The Wolfe Wave Pattern | A Robust Framework For Trading

BY Janne Muta

|Mac 28, 2024The Wolfe Wave pattern stands as a fascinating chart configuration that captures the rhythmic ebb and flow of market prices through a series of five distinct waves. It signals the presence of a natural equilibrium price, offering traders a window to time their market entries and exits with precision. Originating from the keen observations of Bill Wolfe and his son Brian, the pattern is celebrated for its universal applicability across various markets, revealing the inherent patterns of supply and demand through price movements.

The Wolfe Wave is characterized by its ability to forecast bullish or bearish trends, depending on its formation, making it a cornerstone in the toolkit of some technical analysts. Its significance lies not just in identifying potential price breakouts but in predicting the target price at the end of the fifth wave, thus guiding traders towards optimal trading decisions.

By adhering to specific criteria, including symmetry in waves and consistent timing intervals, the Wolfe Wave pattern ensures a robust framework for market analysis, enabling traders to navigate the markets with added confidence.

Are you ready to learn all about it? Then let's get started

What is the Wolfe wave pattern?

Identifying the Wolfe Wave pattern on trading charts is a nuanced process that hinges on observing a confluence of visual characteristics and sequence patterns. This pattern, comprising five distinct waves, serves as a roadmap for understanding market psychology and forecasting future price movements too.

Identifying the Wolfe wave pattern

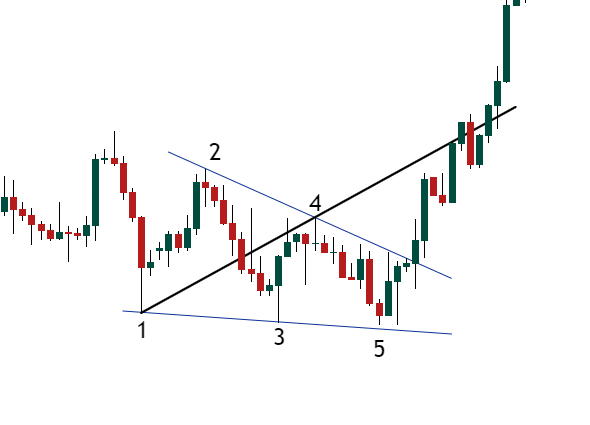

Let’s study a bullish pattern to understand the formation of the Wolfe wave pattern. The pattern is characterized by a sequence of five waves. Waves 1, 3, and 5 are typically directional waves, pushing the price in a specific direction, while waves 2 and 4 are corrective waves, offering a counterbalance. The pattern starts with a baseline established by wave 1, which sets the stage for the oscillatory movement of the price.

A pivotal aspect of the Wolfe wave structure is the channel that forms between waves 1 and 3, which is then projected forward. This channel plays a critical role in validating the pattern, especially as waves develop and bounce within the support and resistance zones created by connecting the peaks of points 2 and 4 and the lows of point 1 and 3.

Symmetry between the waves, particularly in terms of their amplitude and duration, is crucial for a valid Wolfe wave pattern. The timing between successive waves should be consistent, ensuring that the pattern unfolds in a rhythmic manner reflective of underlying market dynamics.

The quintessence of the pattern is the breakout that occurs after the formation of the fifth wave. This breakout is directional, implying a significant price movement opposite to the trend established by the first four waves. It's the anticipation of this breakout that offers traders the opportunity to position themselves strategically.

Wolfe wave formation conditions

- The waves must cycle at regular time intervals, ensuring a harmonic rhythm in the price movements.

- Waves 3 and 4 must remain within the channel created by waves 1 and 2. This boundary reinforces the trading pattern credibility and forecasts the breakout direction.

- A high degree of symmetry between the first two and the next two waves indicates a well-formed Wolfe Wave pattern, hinting at the strength of the impending breakout.

Application of Wolfe waves in market analysis

In practical terms, the Wolfe wave pattern provides traders with a lens through which to view potential market movements as part of a larger, predictable cycle. By identifying this pattern, traders can forecast with a degree of certainty where the price is likely to move, facilitating informed decision-making regarding entry and exit points.

Trading strategies using the Wolfe wave pattern

Trading strategies that harness the predictive power of the pattern can significantly enhance a trader's ability to time the market effectively. This section delineates approaches to utilise this pattern under both bullish and bearish market conditions, providing a framework for practical application.

Strategies in bullish market conditions

Entry Point Identification: The completion of the fifth wave, particularly if it overshoots the trend channel formed by waves 1 to 4, presents a compelling buy signal in a bullish Wolfe Wave setup. Traders should look for the price to retreat back into the channel as confirmation of the pattern's validity and a cue for entry.

Setting profit targets

The projection line drawn from the beginning of wave 1 through the start of wave 4 can be extended to forecast the price target of the bullish reversal. This target is where traders can anticipate the price to surge, providing a clear exit point for the trade.

Stop loss placement

To manage risk effectively, a stop loss is typically placed just below the lowest point reached by wave 5. This positioning safeguards against unexpected reversals that invalidate the pattern.

Strategies in bearish market conditions

In the context of a bearish Wolfe wave, the emergence of wave 5 above the channel signals a potential selling opportunity. The key is to wait for the price to dip back into the channel, affirming the pattern's bearish forecast before initiating a short position.

Profit targets in bearish setups

Similar to the bullish scenario, the profit target is determined by extending a line from the point at the start of wave 1 to the beginning of wave 4. This extension predicts where the price is expected to decline, marking an optimal point for trade exit.

Risk management

A stop loss for a bearish Wolfe Wave trade is judiciously placed just above the peak of wave 5. This minimises potential losses should the market move contrary to the anticipated direction.

Practical application and considerations

The successful application of Wolfe wave strategies demands patience for pattern confirmation and precise timing for trade execution. The entry point after the completion of wave 5 and its return to the channel is critical for both bullish and bearish setups.

While the Wolfe wave pattern provides a strong framework for entry and exit points, traders often supplement their analysis with volume and momentum indicators to corroborate the pattern's signals and enhance trade confidence.

Market conditions can change rapidly, necessitating adjustments to stop loss placements and profit targets. Flexibility and a readiness to adapt to new information are essential traits for traders employing Wolfe Wave strategies.

Examples of the Wolfe wave pattern in trading

This section delves into real and hypothetical scenarios to illuminate the practical application of the Wolfe wave pattern in trading, offering insights into the pattern's identification, strategic decision-making, and outcomes.

Bullish Wolfe wave in EURUSD

A trader identifies a potential bullish Wolfe wave pattern in EURUSD chart. The market has been experiencing a consolidation with a slight downward tilt but the formation of waves suggests an impending reversal.

The first four waves conform to the expected sequence, with wave 5 breaking out of the established channel.

Identification and trading of the bullish pattern

- The trader enters a long position as the price breaks out of the channel during the wave number 5. A more aggressive trader could enter after confirmation at point 5, anticipating the break out.

- A stop loss could be placed just below the lowest point of wave 5 to limit potential losses.

- Using the line projected from points 1 through 4, the trader can set a profit target 1 if or whenever the price reaches the line projected in to the future

Bearish Wolfe wave in the gold market

In this example, a gold trader spots a bearish Wolfe wave pattern in the XAUUSD chart, indicating downward potential in the market.

Identification and trading of the bearish pattern

- The pattern is identified by the orderly formation of five waves, with wave 5 breaching the trend channel to the downside.

- The trader decides to enter a short position when the price breaks out of the channel.

- A stop loss can be placed just above the peak of wave 5 to protect against incorrect pattern interpretation.

- The trader sets a profit target based on the extension line through points 1 and 4, anticipating where the price will potentially drop to.

- The XAUUSD price falls and the trader is looking for price to reach the extension line to close the position.

- A stop loss can be trailed to protect against adverse price movements

Risk management when trading the Wolfe wave pattern

In the context of trading with the Wolfe wave pattern, understanding and applying key risk management strategies is crucial for both safeguarding capital and optimizing profitability. The pattern with its structured approach to market analysis, offers unique opportunities to implement these strategies effectively.

Use stop loss orders

The Wolfe wave pattern provides clear indications for potential reversal points, which can be strategically used to place stop loss orders. For instance, in a bullish Wolfe Wave setup, placing a stop loss just below the lowest point of the fifth wave can limit downside risk. This practice is integral to the Wolfe wave methodology, ensuring that traders can cap their losses automatically, allowing them to stay in the game even when predictions don’t pan out as expected.

Risk-Reward Ratios

Evaluating the risk-to-reward ratio is particularly relevant when trading with this pattern. The pattern’s ability to predict target prices at the end of the fifth wave allows traders to calculate the potential rewards versus the risks with a higher degree of accuracy compared to other reading techniques. Aim for setups where the expected outcome, based on the pattern’s projection, offers a favourable risk-to-reward ratio.

Incorporating these risk management strategies within the Wolfe wave pattern framework enhances a trader's ability to navigate markets and striking a balance between maximizing gains and minimizing losses.

Key insights and takeaways

The Wolfe wave pattern stands as a testament to the intricate dynamics of market psychology, offering traders a potent tool for navigating the complexities of financial markets. The Wolfe wave pattern's versatility and predictive accuracy across various asset classes, highlights its capacity to forecast both bullish and bearish trends with added precision.

A critical insight is the importance of adherence to the pattern's structural criteria - symmetry in wave formation, consistent timing intervals, and channel integrity. These are paramount for the successful application of the pattern, to validate the pattern's presence and also enhance its reliability as a forecasting tool.

A second key takeaway is the pattern's emphasis on strategic entry and exit points. The pattern provides clear trading signals for both buying and selling opportunities, underscoring the value of precise timing and the significance of pattern confirmation. Traders leveraging the Wolfe wave pattern can significantly improve their market timing, thereby optimising their trading decisions.

The practical application of the pattern, illustrated through case studies, offers valuable lessons on the importance of flexibility and adaptability in trading strategies. Market conditions are ever-changing, and while the pattern provides a solid framework for analysis, traders must be ready to adjust their strategies in response to new information. This includes reassessing stop loss placements and profit targets, as well as integrating other indicators to corroborate the pattern's signals.

Conclusion

The Wolfe wave pattern emerges as a very useful tool for traders aiming to decode the complexities of market movements. Its robust framework, capable of forecasting directional trends,, offers traders a unique vantage point from which to approach the market. The key to harnessing the full potential of the Wolfe wave pattern lies in a detailed understanding of its structural components, a disciplined approach to pattern confirmation, and the strategic application of its signals.

As demonstrated through the examples, when applied, the pattern can significantly enhance decision making and trading outcomes.

Would you like to give it a try? Register for an account today.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.