Trade in the Forex market

メジャー、マイナー、エキゾチックな通貨ペアの売買

取引にはリスクが伴います

取引元

0.0 スプレッド幅

取引元

$0 委託

まで

1: 無制限のレバレッジ

+

70 通貨ペア

取引元

0.0 スプレッド幅

取引元

$0 委託

まで

1: 無制限のレバレッジ

+

70 通貨ペア

Trade 70+ currency pairs in the Forex market

Go long or short the majors, minors and exotics

Symbol

ビッド

アスク

スプレッド:

*このページの価格は参考価格です。エキゾチック通貨ペア、株式、指数など流動性の低い商品の価格は、一般的に取引される商品ほど頻繁に更新されません。最新のリアルタイム価格については、MT4/MT5プラットフォーム内でご確認ください。

What is the Forex market?

The Forex market, or the foreign exchange market, is a global marketplace for exchanging national currencies. It stands as the world's largest and most liquid market with an average daily trading volume of $7.5 trillion.

The Forex market is open 24 hours a day, 5 days per week and is split into 3 major trading sessions. Offering unparalleled opportunities and access to traders across the globe.

Forex trading primarily happens over a decentralised electronic banking network and plays a crucial role in the global economy. Serving as an essential medium to facilitate international trade and investments.

How Forex trading works

Forex trading involves the simultaneous buying of one currency and selling of another. For example, if you believe that the value of the Euro will rise against the US Dollar due to strong economic growth in the EU, you might choose to buy the EUR/USD currency pair.

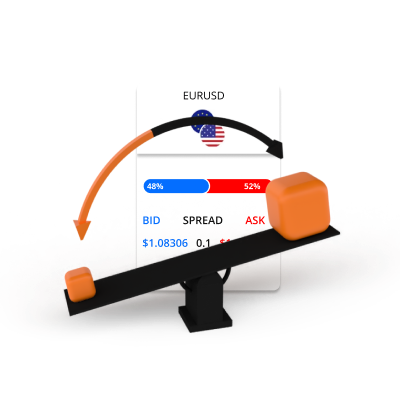

Bid and ask prices

Go long or short

Forex is traded in lots

Forex trading involves leverage and margin

Forex trading example

You decide to buy 0.1 lots of EURUSD at 1.0800 using 200:1 Leverage. The two currencies involved in the trade are the EUR and the USD.

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

Now you have opened a EUR 10,000 long position in the EURUSD by simultaneously selling USD 10,800. Since forex is traded using leverage, only $54 was used as margin from your trading account. After some time, the rate of exchange between the EURUSD moves and you decide to sell.

Scenario 1

The exchange rate moves up from EURUSD 1.0800 to 1.0850.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0850 - 1.0800) x 10000) / 1.0850

P/L = (0.0050 x 10,000) / 1.0850

P/L = 46.08 USD

Scenario 2

The exchange rate moves down from EURUSD 1.0800 to 1.0750.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0750 - 1.0800) x 10,000) / 1.0750

P/L = (0.0050 x 10,000) / 1.0750

P/L= -46.51 USD

プレミアムなサービスでお得な取引を提供

TIOmarketsが選ばれる理由

スプレッドは0.0 pipsから

Raw口座で変動制のロー・スプレッド取引

手数料無料の取引

VIP BlackまたはStandard取引口座で1ロットあたり$0から取引可能

MT4 & MT5

デスクトップ、ウェブ、モバイル対応の高度な取引プラットフォーム

迅速な注文執行

ミリ秒単位での効率的かつ信頼性の高い注文処理

無制限のleverage。

Standard口座では最大無制限レバレッジで取引可能

30%ロイヤリティボーナス

Standardアカウントへの全ての入金でボーナスを獲得

数分で取引を開始

仕組みは次のとおりです

ステップ 1

登録

プロフィールを入力し、口座を開設(数分で完了)

ステップ 2

確認

本人確認書類と住所確認書類をアップロード(出金前に必須)

ステップ 3

入金

国内・海外の便利な方法で即時入金

ステップ 4

取引

プラットフォームをダウンロードし、ログインして取引開始

取引にはリスクが伴います