스왑

포지션을 다음 거래일로 이월할 때 발생하는 크레딧 또는 차변

일일 스왑

종목명

매수호가

매도호가

스프레드

Swaps

*본 페이지의 가격은 참고용입니다. 이국적 통화쌍, 주식 및 지수 등 유동성이 낮은 상품의 가격은 일반적으로 거래되는 상품만큼 자주 갱신되지 않습니다. 최신 실시간 가격은 MT4/MT5 플랫폼 내에서 확인하시기 바랍니다.

거래에서 스왑이란 무엇인가요?

스왑은 포지션을 다음 거래일로 이월할 때 발생하는 수수료로, 오픈 포지션에 크레딧 또는 차변으로 적용됩니다. 포지션을 다음 거래일로 이월할 때 스왑 수수료를 받거나 지불하게 됩니다.

스왑 적용 시점

다음 거래일로 이월된 모든 미결제 포지션에는 스왑 수수료가 발생할 수 있습니다. 거래일 종료 시점은 뉴욕 시간 기준 영업 종료 시점, 즉 GMT 기준 22:00(런던 시간)으로 간주됩니다. 미결제 포지션은 청산될 때까지 스왑이 계속 누적됩니다.

스왑 계산 방식

중앙은행은 통화 정책에 따라 차입 비용을 인상 또는 인하합니다. 각 통화는 해당 중앙은행이 설정한 고유 금리를 가집니다. 통화나 자산을 매수 또는 매도할 때, 스왑은 해당 심볼 내 자산 간 금리 차이에 따라 계산됩니다. 스왑은 이러한 자산 간 금리 차이에 기반하여 핍(pip) 또는 포인트 단위로 계산됩니다.

예를 들어, 미국 연방준비제도(Fed)가 연 5% 금리를 설정하고 일본은행(BOJ)이 0% 금리를 결정했다고 가정해 보겠습니다. 이는 미국 달러가 매년 5%의 이자를 지급하는 반면, 일본 엔은 아무런 이자를 지급하지 않음을 의미합니다. 미국 달러를 차입할 경우 5%의 이자율이 적용되지만, 일본 엔을 차입할 경우 연간 이자가 발생하지 않습니다. 따라서 일본 엔을 매도하고 미국 달러를 동시에 매수하면 연간 5%의 양의 스왑 차익이 발생합니다. 반대로 미국 달러를 매도하고 일본 엔을 동시에 매수하면 연간 5%의 음의 스왑 비용이 발생합니다.

연간 스왑 차익은 연중 일수로 나누어 핍(pip) 또는 포인트로 환산되며, 매일 체결된 포지션에 적용됩니다.

스왑이 거래에 미치는 영향

거래 방향과 해당 통화쌍의 두 자산 간 금리 차이에 따라 스왑을 받거나 지불하게 됩니다. 매수한 통화 또는 자산의 금리가 매도한 통화 또는 자산보다 높으면 스왑을 받게 됩니다(양의 스왑). 금리가 낮으면 스왑을 지불하게 됩니다(음의 스왑). 스왑은 포지션이 유지되는 동안, 즉 다음 거래일까지 오버나이트로 이월되는 동안 미실현 손익에 영향을 미칩니다.

스왑은 시장마다 다른가요?

중앙은행은 각국의 금리를 설정하며, 이 금리는 크게 다를 수 있습니다. 특히 외환 거래에서 스왑은 통화쌍 내 두 통화의 금리 차이에 따라 결정됩니다. 따라서 국가별 금리 차이는 시장별 스왑 차이를 초래합니다.

각 심볼의 스왑 확인 방법

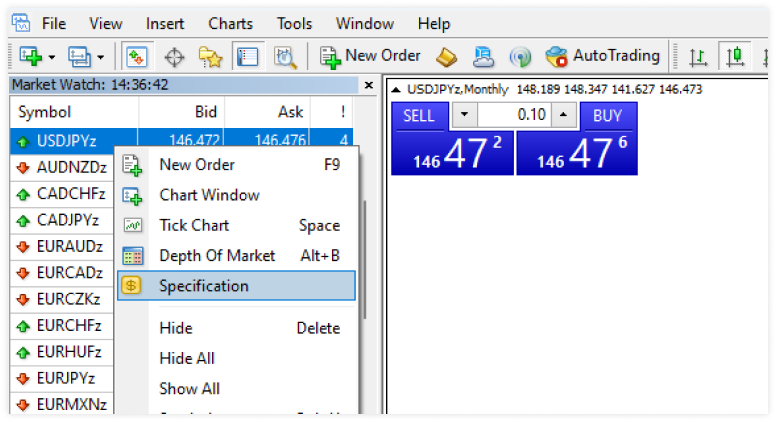

1. MT4 또는 MT5 거래 플랫폼의 시장 감시 창으로 이동합니다. MT4 또는 MT5 마켓 워치 창으로 이동하십시오.

2. 스왑 금리를 확인하려는 금융 상품(심볼)을 마우스 오른쪽 버튼으로 클릭합니다.

3. 표시되는 메뉴에서 사양을 선택합니다.

4. 심볼 설명 창이 열리면 '스왑 롱(매수 포지션)'과 '스왑 숏(매도 포지션)’ 항목 아래에서 스왑 금리를 확인할 수 있습니다.

자신에게 적합한 거래 계좌를 선택하세요.

모든 거래 스타일과 전략을 환영합니다.

Standard

수수료 제로 변동 스프레드 거래 계좌

1.1

$0

최대 무제한

$20

Raw

변동 스프레드와 낮은 수수료로 거래하세요.

0.0

$6

최대 1:500

$250

VIP Black

낮은 가변 스프레드와 제로 수수료로 거래하세요.

0.3

$0

최대 1:500

$1,000

거래에는 위험이 따릅니다

시작하는 방법은 빠르고 간단합니다

몇 분이면 충분합니다. 절차는 다음과 같습니다.

단계 1

등록

프로필을 완성하고 계좌를 개설하세요. 몇 분이면 완료됩니다

단계 2

인증

신원 및 주소 증명 서류를 업로드하세요. 출금 전에 필요합니다

단계 3

입금

편리한 국내 및 국제 방법 중에서 선택하여 즉시 입금하세요

단계 4

거래

플랫폼을 다운로드하고 계좌로 자금을 이체한 후 로그인하여 거래를 시작하세요

안심하고 입금 및 출금하세요

계좌 자금 관리는 편리하고 안전합니다

선택된 결제 수단의 경우 즉시 무료 입금이 가능합니다. 처리 시간은 국가 및 결제 방식에 따라 달라질 수 있습니다. 출금 요청은 일반적으로 영업일 기준 1일 이내에 처리되며, 최초 입금에 사용된 결제 수단으로 반환됩니다.