Trade Commodities

Trade gold, silver, platinum, palladium, crude oil and natural gas

取引にはリスクが伴います

取引元

0.03 ティックスプレッド

取引元

$0 委託

まで

1: 無制限のレバレッジ

7 商品

取引元

0.03 ティックスプレッド

取引元

$0 委託

まで

1: 無制限のレバレッジ

7 商品

Trade global commodities

Symbol

ビッド

アスク

スプレッド:

*このページの価格は参考価格です。エキゾチック通貨ペア、株式、指数など流動性の低い商品の価格は、一般的に取引される商品ほど頻繁に更新されません。最新のリアルタイム価格については、MT4/MT5プラットフォーム内でご確認ください。

What are Commodities?

Commodities like gold, silver, platinum, oil and natural gas are raw materials that play a fundamental role in the global economy. Their prices are directly related to their discovery, extraction and consumption and determine the cost of many goods and services. You can trade them to try and capitalise on this supply and demand dynamic.

Popular commodities include

Crude Oil

Symbol: USOIL

Brent Oil

Symbol: UKOIL

Natural Gas

Symbol: USNGAS

Gold

Symbol: XAUUSD

Silver

Symbol: XAGUSD

How commodities trading works

Commodity trading allows you to speculate on the price movements of commodities without owning the physical commodities. If you think the price of a commodity is likely to rise, you can simply buy it. If you think the price of the commodity is likely to fall, you can sell it.

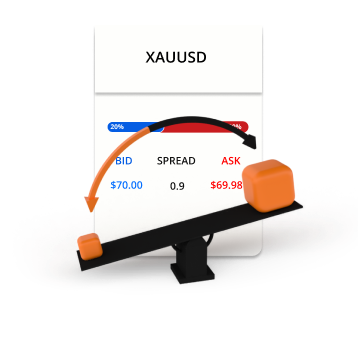

Bid and ask prices

Go long or short

Commodities are traded in lots

Commodity trading involves leverage and margin

Commodities trading example

You decide to buy 0.1 lots of Crude Oil at $70 using 20:1 leverage.

0.1 lots = 100 barrels of Crude Oil

100 barrels x $70 = $7,000

USD 7,000 / 20 = $350

Now you have opened a long position in Crude Oil worth $7,000. Since commodities are traded using leverage, only $350 was used as margin from your trading account. After some time, the price of Crude Oil moves and you decide to sell.

Scenario 1

Crude Oil moves up from $70 to $80 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($80 - $70) x 100

P/L = $10 x 100

P/L = $1,000

Scenario 2

Crude Oil moves down from $70 to $60 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($60 - $70) x 100

P/L = -$10 x 100

P/L = - $1,000

TIOmarketsを選ぶ理由

TIOmarketsが選ばれる理由

スプレッドは0.0 pipsから

Raw口座で変動制のロー・スプレッド取引

手数料無料の取引

VIP BlackまたはStandard取引口座で1ロットあたり$0から取引可能

MT4 & MT5

デスクトップ、ウェブ、モバイル対応の高度な取引プラットフォーム

迅速な注文執行

ミリ秒単位での効率的かつ信頼性の高い注文処理

無制限のleverage。

Standard口座では最大無制限レバレッジで取引可能

30%ロイヤリティボーナス

Standardアカウントへの全ての入金でボーナスを獲得

Trade on the MT4 trading platform

デスクトップ、インターネットブラウザ、またはモバイルからアクセス可能

数分で取引を開始

仕組みは次のとおりです

ステップ 1

登録

プロフィールを入力し、口座を開設(数分で完了)

ステップ 2

確認

本人確認書類と住所確認書類をアップロード(出金前に必須)

ステップ 3

入金

国内・海外の便利な方法で即時入金

ステップ 4

取引

プラットフォームをダウンロードし、ログインして取引開始

取引にはリスクが伴います