Forex Swap Fee Explained | What are swaps in Forex?

BY Chris Andreou

|mai 16, 2022Forex swap fees can surprise a lot of traders new to forex, because they are one of the least considered and misunderstood costs in trading. Although swaps are not hidden costs, they are often overlooked and may come as a surprise when they happen. Simply because many people who have never experienced Forex trading before don’t know what swaps are.

Swaps are not something that you should be majorly concerned about because Forex swap fees are usually small. And in some cases, they can actually work in your benefit.

So let’s dig deep into the subject and unravel what is going on with Forex swap fees and dispel any confusion around them.

Would you like to know more about what swaps are in Forex and how they affect your trading? Keep reading to find out.

Download the trading platform to see what the current Forex swap fees are.

What Forex swap fee means when trading

When you trade Forex, there are various costs involved. Such as the spread and broker commission where applicable and whenever you execute a trade. Another fee that is an integral part of the Forex market is what is referred to as the swap. Even though this is charged to your open trades by your broker, it is not entirely controlled by them.

Let me elaborate further.

What are Forex swap fees?

A Forex swap is a fee credited or debited to your open trades for having a position open in the market overnight. When you roll a position over to the next trading day, you will either earn or pay a swap. These swaps will continue to accrue on your open positions until the trade is closed.

The close of the trading day is considered to be at the close of business New York time, or 22:00 GMT (London time). Any trades carried over during this time to the next trading day may incur a swap fee.

How does swap work in Forex

Swaps in Forex trading are based on interest rates, and the interest rates are set by the respective central bank for that currency. These interest rates change depending on the central bank’s fiscal policy and are subject to change, depending on the economic environment and what their goals are.

For example, when central banks raise interest rates, they increase borrowing costs and incentive savings or deposits. This usually happens in inflationary environments or when economies are overheating. To stimulate growth, central banks reduce interest rates to make borrowing cheaper, which provides incentives to borrow, spend and consume. Low interest rates also motivates investors to move assets and invest in other higher yielding assets because there is low or no interest in savings.

So Forex swap fees are how much you pay in interest to “borrow” currency compared to what you receive in interest when “investing” in another currency. This interest rate differential between assets or currencies determines whether you will pay or receive the Forex swap fee.

Let’s take a look at a couple of examples so you can better understand how this works.

Forex swap fee examples

First of all, let’s be clear that each currency has its own interest rate. Also, two currencies are involved in any Forex transaction. One currency is sold to simultaneously buy another. So two interest rates are involved in the calculation to determine the swap.

If the interest rate of the currency sold is lower than the interest rate of the currency bought, it is possible to earn the swap. Because the interest rate differential between the two currencies will have a positive yield. In other words, the borrowing costs of the currency sold is less than the interest earned from the currency bought.

If it was the other way around, where the currency bought has a lower interest rate than the currency sold. The interest earned will be less than the borrowing costs, creating a negative interest rate differential. So you would be paying the difference in swap fee for as long as you are holding the trade open from one day to the next.

Then when you close the trade or reverse the transaction, the swap fees will stop. Here is an example and the calculation for each positive and negative swap.

The interest rates used are for illustration purposes only and are subject to change. You can find up to date swap rates inside the MT4 & MT5 trading platform.

Example trade with positive swap

Let’s say that you want to trade the USDJPY. The two currencies involved are the US Dollar and the Japanese Yen. The relevant interest rates for these two currencies are set by the respective central banks. Which are the US Federal Reserve (FED) and the Bank of Japan (BOJ). On top of this, brokers usually add a small spread to the swap rate as well.

If the interest rate set by the FED is 2% per annum and the interest rate set by the BOJ is 0% per annum. It will cost 2% per year to borrow US Dollars and 0% per year to borrow Japanese Yen. Conversely, investing in a USD savings account will yield 2% per annum and investing in a JPY savings account will yield 0% per annum.

Now we know what’s what with the currencies.

So, if you were to take out a loan in JPY at 0% interest and convert that to USD and keep it in a savings account at 2% interest, you will earn the difference in the interest rate.

With regards to Forex trading and exchange rate risk aside, buying 1 lot ($100,000) in the USDJPY will yield $2,000 per year in swaps. Or the daily equivalent amount for as long as the trade remains open.

Example trade with negative swap

For this example I am going to use the EURZAR as the currency pair. The relevant interest rates involved with these two currencies come from the European Central Bank (ECB) and the South African Reserve Bank (SARB). On top of this, brokers usually add a small spread to the swap rate as well.

If the interest rate set by the ECB is 1% per annum and the interest rate set by the SARB is set at 5% per annum. It will cost 1% to borrow euros and 5% to borrow South African Rand respectively. Conversely, savings denominated in ZAR will earn 5% per year in interest and 1% per year for savings denominated in EUR.

So if you were to take out a loan in ZAR, convert the amount into EUR and park it in a EUR denominated savings account, you wouldn’t earn any interest. Because EUR is paying 1% while you owe 5% to the lender in ZAR.

With regards to forex trading and exchange rate risk aside, buying 1 lot (EUR 100,000) in the EURZAR will incur negative swaps. Your trade will earn 1% per year on EUR 100,000 or EUR 1,000 but you will owe 5% on the equivalent amount in ZAR. Or the daily equivalent amount for as long as the trade remains open

That is the general gist of it but there is more, the Forex swap fees are calculated and converted in terms of pips and points.

Keep reading to learn more and I will also show you how you can find the swap rates for each symbol on the trading platform. Knowing this can help you make better informed trading decisions.

How do swaps affect my trades

As you already know, Forex swap fees are a cost (or potential benefit) of trading in addition to spreads and commissions. However with the latter, these are one off costs when you open a deal. For the former, swaps are an ongoing cost for as long as the deal is open.

All of these costs of trading are or can be expressed in terms of pips and points and swaps are no exception.

Swaps only affect the unrealized profit or loss of your trade. On the MT4 or MT5 trading platform, the swap fees are not debited or credited to your balance. It accrues, either positively or negatively and is either added or deducted from the net profit or loss of the trade.

Where to find Forex swap fee on the brokers platform

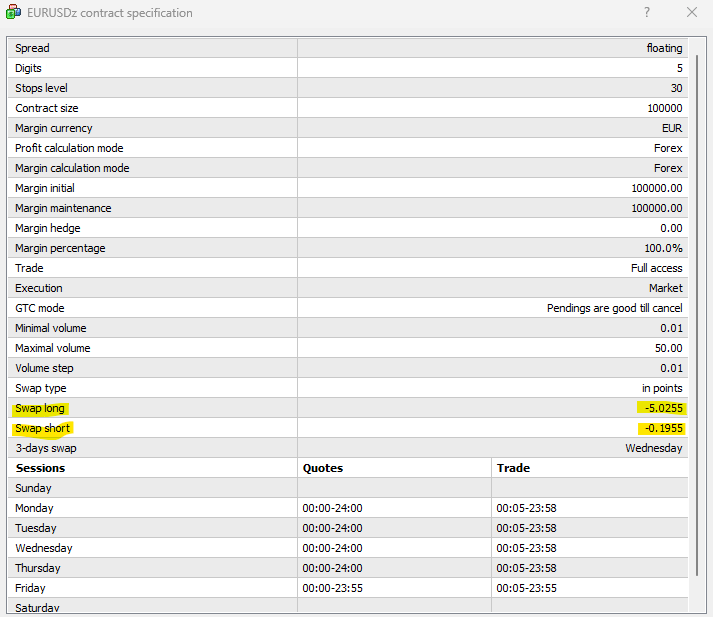

To know what the swap rates are so you can better understand how they can affect your trades, the best place to look on the trading platform. Each symbol has a contract specification and the swap rates can be found there. So open your trading platform and follow these steps.

Step 1. Right click on the symbol in the market watch window

Step 2. Select the specification option from the pop-up menu that appears

Step 3. A window will appear with a description of the symbol. Scroll down

until you find the information related to swaps.

This tells you what the swap rate is in terms of points and also the days that the swap will be applied. In this example for the EURUSD and at the time of publishing this article, the swap is -5.0255 points for long positions in this currency pair. The swap for short positions in the EURUSD is -0.1955 points.

What this means is that you will pay 0.50255 pips if you buy and 0.1955 pips if you sell short. The pip value will depend on your lot size and for the purpose of this explanation, it will be approximately $5.02 for long and $0.02 for short per lot.

You can also see that the swap fee is taken once on Monday, Tuesday, Thursday and Friday. On Wednesday, it will be triple the rate to take the weekends into account.

How you can benefit from the Forex swap fee

If you would like to potentially benefit from the swap, you should look to buy currency pairs where the base currency has a higher interest rate than the quote or counter currency. Alternatively, you can sell the currency pairs where the quote or counter currency has a higher interest rate than the base currency. Always check the trading platform and the contract specification first.

With that being said, although you may receive the swap on rollover, there is no guarantee that you will make money. There is exchange rate risk and currency fluctuations must also be taken into account. However, if you are right about the direction of price it is a nice added bonus to profit from the swap as well while you are in the trade.

Conclusion

Although there are many fees involved in Forex trading, the one fee that causes a lot of confusion is the swap. Similar to the interest payments when taking out a loan, the Forex swap fee are fees paid on the financing currency on the trades you make. In other words, the currency that was sold in order to purchase the other. The longer you carry a position, the more it could cost in terms of swap.

Swaps can also benefit you too, but it requires some understanding of how they work and the steps you can take to avoid paying them. Knowing what the interest rate differential is between two currencies can help you position yourself to earn the swap instead of paying it.

This article explained in detail what swaps are, how they are calculated and the effect they have on your open trades. They are an integral part of the forex and financial markets so it is important that you understand them.

Register your trading account and download the trading platform to try our trading conditions or to see what the Forex swap fees are.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Experienced independent trader