Forex Profit Giants of 2023 | The Years Top Performing Major Currency Pairs

BY Chris Andreou

|Januari 8, 2024It’s always interesting to look back and review what has happened in the past. One of the things we can do is look for recurring patterns and trends that might repeat themselves.

What we have seen over the past few years is that certain currency pairs tend to consistently outperform others. These are the ones that tend to be undervalued based on their fundamentals.

For example, the Bank of Japan (BOJ) has historically maintained a low interest rate policy but decided to set negative rates in 2016 to stimulate the Japanese economy. In the meantime, the US Federal Reserve (Fed) had embarked on a tightening cycle, aggressively ramping up interest rates trying to combat rampant inflation.

These diverging monetary policies created the opportunity for traders to capitalize on the respective currency valuations in the USDJPY. Anyone that went long the currency pair at the beginning of 2021 and held until the end of 2023 would have done very well indeed. The currency pair has substantially appreciated in value and provided a positive swap during the entire holding period.

Opportunities like this existed elsewhere in 2023 too and in this article we'll be looking at them. So maybe, we can learn something from history to help us trade better in the future.

Let's get started.

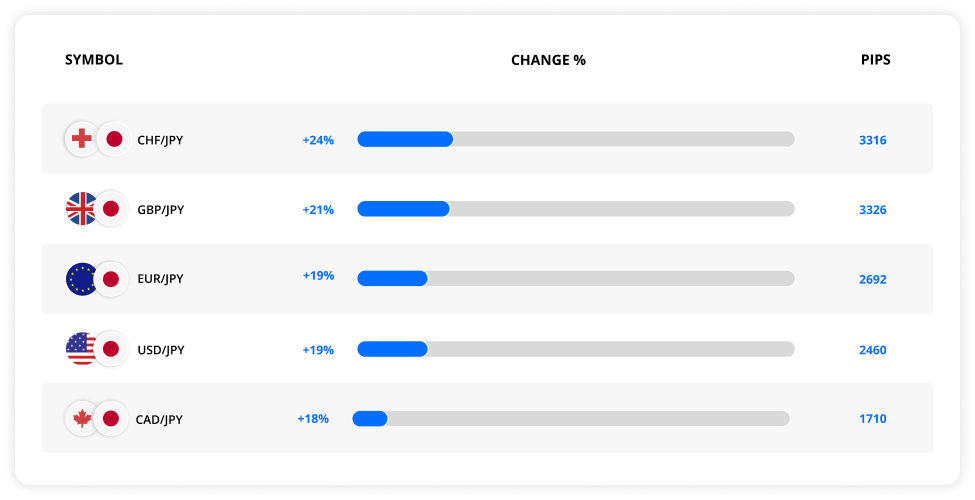

Top major currency pair gainers of 2023

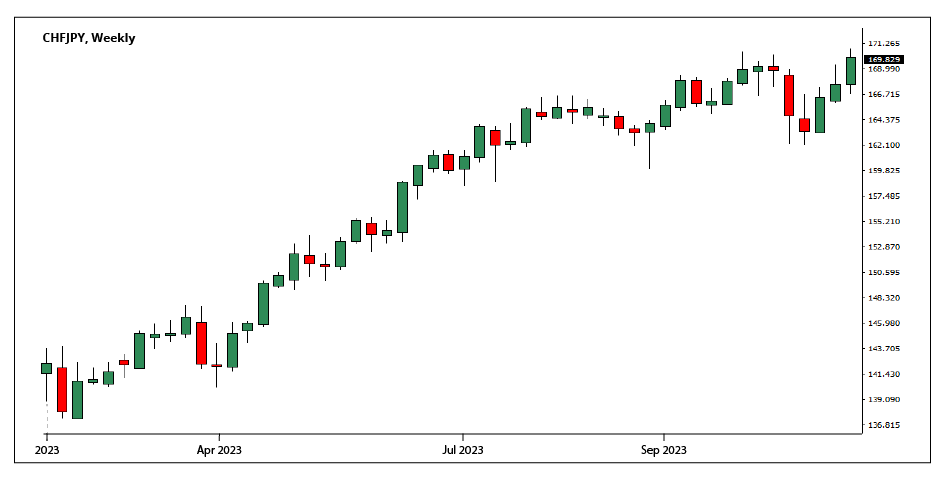

CHF/JPY (Swiss Franc vs Japanese Yen)

The CHFJPY currency pair saw a commendable rally in 2023, exceeding a 24% increase from its January lows to the yearly high.

By Q2 2023, Japan's real GDP surpassed its pre-pandemic levels, helped notably by a 1.2% increase from Q1 due to a bolstered external sector. A weaker Yen stimulated export growth while suppressing imports. However, high inflation combined with sluggish domestic demand softened the growth impact. Japan's central bank, the Bank of Japan (BOJ), maintains a relaxed monetary policy and negative interest rates.

The Swiss Franc is widely recognized as a safe-haven currency, largely due to its resilient economy, low debt levels and high gold reserves. For the past decade, Switzerland's central bank, the Swiss National Bank, has been purchasing significant amounts of euros and dollars to bolster its currency. Moreover, Switzerland has managed to keep inflation around 2.2%. Being the sole major economy in 2023 where inflation objectives have been consistently met.

The Bank of Japan's relaxed monetary policy and negative interest rates contributed to a weaker Yen. While the Swiss National Bank's strategic foreign exchange purchasing to bolster the CHF and consistent inflation management reinforced the CHF position against the JPY.

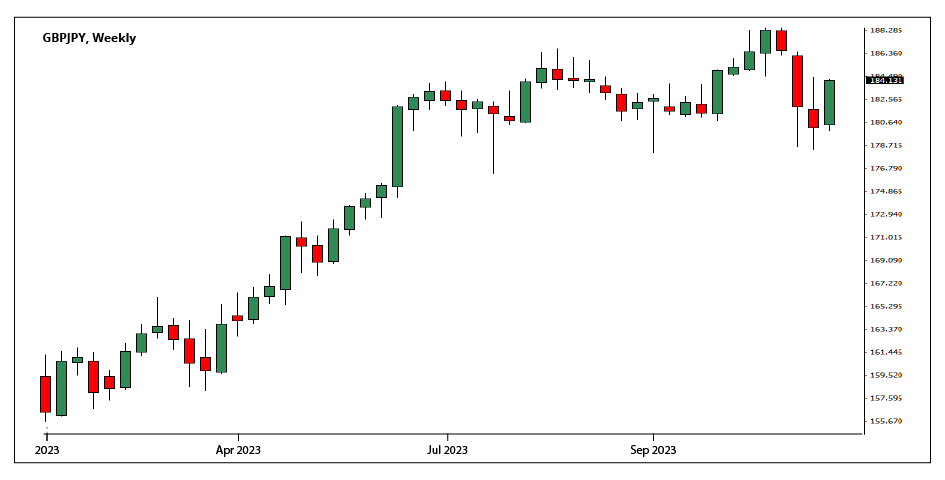

GBP/JPY (Great British Pound vs Japanese Yen)

The GBPJPY currency pair rallied by over 21% from its January lows to its yearly high in November 2023.

The inflation situation took a turn for the worse beginning in 2021 when prices for goods and services started to rise at an alarming pace. The rate of inflation had surged to an extreme high of about 11% in 2022. The Bank of England had no choice but to take aggressive action to wrestle inflation down to more manageable levels. Consequently, interest rates were substantially raised in an attempt to control the price surge and align the economy with their inflation target. This decisive action was aimed to meet their objective of reducing inflation to a pre-established target of 2% by 2024.

Inflation started to fall to about 4% in 2023 with interest rates peaking at 5.25%. The performance of the UK economy in 2023 surpassed expectations. While the initial outlook predicted a decrease of 1% in GDP, economists revised this to forecast a growth of 0.5%. From the start of the year up until the end of Q3 2023, investment in businesses witnessed a strong growth of 6.3% too.

Consequently, these strong economic indicators within the UK, combined with the Bank of England's influence on inflation by increasing interest rates, resulted in the appreciation of the GBP against the JPY.

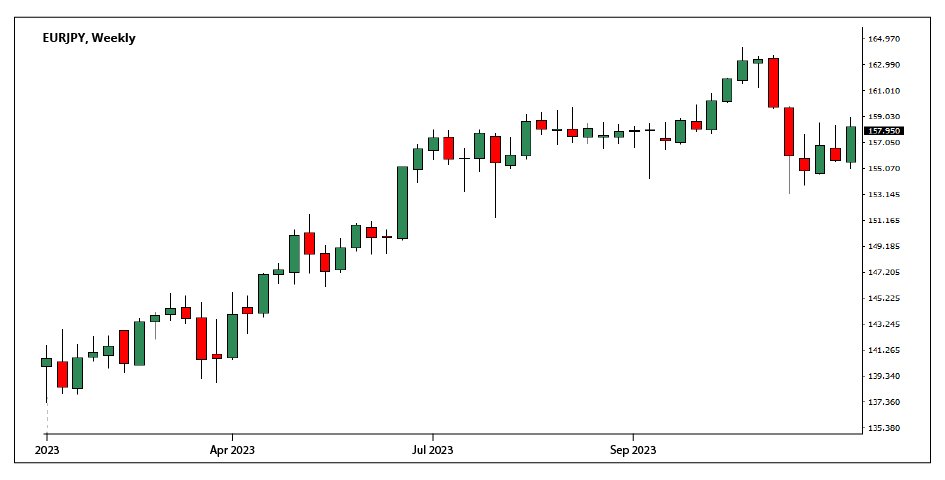

EUR/JPY (Euro vs Japanese Yen)

The EURJPY currency pair also performed exceptionally well in 2023, exceeding a healthy 19% increase from its January low to the yearly high in November.

The upward growth trend of the EU economy persisted throughout the year, although at a slower pace than expected. Anticipated expansion was revised down to around 0.8% in 2023 from the 1% earlier predicted in the spring. Forecasts for 2024 envisage continued expansion, with GDP growth at 1.4%.

Like other major economies in 2023, Europe was also struggling with price acceleration in key goods and raw materials. Inflation in the countries using the Euro started to escalate worryingly from 2021, similar to that of the UK. In 2022, the inflation rate peaked around 11%. The European Central Bank (ECB) adopted a policy of rate hikes to rein in inflation and steer the economy towards its inflation target of 2% by 2024. By the end of 2023, interest rates in the euro area stood at 4.5%. With the ECB managing to bring inflation down to around 2%, more or less meeting their target.

The EURJPY performed very similarly to the GBPJPY due to similar fundamental factors between the UK and European economies versus the situation in Japan.

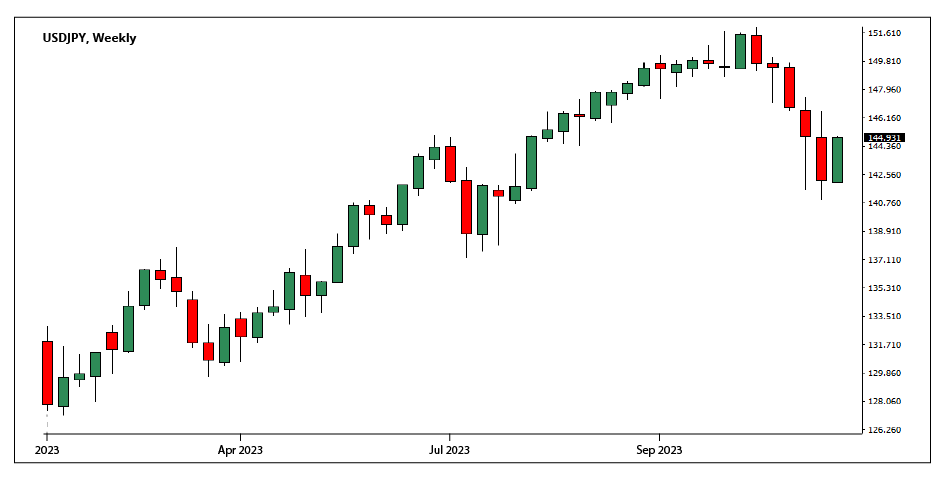

USD/JPY (US Dollar vs Japanese Yen)

Another currency pair that put in a great performance in 2023 was the USDJPY. Increasing by over 19% for the year from its January lows to the November highs.

The US economy defied predictions and expectations during the year of a looming recession. GDP growth was stronger than expected coming in at 2.9% in the third quarter of the year. Inflation also decelerated steadily throughout the year as a result of the Fed maintaining high interest rates. By the end of the year, the US interest rate stood at 5.5%, which was the highest of any major economy or currency. Despite this, consumer demand remained robust largely due to real wage growth.

The US economy demonstrated significant resilience throughout the year and added 216,000 new jobs in December 2023, substantially surpassing expectations.

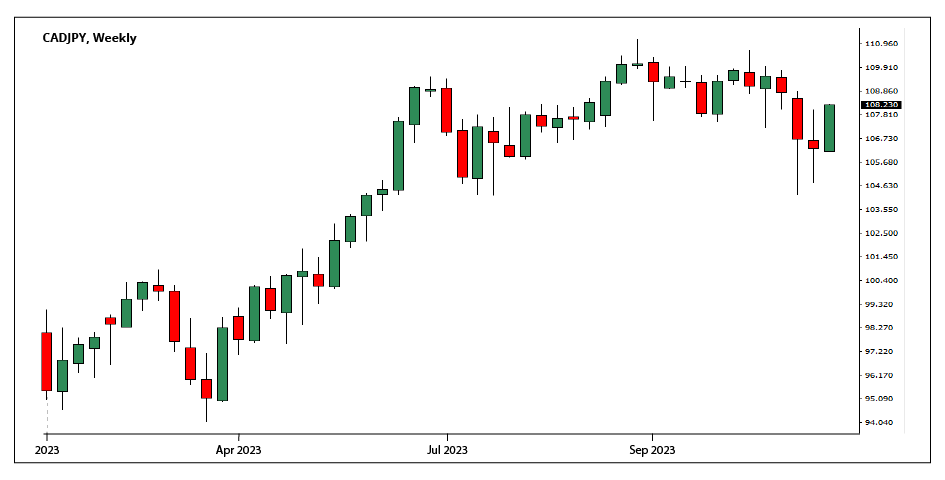

CAD/JPY (Canadian Dollar vs Japanese Yen)

The performance of the CADJPY currency pair was noteworthy during 2023, witnessing a robust increase of over 18% from its low point in March to its yearly peak in September. This uptrend is even more noteworthy when considering the economic climate at the time.

The central Bank of Canada had increased interest rates to 5% in the summer of 2023 to stave off inflation. As a result, Canada's economy grappled with slow growth but was successful in narrowly avoiding a recession. The Canadian economy unexpectedly contracted at an annualized rate of 1.1% in the third quarter of the year.

The CADJPY performed very similarly to other currency pairs including the JPY. Due to similar fundamental factors in the economy but largely due to the wide interest rate differential between the two currencies.

What can we learn from this?

2023 provided invaluable learning opportunities for forex traders. It served as a reminder that understanding macroeconomic factors, particularly those driving monetary policies, can be crucial for making informed trading decisions. Interest rate differentials between countries played a substantial role in shaping currency valuations, with pairs such as the USDJPY, GBPJPY, EURJPY, CHFJPY, and CADJPY significantly appreciating in response to divergent fiscal strategies.

The Bank of Japan's prolonged low-interest-rate policy, which dipped into negative territory, contrasted sharply with the tightening policies of central banks such as the US Federal Reserve, the Bank of England, and the European Central Bank, all raising rates to combat inflation. Those who spotted this divergence and took corresponding positions in the right currency pairs at the right time were generously rewarded.

The experiences of 2023 further reinforced that stable or well-managed inflation is a crucial indicator of economic health and often a driver of interest rates. Countries such as the UK, Canada and the Eurozone that took decisive monetary policy actions to rein in rising inflation saw their currencies appreciate against the Japanese Yen. Another takeaway is the resilience of "safe-haven" currencies like the Swiss Franc, which managed to outperform despite global economic challenges.

2023 also highlighted how sometimes, economic performance can defy expectations. The notable examples of the US and UK economies, which outperformed predictions amid a tightening cycle. Underscoring the intricacy of market dynamics and the necessity for traders to keep evolving their strategies in response to economic realities.

Understanding the underlying fundamentals of currency pairs and adopting a keen eye on global economic trends are key to adapting and profiting from forex trading.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Experienced independent trader

Related Posts

Berdagang secara bertanggungjawab: CFD ialah instrumen yang kompleks dan mempunyai risiko tinggi kehilangan semua modal anda yang dilaburkan disebabkan oleh leverage.

Produk ini tidak sesuai untuk semua pelabur dan anda harus memastikan bahawa anda memahami risiko yang terlibat.

Laman web ini menggunakan kuki.

We use them to give you the best experience. If you continue using our website, we’ll assume that you’re happy to receive all cookies on this website.