Deutsche Bank worries faded on Friday

BY Janne Muta

|Mart 27, 2023Deutsche bank worried traders at the start of the session on Friday but this was quickly reversed and Dow, Dax and FTSE gained while gold and yen started to slip. While indices are starting to show some signs of strength (in the daily timeframe) the performance in the utility stocks (+3.12%) shows how investors are betting on stocks that provide relative safety during a possible recession. Other defensive sectors such as consumer staples (+1.70%) and health care (+1.39%) gained too while financials (-0.06%) and technology (+0.26%) were the laggards of the day.

Ideally, we’d like to see the market firing on all cylinders but given the recent turbulence in bank stocks and recession fears it’s no surprise there’s no broad-based rally. At the time of writing this, indices are retreating. Therefore, it seems that we need to prepare to trade on both sides of the market today. If the bulls manage to halt the decline in the US session it’s good news for the risk sentiment in all markets. All the markets are linked and what happens in equities tends to spill over to gold, commodities and FX. This is why I tend to spend a good chunk of my morning analysing the US equity markets.

DJ is trying to turn bullish

DJ is trying to turn bullish above Friday’s low (31 736). The quick rejection of the level indicates strength and suggests the market could be soon ready to reverse the recent downtrend. But, we need to see further evidence to believe these early indications. A higher low would help and then the final confirmation for the trend change is a decisive breakout above last week’s high (32 767). This would open the way to 33 600 or so. Alternatively, if Friday’s low is penetrated the market is likely to test last week’s low.

FTSE 100 tries to turn higher

Similar to DJ, the UK 100 is bullish above 7330. If the level isn’t penetrated on a closing basis in the 8h chart the market is likely to trade to 7590 or so. Alternatively, if the 7330 level doesn’t hold FTSE probably trades down to 7250 or so.

Gold traded down to the 1966 level

Gold could be bearish below Friday’s high. The market created a top-heavy candle in the weekly timeframe (bearish) and the reactionary high created on Friday was lower than Monday 20th high. Lower reactionary highs often lead to the breaking of the nearest support. Therefore, pay special attention to how the market trades around the 1966 level. Currently, the market is reacting higher from the 1966 level so the bulls might want to push the price a little higher. However, if the level is violated the 1934 level probably gets tested. On the other hand, above 2010 gold could trade to 2030.

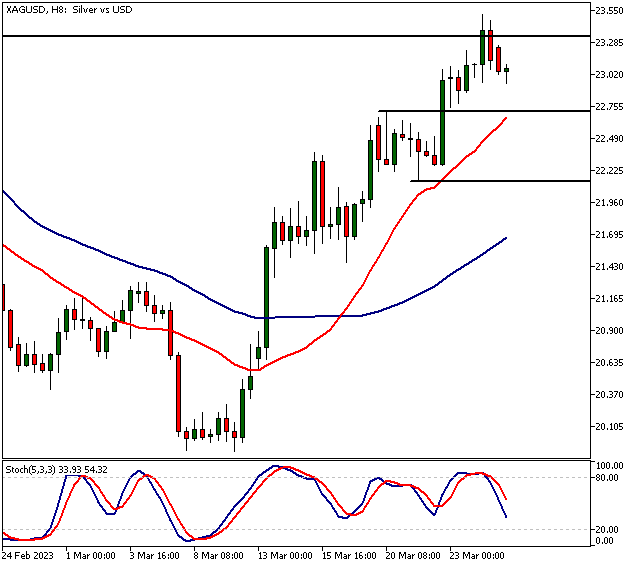

Silver trends higher but reached a key resistance area

The silver uptrend in the 8h chart is in force above 22.70 but the market is trading near a resistance (23.33) and thus the rally could be slowing down. The market has rallied to a key price area (used to support the market in January). If the 22.70 minor support level is broken decisively the market probably trades down to 22.30 or so.

The Next Main Risk Events

- GBP BOE Gov Bailey Speaks

- GBP BOE Gov Bailey Speaks

- USD CB Consumer Confidence

- USD Richmond Manufacturing Index

- AUD CPI y/y

- USD Pending Home Sales m/m

- EUR German Prelim CPI m/m

- EUR Spanish Flash CPI y/y

- USD Final GDP q/q

- USD Unemployment Claims

- USD Final GDP Price Index q/q

- CHF Gov Board Member Maechler Speaks

- USD Treasury Sec Yellen Speaks

- JPY Tokyo Core CPI y/y

- CNY Manufacturing PMI

- CNY Non-Manufacturing PMI

- EUR ECB President Lagarde Speaks

- EUR CPI Flash Estimate y/y

- EUR Core CPI Flash Estimate y/y

- CAD GDP m/m

- USD Core PCE Price Index m/m

- USD Chicago PMI

- USD Revised UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets.com

DISCLAIMER TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval. FX and CFDs are leveraged products. They are not suitable for every investor, as they carry a high risk of losing your capital. Please ensure you fully understand the risks involved. All the prices in this report are CFD prices based on price charts provided by TIOmarkets unless otherwise stated.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.