Komoditi Perdagangan

Berdagang emas, perak, platinum, paladium, minyak mentah dan gas asli

Perdagangan berisiko

DAGANGAN DARI

0.03 PEMBUKAAN TIK

DAGANGAN DARI

$0 KOMISEN

SEHINGGA

1: LEVERAGE TANPA HAD

7 KOMODITI

DAGANGAN DARI

0.03 PEMBUKAAN TIK

DAGANGAN DARI

$0 KOMISEN

SEHINGGA

1: LEVERAGE TANPA HAD

7 KOMODITI

Perdagangan komoditi global

Simbol

Bida

Tanya

Spread

*Harga-harga di halaman ini adalah indikatif. Harga untuk instrumen dengan likuiditas lebih rendah seperti pasangan mata wang eksotik, saham, dan indeks tidak dikemaskini sekerap instrumen yang biasa didagangkan. Sila semak di dalam platform MT4/MT5 anda untuk mendapatkan harga terkini secara langsung.

Apakah Komoditi?

Komoditi seperti emas, perak, platinum, minyak dan gas asli adalah bahan mentah yang memainkan peranan asas dalam ekonomi global. Harga mereka secara langsung berkaitan dengan penemuan, pengekstrakan dan penggunaan mereka dan menentukan kos banyak barangan dan perkhidmatan. Anda boleh menukarnya untuk mencuba dan memanfaatkan dinamik penawaran dan permintaan ini.

Komoditi popular termasuk

Minyak Mentah

Symbol: USOIL

Minyak Brent

Symbol: UKOIL

Gas Asli

Symbol: USNGAS

emas

Symbol: XAUUSD

Perak

Symbol: XAGUSD

Bagaimana perdagangan komoditi berfungsi

Perdagangan komoditi membolehkan anda membuat spekulasi mengenai pergerakan harga komoditi tanpa memiliki komoditi fizikal. Jika anda fikir harga komoditi mungkin akan meningkat, anda boleh membelinya. Jika anda fikir harga komoditi itu berkemungkinan akan jatuh, anda boleh menjualnya.

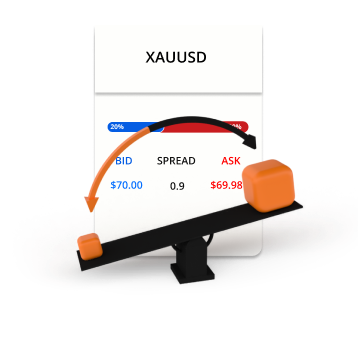

Bida dan tanya harga

Buat dagangan panjang atau pendek

Komoditi diniagakan secara lot

Perdagangan komoditi melibatkan leverage dan margin

Contoh dagangan komoditi

Anda memutuskan untuk membeli 0.1 lot Minyak Mentah pada $70 menggunakan leverage 20:1.

0.1 lot = 100 tong Minyak Mentah

100 barrels x $70 = $7,000

USD 7,000 / 20 = $350

Kini anda telah membuka kedudukan panjang dalam Minyak Mentah bernilai $7,000. Memandangkan komoditi didagangkan menggunakan leveraj, hanya $350 digunakan sebagai margin daripada akaun dagangan anda. Selepas beberapa lama, harga Minyak Mentah bergerak dan anda memutuskan untuk menjual.

Senario 1

Minyak Mentah naik dari $70 kepada $80 dan anda memutuskan untuk menjual.

Ini adalah bagaimana keuntungan atau kerugian pada perdagangan akan dikira.

P/L = (Harga semasa - Harga awal) x Kuantiti

P/L = ($80 - $70) x 100

P/L = $10 x 100

P/L = $1,000

Senario 2

Minyak Mentah turun daripada $70 kepada $60 dan anda memutuskan untuk menjual.

Ini adalah bagaimana keuntungan atau kerugian pada perdagangan akan dikira.

P/L = (Harga semasa - Harga awal) x Kuantiti

P/L = ($60 - $70) x 100

P/L = -$10 x 100

P/L = - $1,000

Mengapa TIOmarkets

Inilah sebabnya orang seperti anda memilih TIOmarkets

Spreads dari 0.0 pips

Dagangkan dengan spread mentah berubah-ubah pada akaun Raw

Perdagangan tanpa komisen

Berdagang dari $0 setiap lot di akaun VIP Black atau Standard kami

PLATFORM PERDAGANGAN

Platform perdagangan canggih untuk desktop, web dan mudah alih

Pelaksanaan pesanan yang pantas

Pemprosesan pesanan cekap dan boleh dipercayai dalam milisaat

Leverage tanpa had.

Dagangkan dengan leveraj sehingga tanpa had pada akaun Standard

Bonus Kesetiaan 30%

Dapatkan bonus pada setiap deposit ke akaun Standard kami

Berdagang di platform dagangan MT4

Daripada komputer meja, pelayar internet atau peranti mudah alih

MT4 telah direka bentuk dan berkembang untuk dagangan forex dan niaga hadapan. Untuk membolehkan pedagang menganalisis dan berdagang pasaran kewangan, menguji kembali strategi dagangan, mengkembangkan robot dagangan dan menyalin pedagang lain.

Mula berdagang dalam beberapa minit

Begini cara ia berfungsi

LANGKAH 1

Daftar

Lengkapkan profil anda dan cipta akaun anda, hanya mengambil masa beberapa minit

LANGKAH 2

Sahkan

Muat naik bukti identiti dan alamat anda, ini diperlukan sebelum pengeluaran

LANGKAH 3

Masukkan Dana

Pilih daripada kaedah tempatan dan antarabangsa yang mudah dan deposit serta-merta

LANGKAH 4

Berdagang

Muat turun platform, pindahkan dana ke akaun anda, log masuk dan mula berdagang

Perdagangan berisiko