Exponentially Weighted Moving Average Strategies

BY Janne Muta

|februarie 8, 2024The Exponentially Weighted Moving Average plays a crucial role in Forex trading by enabling traders to identify market trends more effectively. Unlike simple moving averages (SMAs) that treat all data points equally, EWMA prioritizes recent price changes, offering a more sensitive and timely reaction e.g. to market reversals. This responsiveness to recent price action makes EWMA an indispensable tool for Forex traders aiming to make informed decisions in a timely manner.

The Calculation of EWMA

The formula for calculating the Exponentially Weighted Moving Average (EWMA) or Exponential Moving Average (EMA) is as follows:

EWMA = (α * X) + ((1 - α) * EWMA_previous)

Where:

- EWMA is the Exponentially Weighted Moving Average at the current time period.

- X is the value of the data point at the current time period.

- α (alpha) is the smoothing factor or weighting factor between 0 and 1. It determines how much weight is given to the current data point, with higher values giving more weight to recent data.

The EWMA is calculated by taking a weighted average of the current data point (X) and the previous EWMA value (EWMA_previous), with the weight of the current data point determined by α.

Typically, α is chosen based on the desired smoothing effect. Higher values of α result in a faster response to recent data, while lower values give more weight to historical data, resulting in a smoother, less responsive average.

The Key Takeaways from This Article

- The Exponentially Weighted Moving Average (EWMA) represents a mathematical or statistical approach for analysing a time series. It is extensively applied in the financial sector, with its primary uses including technical analysis and the modelling of volatility.

- By using different EWMA lengths, traders can tailor their analysis to short-term or long-term trends. This flexibility helps align trading strategies with the market's direction and adapt to changing conditions.

- The crossover strategy uses long-term and short-term EWMAs to identify potential buy/sell signals. Careful timing and interpretation are crucial for successful implementation to avoid false signals and maximize gains.

- Monitoring multiple Exponentially Weighted Moving Average with varying timeframes helps assess trend strength. Convergence suggests a robust trend, while divergence indicates weakening momentum.

Practical Applications of EWMA in Forex Trading

EWMA's adaptability makes it highly useful in various trading scenarios. It can be employed for trend identification, enabling traders to spot both the commencement of new trends and the conclusion of existing ones. By overlaying EWMAs of different lengths on a chart, traders can observe crossovers that indicate potential buy or sell signals.

For instance, a shorter-term EWMA crossing above a longer-term EWMA may suggest an upward trend, presenting a buying opportunity.

Moreover, EWMA can be integrated into risk management strategies. Its sensitivity to recent price movements helps traders assess volatility and adjust their positions accordingly, minimizing potential losses and maximizing gains.

Comparison between the EWMA and SMA

When comparing the exponentially weighted moving average (EWMA) with a simple moving average (SMA), the key distinction lies in how each calculates and prioritises data points. SMA computes the average price of a security over a specific period, treating each data point equally. For instance, a 20-day SMA would sum up the closing prices of the past 20 days and divide by 20, offering a smooth but lagging indicator of price movement.

Conversely, EWMA goes a step further by applying more weight to recent prices, thus being more sensitive to new information. This difference is crucial in volatile Forex, equity and commodities markets, where the ability to quickly adapt to new data can significantly impact trading decisions.

For example, if a currency pair experiences a sudden uptick due to an unexpected economic announcement, EWMA will reflect this change more promptly than SMA, providing traders with a more accurate representation of current market conditions.

This responsiveness to new market information makes EWMA a superior tool for traders looking to capture short-term movements without the lag inherent in SMA calculations. By prioritising recent data, EWMA allows for a nuanced analysis, enabling traders to identify potential entry and exit points more effectively as market conditions evolve.

How to use EWMA to create trading strategies

The exponentially weighted moving average (EWMA) serves as an invaluable tool for Forex traders aiming to discern both short-term and long-term market trends. By adjusting the lookback period, traders can tailor EWMA to suit their specific needs, using a shorter span for short-term trends and a longer one for capturing broader market movements.

This flexibility allows for a detailed analysis of currency pair trends, facilitating strategic decision-making. Note that professional trading requires continuous adaptation and a profound understanding of market intricacies. Join our thriving community of traders today and experience the difference with TIOmarkets. To embark on this journey, simply visit our account opening page.

EURUSD Example

Consider a trader monitoring the EURUSD pair. For short-term trends, they might use a 10-day EWMA, which would quickly adapt to recent market volatility, highlighting potential opportunities for quick trades. Conversely, to understand the long-term trajectory, a 50-day EWMA could be employed, offering insight into the underlying momentum beyond daily fluctuations.

This dual approach enables traders to align their strategies with the market's direction effectively.

Exponentially Weighted Moving Average Daily Timeframe Trend

There have been occasions where the short EWMA moving average in the daily GBPJPY chart looks bearish but the trend is not over. A short-term EWMA might point lower, indicating a lack of buying pressure, while a long-term EWMA could still either move sideways or point higher, suggesting the sell-off is a temporary correction within a larger bullish trend.

As long as the short EWMA remains above the slow, the market is likely just resting before the next push higher. Make sure you test several combinations of look back periods with historical price data before committing to a setting. This can be very helpful in creating a systematic approach to trading instead of jumping into conclusions based on either emotional hunches or indications from one indicator.

Short-Term Trading Opportunities with Short-Term EWMA

Short-term trading strategies that leverage the exponentially weighted moving average (EWMA) can significantly capitalise on rapid price movements in the Forex market. By configuring EWMA with a short-term setting, such as a 5 to 15-day period, traders can enhance their responsiveness to immediate market changes, enabling them to seize trading opportunities as they arise.

Intraday Exponentially Weighted Moving Average strategy with a 5-minute chart

One effective intraday strategy involves using a short-term EWMA and a medium-term EWMA together with recent highs as a trigger for buy signals.

In this strategy, traders utilise a 5-minute timeframe, focusing on two Exponential Moving Averages (EMAs): a short-term EMA over 15 periods and a slower EMA over 30 periods. The approach dictates entering long positions when both EMAs trend upwards, signalling increasing momentum.

Bullish Indication

Additionally, the market trading above the slow EMA, coupled with the short EMA surpassing the slow Exponentially Weighted Moving Average, confirms the bullish indication. The trade entry is further refined by waiting for the price to cross above the highest close of the previous 20 periods, ensuring engagement during strong upward movements.

Once again, test the strategy using historical price data to determine the market conditions in which this strategy performs best.

Trade Exits

Conversely, the strategy suggests exiting long positions when the short EMA falls below the slow EMA, indicating a potential reversal or weakening in the market's upward momentum. This methodology provides a structured framework for capturing trends, focusing on momentum and market position relative to moving averages.

Such short-term Exponentially Weighted Moving Average strategies require vigilance and a readiness to act swiftly on the signals provided. This approach, while more demanding in terms of attention and quick decision-making, can offer substantial rewards by exploiting the volatility inherent in the Forex market.

Through careful analysis and timely action, traders can use short-term EWMA settings to enhance their trading performance, capturing gains from rapid market movements.

Crossover Strategy Using Long-Term and Short-Term EWMA

The crossover strategy, utilizing both long-term and short-term exponentially weighted moving averages (EWMA), is a method for Forex traders to identify potential buy and sell signals.

This approach involves setting two EWMAs with different time spans: a shorter one to capture quick market movements (e.g., 10 days) and a longer one to identify the overall trend direction (e.g., 50 days). When these two averages cross, it signifies a potential shift in market momentum, providing actionable trading signals.

Buy Signal

For a buy signal, the strategy looks for the short-term EWMA to cross above the long-term EWMA, indicating that recent price movements are stronger and potentially signalling the start of an uptrend.

Conversely, a sell signal could be generated when the short-term EWMA crosses below the long-term EWMA but traders might also consider overriding this rule if the market breaks a key support level after a long trend and exit the trade as the market closes below the EWMA 50.

USDJPY Example

Consider the example of the USDJPY currency pair which has had strong trends ever since the Fed started to hike rates in March 2022. This created an environment in which a moving average cross over strategy has been very profitable.

Conversely, a moving average cross over strategy is a bad fit with a market that moves sideways in a range. Ranging price action results in many false starts and the faster moving average oscillates around the longer Exponentially Weighted Moving Average.

All in all, timing is crucial in executing trades based on crossover signals. Acting too hastily before a clear trend is confirmed may lead to false signals and potential losses. Conversely, entering the trade too late after the crossover can result in the trader entering at levels that are too high which in turn can result in stop placement that is far from ideal.

Placing Stops

This is a problem often faced by traders with small accounts as they can’t place stops far enough from the likely range the market could fluctuate in. Successful implementation of this strategy requires careful observation of the market movements and disciplined decision-making to capitalise on the signals provided.

By mastering the nuances of timing and signal interpretation, traders can effectively use the crossover strategy to navigate the complexities of the Forex market, maximising their chances of successful trades.

Assessing Trend Strength and Direction with EWMA Slope

Assessing the strength and direction of market trends through the slope of the exponentially weighted moving average (EWMA) offers traders a refined method for evaluating momentum. The slope of an EWMA is a direct indicator of market trend direction and its velocity; an upward slope signifies a bullish trend, while a downward slope indicates a bearish trend. The steepness of the slope further reveals the trend's strength — steeper slopes represent stronger trends.

To evaluate the momentum of a trend using the slope of EWMA, traders can compare the current EWMA value to its value a set number of periods ago.

This comparison provides a quantitative measure of how much the average has moved, thus indicating the trend's strength. A more sophisticated approach involves calculating the derivative of the EWMA line over time, which can offer a more precise measurement of its slope and, by extension, the trend's momentum.

Changing Slope of the EWMA

Consider the case study of the GBPUSD currency pair. A trader observing a gradual increase in the slope of a 30-day EWMA might interpret this as a strengthening bullish trend, suggesting an opportune moment to enter a long position.

Conversely, if the slope of the EWMA begins to flatten or turn downward, it could signal that the bullish momentum is waning, potentially guiding the trader to secure profits and exit the position. In the above chart the change of slope signalled lower momentum in the market alerting traders to the coming break lower in GBPUSD.

Exponentially Weighted Moving Average Slope

Another example involves the USDCAD pair, where a sudden steep decline in the slope of a short-term EWMA, such as a 10-day period, indicates a sharp increase in bearish momentum. The traditional bar chart above shows the change of slope better than a candle stick chart. The abrupt change of slope could prompt a trader to consider short-selling as a strategy, capitalising on the expected decline.

Conversely, a flattening of the slope after a period of decline could suggest that the bearish momentum is losing strength, potentially signalling a reversal or a consolidation phase.

By carefully monitoring the slope of the EWMA, traders can gain valuable insights into the market's momentum, aiding in the timing of their trades. This methodology not only helps in identifying the most opportune moments to enter or exit the market but also in managing risk, as it provides early warnings of potential trend reversals or slowdowns.

Multiple Exponentially Weighted Moving Averages in strength of a trend assessment

Using multiple exponentially weighted moving averages (EWMA) with varying time spans is a strategic approach to assess the strength of a trend in Forex trading. This technique involves plotting short, medium, and long-term EWMAs on the same chart to provide a comprehensive view of market momentum across different time frames. The convergence or divergence of these EWMAs offers insights into the trend's robustness and potential longevity.

EURJPY Example

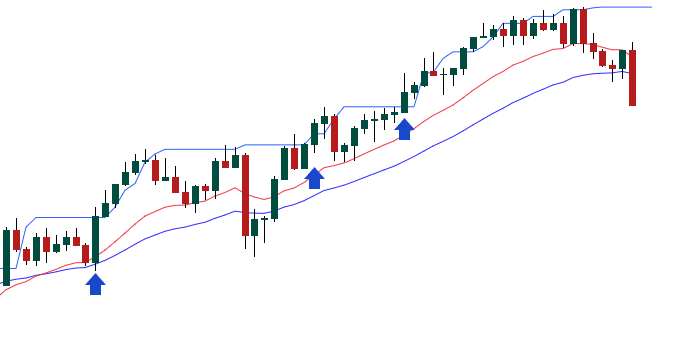

For example, a trader might use a combination of 10-day (short-term), 30-day (medium-term), and 50-day (long-term) EWMAs on the EURJPY currency pair chart. A strong uptrend is indicated when the short-term EWMA is above the medium-term, which in turn is above the long-term EWMA.

This alignment suggests that the current price movement is supported across various time frames, signalling a robust and likely sustainable upward trend. Note also how distance between the fast EWMA and the slowest Exponentially Weighted Moving Average increases (blue arrows increase in size), indicating increasing upside momentum in the market.

Conversely, if distance between the short-term EWMA and the longer-term EWMAs decrease (smaller red arrows), it indicates that the trend could be losing strength. Such a scenario might prompt a trader to reassess their position, considering the potential for a trend reversal or pullback.

This multi-EWMA strategy enriches trend analysis, allowing traders to make more informed decisions by understanding the interplay between short-term price actions and long-term market directions.

Conclusion

In conclusion, the exponentially weighted moving average (EWMA) is an essential tool for Forex traders, offering a dynamic and flexible method to analyse market trends, assess risk, and identify trading opportunities. Its ability to prioritise recent price movements over older data makes it highly effective in the fast-paced Forex market, where quick adaptation to new information is critical.

Whether employed for short-term trading strategies, long-term trend analysis, or risk management, EWMA's versatility allows traders to fine-tune their approaches to match their trading style and objectives.

By integrating Exponentially Weighted Moving Averages into their trading arsenal, alongside careful consideration of market conditions and disciplined strategy testing, traders can enhance their ability to navigate the complexities of the Forex market, maximising their potential for success.

The comparison with SMA highlights EWMA's superior responsiveness, reinforcing its value in creating robust, informed trading strategies that can adapt to and capitalise on market dynamics.

Remember that a successful trading strategy goes beyond simply following an indicator. It requires continuous adaptation and a profound understanding of market intricacies. Join our thriving community of traders today and experience the difference with TIOmarkets. To embark on this journey, simply visit our account opening page.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

undefined