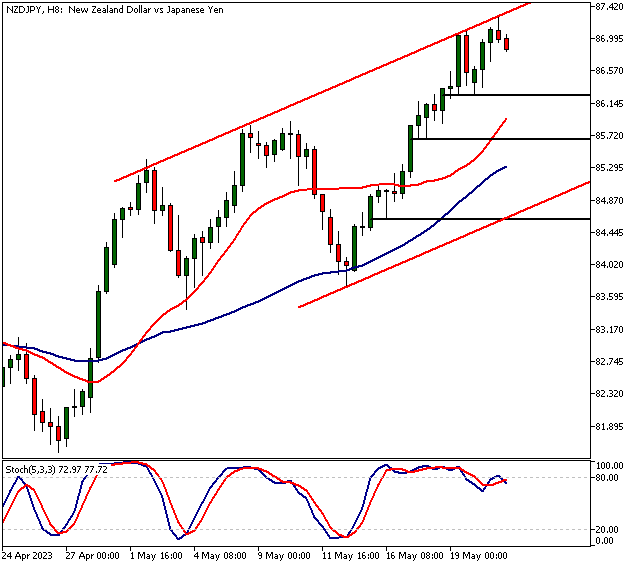

NZDJPY

NZDJPY is bullish above 86.27 but trades near the bull channel top. Therefore, a retracement to the support wouldn’t be out of the question. If 86.27 doesn’t hold, the market might test the next support (85.68) level.

The Next Main Risk Events

- EUR German Flash Manufacturing PMI

- EUR German Flash Services PMI

- EUR Flash Manufacturing PMI

- EUR Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

- USD Richmond Manufacturing Index

- NZD Retail Sales

- NZD Official Cash Rate

- NZD RBNZ Monetary Policy Statement

- NZD RBNZ Rate Statement

- NZD RBNZ Press Conference

- GBP CPI

- EUR German IFO Business Climate

- GBP BOE Gov Bailey Speaks

- GBP BOE Gov Bailey Speaks

- USD Treasury Sec Yellen Speaks

- USD FOMC Meeting Minutes

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.