外匯市場交易

買賣主要、次要或奇異貨幣對

交易涉及風險

來自交易

0.0 點差

來自交易

$0 佣金

高達

1: 無限槓桿

+

70 貨幣對

來自交易

0.0 點差

來自交易

$0 佣金

高達

1: 無限槓桿

+

70 貨幣對

在外匯市場上交易 70 多種貨幣對

做多或做空主要、次要和異國貨幣

符號

出價

問

點差

*本頁價格僅供參考。流動性較低的工具,如但不限於外來貨幣對、股票和指數,其價格不像一般交易工具那樣經常更新。請查看您的MT4/MT5平台內的最新即時價格

什麼是外匯市場?

外匯市場或外匯市場是交換各國貨幣的全球市場。它是全球最大、流動性最強的市場,每日平均交易量達 7.5 兆美元。

外匯市場每週 5 天、每天 24 小時開放,分為 3 個主要交易時段。為全球交易者提供無與倫比的機會和管道。

外匯交易主要透過去中心化的電子銀行網路進行,在全球經濟中發揮至關重要的作用。作為促進國際貿易和投資的重要媒介。

外匯交易如何運作

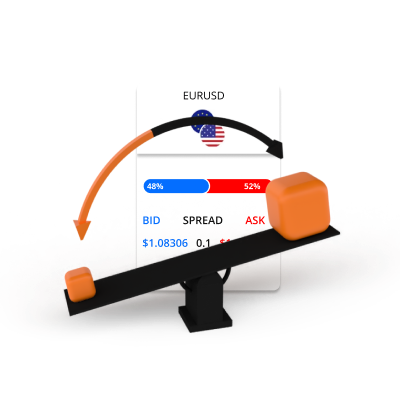

外匯交易涉及同時買入一種貨幣並賣出另一種貨幣。例如,如果您認為由於歐盟經濟強勁成長,歐元兌美元的價值將會上漲,您可能會選擇購買歐元/美元貨幣對。

買入價和賣出價

做多或做空

外匯以手數進行交易

外匯交易涉及槓桿和保證金

外匯交易範例

您決定使用 200:1 槓桿以 1.0800 買入 0.1 手 EURUSD。交易涉及的兩種貨幣是歐元和美元。

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

現在您已透過同時賣出 10,800 美元開設了 10,000 歐元的歐元兌美元多頭頭寸。由於外匯交易使用槓桿,因此您的交易帳戶中僅使用 54 美元作為保證金。一段時間後,歐元兌美元之間的匯率發生變化,您決定賣出。

場景 1

歐元兌美元匯率從 1.0800 上漲至 1.0850。

這就是交易利潤或損失的計算方式。

盈虧 = ((當前匯率 - 初始匯率)

x 頭寸價值)/當前匯率

盈虧 = ((1.0850 - 1.0800) x 10000) / 1.0850

盈虧 = (0.0050 x 10,000) / 1.0850

盈虧 = 46.08 USD

場景 2

匯率從歐元兌美元 1.0800 下跌至 1.0750。

這就是交易利潤或損失的計算方式。

盈虧 = ((當前匯率 - 初始匯率)

x 頭寸價值)/當前匯率

盈虧 = ((1.0750 - 1.0800) x 10,000) / 1.0750

盈虧 = (0.0050 x 10,000) / 1.0750

盈虧= -46.51 USD

極具價值的交易與優質服務

這就是像您這樣的人選擇TIOmarkets的原因

點差低至0.0 pips

在 Raw 帳號享受原始浮動點差交易

零佣金交易

在我們的VIP Black或Standard交易帳戶上,從$0每手開始交易

MT4和MT5

適用於桌面端、網頁端及行動端的進階交易平台

訂單極速執行

毫秒級高效率可靠的訂單處理

不限leverage。

在 Standard 帳戶交易,槓桿最高可達無上限

30%忠誠獎勵

在我們的Standard帳戶每次存款均可獲得獎金

幾分鐘內開始交易

運作方式如下

步驟 1

註冊

填寫基本個人資料並建立帳戶,只需幾分鐘

步驟 2

驗證

上傳身分與地址證明,提款前必須完成

步驟 3

注資

選擇便利的本地或國際方式並完成入金

步驟 4

交易

下載交易平台、登入帳戶並開始交易

交易涉及風險