Copy Trading | A Guide to Get Started

BY TIOmarkets

|أكتوبر 24, 2023Are you intrigued by the idea of making money in the financial markets but feel overwhelmed by the complexities of trading? Imagine if you could start investing without needing to know a lot or have much experience. Enter copy trading – a new idea that's changing how people invest.

Copy trading lets you copy the trades of skilled traders without doing anything yourself. This accessibility and potential for profitability have made copy trading gain popularity, attracting both beginners and experienced traders.

In this guide, we will explore the potential of copy trading and show you how you can get started.

Understanding Copy Trading

Copy trading is a relatively new phenomenon in the realm of investing. Since copy trading lets new investors copy the strategies of experienced traders, individuals can potentially make money from their expertise without needing to have the same knowledge or experience.

Copy trading platforms connect investors with traders, each with their unique strategies and track records. Investors can browse through these traders (often referred to as strategy providers), and assess their track record of performance, before deciding which ones to follow and copy.

Once an investor (or follower) selects a trader to subscribe to, the copy trading platform automatically copies the chosen trader's actions into the investor's account. This means that whenever the chosen trader executes a trade, whether it's buying a stock, selling a currency pair or a commodity, the same action is mirrored in the investor's account.

Copy trading is great because it's easy to understand and accessible. Even if you don't know much about financial markets, you can participate and potentially benefit by following experienced traders.

However, it's essential to understand that copy trading comes with risks, and success is not guaranteed. Like any form of trading or investing, thorough research, risk management, and diversification are important for long-term success.

Benefits of Copy Trading For Followers

Passive Income Potential: For those who lack the expertise to actively trade, copy trading provides an opportunity to earn profits without actively managing their investments.

Access to Expertise: Since copy trading allows followers to copy the trades of experienced and successful traders, it provides access to their knowledge and expertise.

Time Savings: Since you don’t need to spend countless hours analyzing markets and individual assets, it saves time and effort while still potentially generating returns.

Diversification: Copy trading allows investors to diversify their portfolios by following multiple traders who employ different strategies across various markets.

Risk Management: Followers can reduce risk by diversifying their investments across multiple traders with different trading styles and risk profiles.

Convenience: Copy trading eliminates the need for followers to constantly monitor markets and execute trades manually.

Benefits of Copy Trading For Strategy Providers

Additional Income Stream: Strategy providers can earn additional income from their trading by sharing their trading strategies and attracting followers to copy them. These include performance, management, and registration fees which are all decided and set by the strategy provider.

- Performance fees: Are calculated based on a high watermark level either daily, weekly, or monthly. Strategy providers can earn up to 30% of their follower's profits.

- Management fees: Strategy providers can also earn a monthly management fee of up to $30. This is an optional ongoing fixed monthly fee.

- Registration fee: This is an optional one-time fee decided by the strategy provider. This is when a follower starts copying their trades.

Build a Reputation: Strategy providers can establish a track record of performance within the copy-trading community, to attract subscribers and potentially increase their earnings.

Accountability: Creating a public record of your trading performance can serve as a personal reminder of your progress and motivate you to improve to achieve better results.

Focus on Trading: By becoming a strategy provider, traders can focus on trading without the need to manage individual client accounts or provide investment advice.

Getting Started with Copy Trading

Choosing the right copy trading platform is crucial for a successful experience because it affects several key aspects of your trading journey, from the quality of the traders you can copy to the tools available for risk management.

Here is why the TIOmarkets copy trading platform stands out for both followers and strategy providers:

Quality of Traders

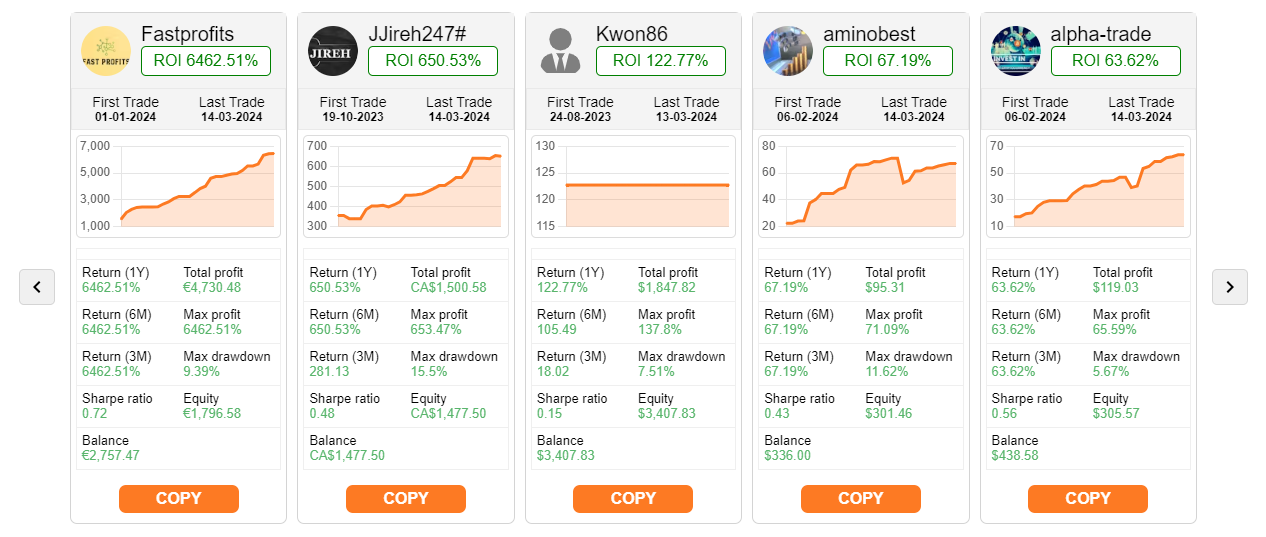

The effectiveness of copy trading heavily relies on the skill and strategy of the traders you copy. TIOmarkets copy trading platform has a diverse range of traders that you can select from and copy.

Performance History

You will have access to the performance history of the traders available for copying. This transparency enables you to make informed decisions before you invest. However, it is important to note that past performance is not a reliable indicator of future results because the market is dynamic and performance can change.

Reliable Execution

With copy trading, your trade needs to be executed simultaneously with the trader you're following with minimal delay and price slippage. Your copy trading account is co-located with the strategy provider's trading account on the same trade server.

Risk Management Tools

Our platform provides the tools that allow you to manage your risk levels, such as stop-loss levels, lot sizes to trade, and control for the amount of capital assigned to each strategy provider.

Fees Structure

The fee structure is set by the strategy provider and is designed to align their interests with their followers. If the followers don’t make any profits, then the strategy provider doesn’t make any either. The fees to copy any strategy provider are clear and upfront and you should take these into account before you subscribe.

User-Friendly Interface

Our copy trading platform is well-designed and has an intuitive user interface. Giving you easy access and full control to configure your copy trading settings and make better-informed investment decisions.

How to Select Strategy Providers to Copy

When it comes to choosing traders to copy, it's essential to consider several criteria to increase your chances of success and minimize risk. Here are some key factors to keep in mind:

Performance History

Look for strategy providers with a proven track record of consistency over an extended period. Review their historical performance, including return on investment (ROI), drawdowns, balance, and equity. Another important piece of information to consider is a strategy provider's Sharpe ratio, which shows the trader's risk-adjusted return. A high sharpe ratio indicates that a trader took less risk to generate higher returns. While a low sharpe ratio indicates that a trader is willing to assume higher risk to generate returns. While past performance doesn't guarantee future results, you want to see some evidence that a strategy provider is consistent and reliable.

Risk Management

Evaluate how strategy providers manage risk in their trading. Assess whether they use appropriate risk management techniques, such as setting stop-loss orders to limit potential losses or diversifying their trades across multiple assets and markets. You may want to overlook strategy providers with a higher risk tolerance to you or invest a smaller amount to more riskier strategies.

Trading Strategy

Strategy providers have an opportunity to clarify and describe their strategies and risk management rules to potential followers before they invest. Try to understand the way each strategy provider trades and consider whether their approach aligns with your investment goals and risk tolerance. Some traders may specialize in day trading, while others focus on long-term investing or specialize in certain asset classes.

Demo Account Testing

Before committing real capital, you may want to consider testing with a demo account. However, it is important to understand that demo accounts are not cross-compatible with real accounts. This means that a demo follower can only copy a demo strategy provider and real account followers can only copy real account strategy providers. This ensures that when you do invest real funds for copy trading, your strategy provider is also trading their real funds.

How to register as a follower

Step 1: Log in to your TIOmarkets account

Step 2: Click on ‘Open live account’

Step 3: Select ‘Copy Trading’ from the available account types and configure your account

Step 4: Check the terms and conditions and click ‘Open Live Account’

Step 5: Check your email for the login details

Step 6: Return to your TIOmarkets client portal and select ‘Copy Trading’

Step 7: Check the strategy providers and find one to copy

Step 8: Click ‘Login’

Step 9: Select ‘Register as a Follower’ and enter your login details from the email

Step 10: Choose any strategy and click ‘Register’

Step 11: Go to ratings to find more strategy providers, and see their profiles and offers

Step 12: Once you have decided who to copy, click ‘Invest’ to create a new subscription

Step 13: Activate copy trading by going to ‘My Portfolio’ to locate the strategy you have subscribed to, enter the strategy details by clicking on the arrows, and copy new position

How to register as a strategy provider

Step 1: Log in to your TIOmarkets account

Step 2: Click on ‘Open live account’

Step 3: Select ‘Copy Trading’ from the available account types and configure your account

Step 4: Check the terms and conditions and click ‘Open Live Account’

Step 5: Check your email for the login details

Step 6: Return to your TIOmarkets client portal and select ‘Copy Trading’

Step 7: Click ‘Become a Provider’

Step 8: Select ‘Login as a Client’ and then register as a provider with your login details

Step 9: Click ‘Login’

Step 10: Go to ‘My Providers’ to edit your common information and save the changes

Step 11: Edit the personal details of the account, enter a description of your trading strategy

Step 12: Edit the strategy settings for publishing deals

Step 13: Update your finance settings and choose the account to receive the fees from your follower

Step 14: Create an offer: set your performance, management, or registration fees and click ‘Create’

Maximizing Your Copy Trading Experience

Once you've started copy trading, maximizing your experience involves more than just selecting the right traders to follow. It's about implementing effective strategies that prioritize risk management, diversification, and responsible investing. Here are some key strategies for making the most of your copy-trading journey:

Strategies and Tools for Effective Copy Trading

Once you've begun your copy trading journey, it's important to leverage the available tools and features to enhance your experience and optimize your investment outcomes. Here's a guide to exploring and utilizing platform tools and features:

Prioritize Risk Management

One of the most critical aspects of successful copy trading is effective risk management. It's important not to invest money you can not afford to lose. Here are some things to consider to enhance your copy trading experience.

- Set Stop-Losses: Utilize this feature to limit your downside risk.

- Managing Position Sizes: Adjust your lot sizes to copy strategy providers to an appropriate proportion given their account balance and your invested amount.

- Pay Attention to Drawdowns: Keep a close eye on the drawdowns experienced by the traders you're copying. If a trader's drawdown or equity exceeds your risk tolerance or expectations, consider reducing the amount you invest to copy the strategy provider.

- Set maximum allocation percentages per trader: Determine the maximum percentage of your total investment portfolio that you're willing to allocate to any single trader.

- Adjust leverage levels:

Embrace Diversification

By spreading your investments across multiple strategy providers, you can reduce the impact of individual losses and potentially improve the stability of your portfolio. Here are some ways you can effectively diversify with copy trading:

- Select Traders with Different Strategies: Choosing traders who take on different trading styles and strategies will reduce the likelihood of duplicating trades.

- Copy strategy providers who trade in different markets: Diversify your portfolio by copying traders who trade various asset classes, including stocks, forex, commodities, and cryptocurrencies.

- Balance Risk and Reward: Diversify between strategy providers and allocate your investments according to low, medium, and high-risk performance.

Invest Responsibly

While copy trading can be a powerful tool for generating returns, it's essential to invest responsibly and avoid risking more capital than you can afford to lose. Keep the following principles in mind:

- Set Realistic Expectations: Set realistic expectations for returns and be prepared for periods of volatility and potential losses.

- Start Small: Start copy trading with an amount you are comfortable with, especially if you're new.

- Regularly Review and Adjust: Comprehensive performance analytics tools include metrics such as annualized returns, maximum drawdown, win rate, and average trade duration. Continuously monitor the performance of the traders you're copying and be prepared to make adjustments to your portfolio along the way.

Start your copy trading journey with TIOmarkets

Whether you're a beginner to the financial markets or an experienced trader with a viable strategy, copy trading has huge potential. For beginners, you can effortlessly invest in the global financial markets by leveraging the skills and experience of other traders. Reducing the time and effort required for learning, monitoring the markets, and executing trades.

For experienced traders, copy trading can provide additional income from trading. Besides the potential financial benefits, publicizing your track record can help to improve accountability and motivation for continuous improvement.

Our copy trading platform offers an excellent environment for both followers and strategy providers to maximize their opportunities. Take the next step, register and create your copy trading account in the client area.

Learn about other forex trading accounts

- Forex nano account

- Forex cent account

- Forex micro account

- Forex mini account

- Forex raw spread vs standard account

- Forex low fee trading account

- Forex demo account

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & Countries included in the OFAC sanction list. The Company holds the right to alter the aforementioned list of countries at its own discretion.

TIOmarkets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.