Pertukaran

Kredit atau debit untuk memindahkan posisi ke hari perdagangan berikutnya

Pertukaran semalam

Simbol

Penawaran

Tanyakan

Spread

Swaps

*Harga-harga di halaman ini bersifat indikatif. Harga-harga untuk instrumen dengan likuiditas lebih rendah seperti pasangan mata uang eksotis, saham, dan indeks tidak diperbarui se sering instrumen yang umum diperdagangkan. Silakan periksa di dalam platform MT4/MT5 Anda untuk harga live terbaru.

Apa itu swap dalam perdagangan

Swap adalah biaya yang dikreditkan atau didebitkan ke perdagangan terbuka Anda untuk membawanya semalaman ke hari perdagangan berikutnya. Saat Anda meneruskan posisi ke hari perdagangan berikutnya, Anda akan memperoleh atau membayar biaya swap.

Kapan swap berlaku

Setiap perdagangan terbuka yang dipindahkan ke hari perdagangan berikutnya mungkin dikenakan biaya swap. Penutupan hari perdagangan dianggap pada penutupan waktu bisnis New York, atau 22:00 GMT (waktu London). Perdagangan terbuka akan terus menghasilkan swap hingga ditutup.

Bagaimana swap dihitung

Bank sentral menaikkan atau menurunkan biaya pinjaman sesuai dengan kebijakan moneternya. Setiap mata uang memiliki tingkat suku bunga tersendiri yang ditetapkan oleh bank sentral masing-masing. Saat Anda membeli atau menjual mata uang atau aset, swap dihitung berdasarkan perbedaan suku bunga antara aset dalam simbol. Swap dihitung dalam pips atau poin berdasarkan perbedaan suku bunga antara aset-aset ini.

Misalnya, Federal Reserve AS (The Fed) menetapkan tingkat suku bunga sebesar 5% per tahun, sedangkan Bank of Japan (BOJ) menetapkan tingkat suku bunga 0%. Artinya, Dolar AS akan menghasilkan bunga 5% setiap tahunnya, sedangkan Yen Jepang tidak akan menghasilkan apa pun. Meminjam Dolar AS akan dikenakan tingkat bunga 5% sedangkan meminjam Yen Jepang tidak akan dikenakan bunga tahunan. Jadi dengan menjual Yen Jepang secara bersamaan untuk membeli Dolar AS, maka akan timbul selisih swap positif sebesar 5% per tahun. Namun dengan menjual dolar AS secara bersamaan untuk membeli Yen Jepang, maka akan terjadi swap negatif sebesar 5% per tahun.

Diferensial swap tahunan kemudian dibagi dengan jumlah hari dalam setahun dan dikonversi ke setara pip atau poin dan diterapkan pada perdagangan terbuka setiap hari.

Bagaimana swap mempengaruhi perdagangan Anda

Bergantung pada arah perdagangan dan perbedaan suku bunga antara dua aset dalam simbol, Anda dapat memperoleh atau membayar swap. Jika mata uang atau aset yang Anda beli memiliki tingkat bunga yang lebih tinggi dibandingkan mata uang atau aset yang Anda jual, Anda akan menerima swap (swap positif). Jika tingkat bunga lebih rendah, Anda akan membayar swap (swap negatif). Swap mempengaruhi keuntungan atau kerugian yang belum direalisasi dari perdagangan terbuka selama perdagangan tersebut tetap terbuka dan dibawa semalaman ke hari perdagangan berikutnya.

Apakah swap bervariasi antar pasar?

Bank sentral menetapkan suku bunga untuk negaranya masing-masing, dan suku bunga ini dapat berbeda secara signifikan. Swap, khususnya dalam trading forex, bergantung pada perbedaan suku bunga antara dua mata uang dalam suatu pasangan mata uang. Jadi, tingkat suku bunga yang berbeda-beda di berbagai negara berkontribusi terhadap pertukaran yang berbeda di pasar yang berbeda.

Bagaimana menemukan swap untuk setiap simbol

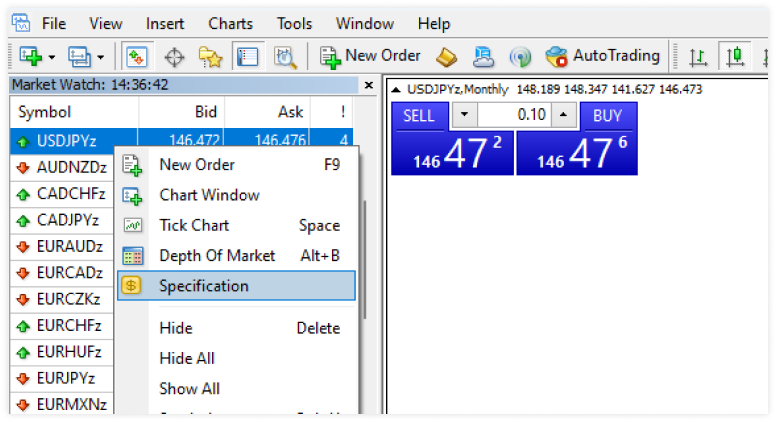

1. Buka jendela Market Watch di platform perdagangan MT4 atau MT5. MT4 atau MT5 platform perdagangan.

2. Klik kanan pada instrumen keuangan (simbol) yang ingin Anda lihat nilai swapnya.

3. Pilih Spesifikasi dari menu yang muncul.

4. Jendela deskripsi simbol akan terbuka di mana Anda dapat menemukan nilai swap di bawah Swap long (untuk posisi beli) dan Swap Short (untuk posisi short)

Pilih akun trading yang tepat untuk Anda

Dapat menggunakan segala gaya dan strategi trading

Standard

Akun trading spread variabel dengan komisi nol

1.1

$0

Hingga tidak terbatas

$20

Raw

Trading dengan spread variabel mentah dan komisi rendah

0.0

$6

Hingga 1:500

$250

VIP Black

Trading dengan spread variabel rendah dan komisi nol

0.3

$0

Hingga 1:500

$1,000

Trading mengandung risiko

Memulai dengan cepat dan mudah

Hanya perlu beberapa menit, begini cara kerjanya

LANGKAH 1

Daftar

Lengkapi profil Anda dan buat akun Anda, hanya membutuhkan waktu beberapa menit

LANGKAH 2

Verifikasi

Unggah bukti identitas dan alamat Anda, ini diperlukan sebelum penarikan

LANGKAH 3

Kirim Dana

Pilih dari metode lokal dan internasional yang nyaman dan setor secara instan

LANGKAH 4

Trading

Unduh platform, transfer dana ke akun Anda, masuk, dan mulai trading

Deposit dan tarik dana dengan percaya diri

Pendanaan akun Anda mudah dan aman

Deposit instan dan gratis tersedia pada metode tertentu. Waktu pemrosesan dapat berbeda tergantung negara dan metodenya. Permintaan penarikan biasanya diproses dalam satu hari kerja dan dikembalikan melalui metode deposit awal.