CFD Indices Trading Simplified | How Does It All Work?

BY TIOmarkets

|Maret 22, 2024Among the various avenues available for trading, CFD indices stand out as a popular choice for investors seeking exposure to market movements without the need to own underlying assets.

In this article, we'll explore the intricacies of CFD indices trading, clarify the mechanics of trading indices, benefits, and potential pitfalls. From understanding the basics of CFD trading to developing a successful trading strategy, we'll equip you with the essential knowledge to begin your journey into CFD indices trading.

Understanding CFD Indices

Indices, such as the S&P 500, FTSE 100, or DAX 30, represent the performance of a group of stocks that are selected to reflect the overall performance of a stock market or sector. CFDs (Contracts For Difference) allow you to trade on the price movements of indices without needing to buy or sell the individual stocks that comprise them. This offers exposure to broader market trends and allows for diversification within a single trade.

Benefits of trading indices through CFDs

1. Leverage

One of the key advantages of trading indices through CFDs is the ability to use leverage. Leverage allows you to control a larger position size with a relatively small amount of capital. For example, with a leverage ratio of 1:100, you can control a position worth $10,000 with just $100 in your trading account. This lowers the barrier to entry and amplifies your profit potential. However, it can also amplify your losses too, so it's important to use leverage with caution and manage risk effectively.

2. Ability to go long or short

CFDs offer the flexibility to profit from both rising and falling prices. If you think an index will rise in value, they can open a long position (buy). Conversely, if you anticipate a price decline, you can open a short position (sell). This ability to go short allows you to profit from falling markets or hedge existing positions in your portfolios.

3. Diverse market exposure

Indices represent a diverse range of companies from various sectors, making them a convenient way to gain exposure to the broader stock market with a single contract. Whether it's the performance of technology stocks in the NASDAQ or blue-chip companies in the Dow Jones Industrial Average, CFD indices trading allows you to potentially capitalize on market movements without the need to trade in all the individual stocks.

The Mechanics of CFD Indices Trading

CFD indices trading involves speculating on the price movements of various stock indices without owning the underlying assets. Instead, traders enter into a contract with a broker to exchange the difference between the buy and sell price.

When you decide to open a CFD position on an index, you choose whether to go long (buy) or short (sell) based on your market analysis. If you predict that the index's value will rise, you will enter a long position; if you anticipate a decline, you opt for a short position.

Indices CFD trading example

You decide to buy 0.1 lots of the S&P500 at 4500 using 100:1 leverage.

Trade size: 10 indices contracts x 4500 = USD 45,000

Position value: USD 45,000

Margin requirement: USD 45,000 / 100 = USD 450

Now you have a long position in the S&P500 worth USD 45,000. Since futures are traded using leverage, only $450 was used as margin from your trading account.

After some time, the price of the S&P500 moves and you decide to sell.

Scenario 1

The S&P500 moves up from 4500 to 4600 and you decide to sell.

This is how the profit or loss on the trade would be calculated:

- P/L = (Current price - Initial price) x Position value / Current price

- P/L = ((4600 - 4500) x 45,000) / 4,600

- (100 x 45,000) / 4,600

- P/L = 978.26

Scenario 2

The S&P500 moves down from 4500 to 4400 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

- P/L = ((Current price - Initial price) x Position value) / Current price

- P/L = ((4400 - 4500) x 45,000) / 4,400

- P/L = (-100 x 45,000) / 4,600

- P/L = -978.26

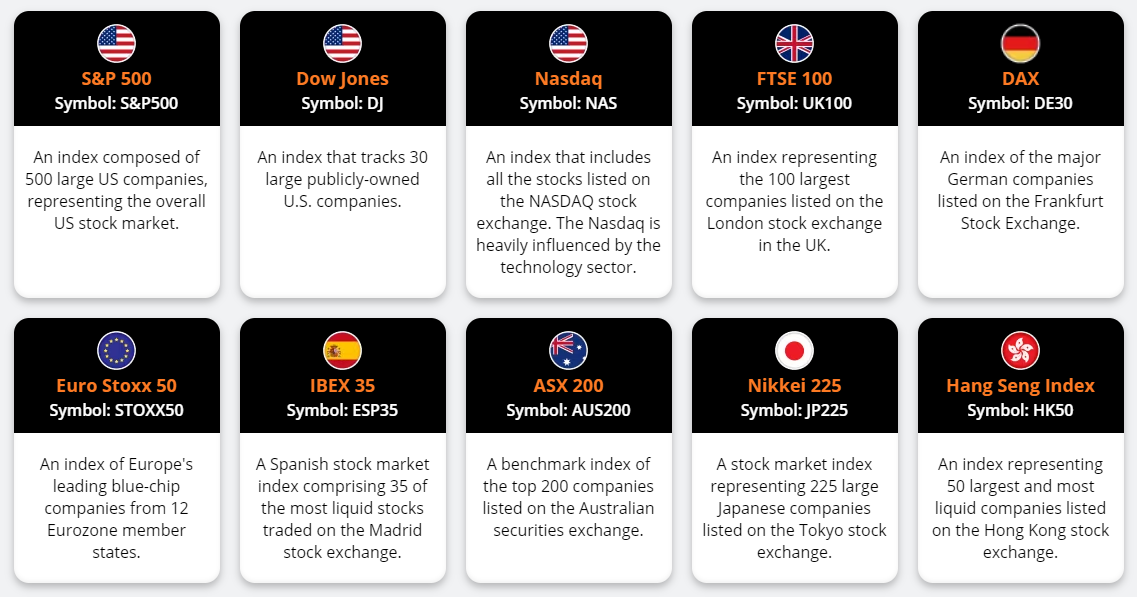

Popular CFD indices for trading

Several global stock indices are commonly traded through CFDs, offering exposure to diverse markets and sectors. Some of the most popular indices include:

- S&P 500 - An index composed of 500 large US companies, representing the overall US stock market.

- Nasdaq - The Nasdaq is heavily influenced by the technology sector.

- FTSE 100 - An index representing the 100 largest companies listed on the London Stock Exchange in the UK.

- Stoxx 50 - An index of Europe's leading blue-chip companies from 12 Eurozone member states.

Trading these indices via CFDs allows you to capitalize on both rising and falling markets, leveraging market fluctuations to your advantage.

Choosing the Right CFD Indices Trading Platform

With many options available, it's important to find the right platform that not only aligns with your trading goals but also offers essential features to enhance your trading experience.

Here are some of the key features and benefits to look for.

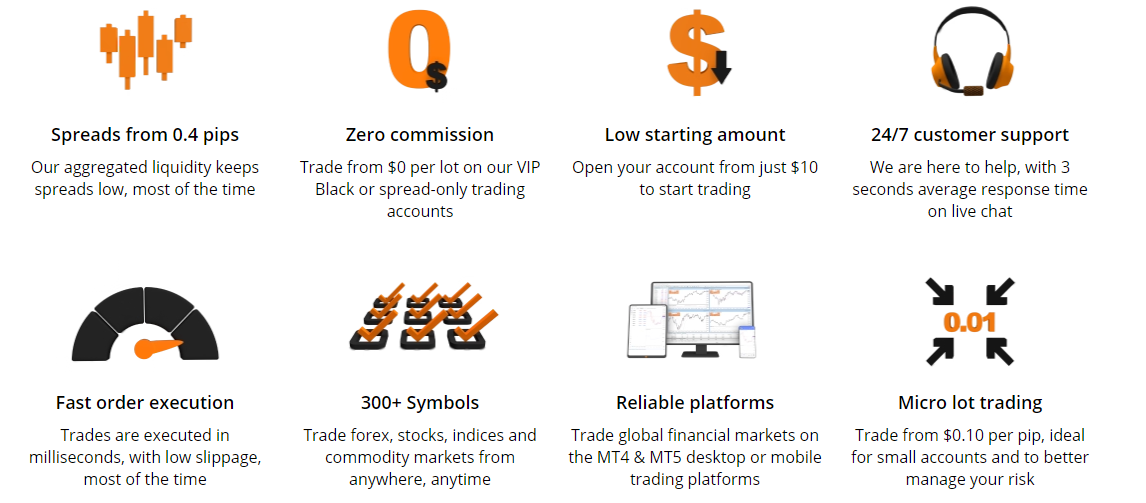

1. Competitive trading conditions

A CFD indices trading platform should offer competitive trading conditions to maximize your profitability and minimize costs. Look for platforms that provide low trading fees and competitive leverage options.

2. Low starting amount

A lower barrier to entry makes the trading platform accessible to more people, especially beginners who might be hesitant about investing a large amount of money. Trading inherently comes with risks, especially in volatile markets like indices. A low minimum deposit requirement allows you to start small, limiting your potential losses as you learn.

3. Small lot sizes

The ability to trade CFD indices in micro lots offers traders greater flexibility and precision in managing their investment sizes. It enables you to execute trades that are proportionate to your risk tolerance and account size. Also, smaller position sizes, can limit the potential downside risk, making this more appealing for beginners or traders that are investing small amounts of capital.

4. Reliable customer support

Efficient customer support is essential for traders and good brokers should offer responsive and knowledgeable customer support. At TIOmarkets, we are available 24 hours a day, 7 days a week with an average live chat response time of about 3 seconds.

5. Fast order execution

Fast execution times reduce the risk of slippage, ensuring trades are executed closer to the prices you see on the trading platform. Lower slippage means more predictable outcomes and potentially better profitability on your trades.

6. Reliable trading platforms

The trading platform is like your door to the financial markets, so choose one that's easy to use and has a variety of helpful features. Opt for platforms known for their reliability, speed and advanced features. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are two of the most popular retail trading platforms available today.

Developing a Successful CFD Indices Trading Strategy

Developing a robust CFD Indices trading strategy involves a structured approach, to reduce uncertainty and enhance the potential for successful trades. Here's a simple step-by-step methodology to help you get started:

1. Understand the market

Educate yourself about the indices markets you're trading in, including how they work and the fundamental and economic factors that influence their movements.

2. Define your trading rules

Your strategy should clearly outline the conditions and criteria for entering and exiting trades. This rule-based approach helps eliminate impulsive decisions and keeps your trading disciplined.

3. Use fundamental analysis

Evaluate the overall health of the indices you're trading. This involves analyzing economic, industry, and company data – including earnings reports, GDP, interest rates, and economic indicators to predict future price movements.

4. Use technical analysis

Learn to identify potential support and resistance levels, which are the price points that an index rarely falls below (support) or rises above (resistance). These levels can provide insights for strategic entry and exit points. There are also a myriad of other technical indicators and techniques you can use to identify entry and exit points.

5. Risk management

Define your risk tolerance level and decide how much capital you're willing to risk on each trade. This step might involve setting stop losses and taking profits at certain levels to protect your account against significant losses.

6. Practice and refine your strategy over time

Remember, every trader's strategy will be unique, reflecting their financial goals, risk tolerance, and trading style. What works for one might not work for another, so it's important to develop a trading strategy that suits your individual needs and stick with it.

Common Pitfalls to Avoid When Trading

Many traders fall into common pitfalls that can lead to substantial losses. Understanding these pitfalls and knowing how to avoid them is crucial for success in CFD indices trading.

Here are some of the most common mistakes traders make and how to avoid them to become a better trader:

1. Over-leveraging your account

One of the most common mistakes traders make in CFD indices trading is over-leveraging. While leverage can amplify gains, it also magnifies losses, leading to significant risks. Beginners often fall into the trap of using excessive leverage, lured by the promise of quick profits.

To avoid this, it's important to use responsible leverage ratios, making sure your trading positions are proportionate to your capital. A general rule of thumb is to limit lot sizes to amounts you're comfortable with and avoid risking too much.

2. Trading based on emotion

Emotions play a significant role in trading, and allowing them to control your decisions can lead to bad outcomes. Fear and greed often drive impulsive actions, causing traders to deviate from their strategies and start revenge trading.

To avoid emotional trading, it's important to stick to a well-defined trading plan with predetermined entry and exit points. Practicing discipline and maintaining a rational mindset can prevent you from giving in to emotional urges.

3. No trading plan

Your capacity to improve and succeed as a trader relies on focusing on elements within your control. This includes decisions about the markets or instruments you trade, risk management and how you handle emotional responses to the market or trading outcomes.

How to Get Started with CFD Indices Trading

If you haven’t already got an account, follow these simple steps to get started with indices trading.

1. Register your account

Register your account with TIOmarkets, it only takes a few minutes and this will take you to your secure client portal.

2. Open a demo or live account

Create your demo or live account and choose the MT4 trading platform when setting it up. The login credentials will be sent to you by email.

3. Download the trading platform

Download the MT4 trading platform to your computer or mobile phone.

4. Deposit funds

Go to deposit, select your deposit method and enter your preferred amount. You can start trading with TIOmarkets from just $10.

5. Transfer funds to your trading account

Once you have made a successful deposit, go to manage funds and transfer the funds from your TIOmarkets wallet to your trading account.

6. Log in to trading platform and start trading

Log in to the MT4 trading platform and you should notice your balance reflects your deposit.

Try Trading on a Demo Account

Demo accounts serve as invaluable tools for CFD indices trading by providing a risk-free environment where you can practice and develop your skills without the possibility of financial loss. Demo accounts mimic real market conditions, allowing you to familiarize yourself with the market, the trading platform, and test strategies.

By using a demo account, you can get real-time, hands-on education and develop skills that are essential for making informed decisions in the market.

Conclusion

Exploring CFD indices trading opens up lots of opportunities for anyone interested in trading global financial markets. However, understanding the mechanics of CFD trading and its application to indices is essential for navigating the market successfully.

Developing a successful trading strategy requires research, disciplined execution, and effective risk management. Remember to set clear trading goals, stick to risk management principles, and stay updated with market developments. You can practice on a demo account to refine your strategies before moving on to live trading.

Moreover, selecting the right broker and trading platform is key for a seamless trading experience. Prioritize brokers with a solid reputation and customer support and competitive trading conditions like TIOmarkets.

Take the first step today and explore the world of CFD indices trading by registering your account.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.

Related Posts