Giao dịch CFD cổ phiếu

Mua hoặc bán hơn 170 cổ phiếu với mức phí thấp

Giao dịch có rủi ro

GIAO DỊCH TỪ

0.01 CHÊNH LỆCH GIÁ

GIAO DỊCH TỪ

$0 ỦY NHIỆM

ĐẾN

1: ĐÒN BẨY 20X

+

170 CỔ PHIẾU

GIAO DỊCH TỪ

0.01 CHÊNH LỆCH GIÁ

GIAO DỊCH TỪ

$0 ỦY NHIỆM

ĐẾN

1: ĐÒN BẨY 20X

+

170 CỔ PHIẾU

Giao dịch cổ phiếu của các công ty lớn

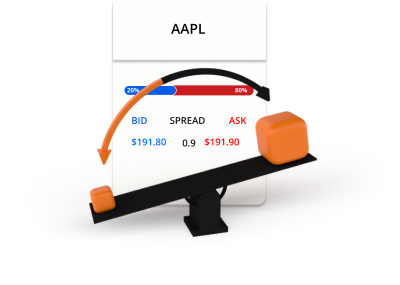

Biểu tượng

Đấu thầu

Hỏi

Chênh lệch giá

*Giá trên trang này là chỉ định. Giá của các công cụ có tính thanh khoản thấp hơn, chẳng hạn như nhưng không giới hạn đối với các cặp tiền tệ kỳ lạ, cổ phiếu và chỉ số không được làm mới thường xuyên như các công cụ được giao dịch phổ biến. Vui lòng kiểm tra bên trong nền tảng MT4/MT5 của bạn để biết giá trực tiếp mới nhất

Cổ phiếu là gì?

Cổ phiếu, còn được gọi là cổ phiếu hoặc vốn cổ phần, thể hiện quyền lợi sở hữu trong một công ty. Khi bạn mua cổ phiếu của một công ty, bạn đang mua một phần nhỏ của công ty đó, bao gồm cả quyền hưởng một phần thu nhập của công ty. Cổ phiếu được các công ty phát hành để huy động vốn nhằm phát triển kinh doanh và chúng có thể được mua và bán. Tuy nhiên, với giao dịch CFD cổ phiếu, nó cho phép bạn suy đoán về biến động giá mà không cần sở hữu cổ phiếu thực tế.

Giao dịch CFD cổ phiếu hoạt động như thế nào

Giao dịch CFD cổ phiếu cho phép bạn suy đoán về biến động giá của cổ phiếu công ty mà không cần sở hữu cổ phiếu thực tế. Nếu bạn nghĩ rằng giá cổ phiếu có khả năng tăng lên, bạn chỉ cần mua nó. Nếu bạn cho rằng giá cổ phiếu có thể giảm, bạn có thể bán nó.

Đặt giá thầu và yêu cầu giá

Mua vào hoặc bán ra

Cổ phiếu được giao dịch theo lô

Giao dịch chứng khoán liên quan đến đòn bẩy và ký quỹ

Ví dụ giao dịch chứng khoán

Bạn quyết định mua 0,1 lô Apple (AAPL) với giá 200 USD sử dụng đòn bẩy 20:1.

0,1 lô = 10 CFD cổ phiếu AAPL

10 CFD cổ phiếu x 200 USD = 2.000 USD

$2,000 / 20 = $100

Bây giờ bạn đã mở một vị thế mua AAPL trị giá 2.000 USD. Vì CFD cổ phiếu được giao dịch bằng đòn bẩy nên chỉ 100 USD được sử dụng làm tiền ký quỹ từ tài khoản giao dịch của bạn. Sau một thời gian, giá AAPL thay đổi và bạn quyết định bán.

Kịch bản 1

AAPL tăng từ $200 lên $250 và bạn quyết định bán.

Đây là cách tính lãi hoặc lỗ trong giao dịch.

P/L = (Giá hiện tại - Giá ban đầu) x Số lượng

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Kịch bản 2

AAPL giảm từ $200 xuống $150 và bạn quyết định bán.

Đây là cách tính lãi hoặc lỗ trong giao dịch.

P/L = (Giá hiện tại - Giá ban đầu) x Số lượng

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Giao dịch giá trị lớn với dịch vụ cao cấp

Đây là lý do tại sao những người như bạn chọn TIOmarkets

Spreads từ 0.0 pips

Giao dịch với chênh lệch biến đổi thô trên tài khoản Raw của chúng tôi

Giao dịch miễn phí hoa hồng

Giao dịch từ $0 mỗi lot trên tài khoản VIP Black hoặc Standard của chúng tôi

MT4 & MT5

Nền tảng giao dịch tiên tiến cho máy tính để bàn, web và thiết bị di động

Khớp lệnh nhanh

Xử lý lệnh hiệu quả và đáng tin cậy trong vài mili giây

Đòn bẩy leverage không giới hạn.

Giao dịch với đòn bẩy không giới hạn trên tài khoản Standard của chúng tôi

Thưởng 30% Loyalty

Nhận thưởng khi nạp tiền vào tài khoản Standard của chúng tôi

Giao dịch trên nền tảng MT4 hoặc MT5

Từ máy tính, trình duyệt internet hoặc điện thoại di động của bạn

Bắt đầu giao dịch chỉ trong vài phút

Cách thức hoạt động như sau

BƯỚC 1

Đăng ký

Hoàn tất hồ sơ và tạo tài khoản của bạn, chỉ mất vài phút

BƯỚC 2

Xác minh

Tải lên giấy tờ xác minh danh tính và địa chỉ, yêu cầu trước khi rút tiền

BƯỚC 3

Nạp tiền

Chọn các phương thức nội địa và quốc tế thuận tiện và nạp tiền ngay lập tức

BƯỚC 4

Giao dịch

Tải nền tảng, chuyển tiền vào tài khoản, đăng nhập và bắt đầu giao dịch

Giao dịch có rủi ro