交換

Credits or debits for rolling positions over to the next trading day

Overnight swaps

Symbol

ビッド

アスク

スプレッド:

Swaps

*このページの価格は参考価格です。エキゾチック通貨ペア、株式、指数など流動性の低い商品の価格は、一般的に取引される商品ほど頻繁に更新されません。最新のリアルタイム価格については、MT4/MT5プラットフォーム内でご確認ください。

What are swaps in trading

The swap is a fee credited or debited to your open trades for carrying it overnight to the next trading day. When you roll a position over to the next trading day, you will either earn or pay a swap fee.

When swaps apply

Any open trades carried over to the next trading day may incur a swap fee. The close of the trading day is considered to be at the close of business New York time, or 22:00 GMT (London time). Open trades will continue to accrue swaps until they are closed.

How is the swap calculated

Central banks increase or decrease borrowing costs in accordance with their monetary policy. Each currency has its own interest rate set by the respective central bank. When you buy or sell currencies or assets, the swap is calculated based on the interest rate differential between the assets in the symbol. Swaps are calculated in pips or points based on the interest rate differential between these assets.

For example, suppose the US Federal Reserve (the Fed) sets an interest rate of 5% annually, while the Bank of Japan (BOJ) decides upon a 0% interest rate. This means that the US Dollar would yield 5% interest each year, while the Japanese Yen would not yield anything. Borrowing US Dollars would incur a 5% interest rate while borrowing the Japanese Yen wouldn't incur any yearly interest. So by simultaneously selling the Japanese Yen to buy US Dollars, it would incur a positive swap differential of 5% per annum. However by simultaneously selling US dollars to buy Japanese Yen, it would incur a negative swap of 5% per annum.

The annual swap differential is then divided by the number of days in the year and converted to the pip or point equivalent and is applied to open trades daily.

How swaps affect your trades

Depending on the direction of the trade and the interest rate differential between the two assets in the symbol, you may either earn or pay swaps. If the currency or asset you bought has a higher interest rate than the currency or asset you sold, you will receive the swap (positive swap). If the interest rate is lower, you will pay the swap (negative swap). Swaps affect the unrealized profit or loss of open trades for as long as they remain open and are being carried overnight to the next trading day.

Do swaps vary between markets?

Central banks set interest rates for their respective countries, and these rates can differ significantly. Swaps, especially in forex trading, depend on the interest rate differential between the two currencies in a currency pair. So varying interest rates across countries contribute to different swaps in different markets.

How to find the swaps for each symbol

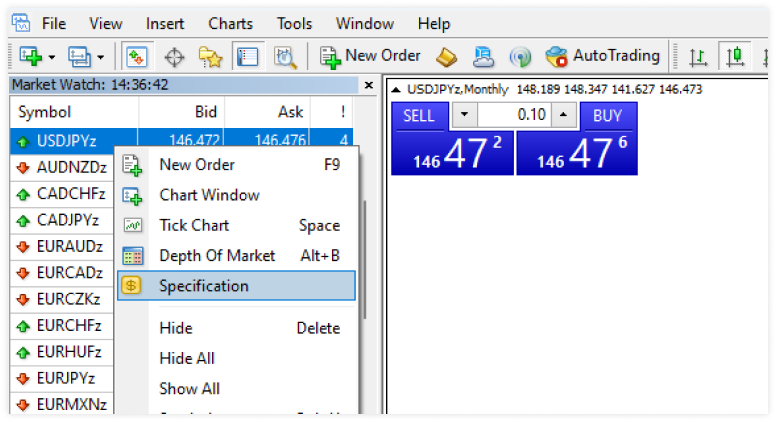

1. Go to the Market Watch window in the MT4 or MT5 trading platforms. MT4またはMT5 trading platforms.

2. Right-click on the financial instrument (symbol) you want to view the swap rates.

3. Select Specification from the menu that appears.

4. The symbol description window will open where you can find the swap rates under Swap long (for buy positions) and Swap Short (for short positions)

あなたに合ったトレーディングアカウントを選択

あらゆる取引スタイルと戦略を歓迎します

Standard

手数料ゼロの変動スプレッド取引口座

1.1

$0

無制限

¥3,000

Raw

生の変動スプレッドと低手数料で取引

0.0

$6

から 1:500

¥37,000

VIP Black

低い変動スプレッドとゼロ手数料で取引

0.3

$0

から 1:500

¥150,000

取引にはリスクが伴います

素早く、簡単に始められます

ほんの数分しかかかりません。

ステップ 1

登録

プロフィールを入力し、口座を開設(数分で完了)

ステップ 2

確認

本人確認書類と住所確認書類をアップロード(出金前に必須)

ステップ 3

入金

国内・海外の便利な方法で即時入金

ステップ 4

取引

プラットフォームをダウンロードし、ログインして取引開始

安心の入出金

口座への資金入金は便利かつ安全に行えます

一部の方法では即時かつ無料での入金が可能です。処理時間は、国や方法によって異なる場合があります。出金リクエストは通常、1営業日以内に処理され、元の入金方法にて返金されます。