Pertukaran

Kredit atau debit untuk pusingan kedudukan ke hari dagangan seterusnya

Pertukaran semalaman

Simbol

Bida

Tanya

Spread

Swaps

*Harga-harga di halaman ini adalah indikatif. Harga untuk instrumen dengan likuiditas lebih rendah seperti pasangan mata wang eksotik, saham, dan indeks tidak dikemaskini sekerap instrumen yang biasa didagangkan. Sila semak di dalam platform MT4/MT5 anda untuk mendapatkan harga terkini secara langsung.

Apakah swap dalam perdagangan

Swap ialah yuran yang dikreditkan atau didebitkan kepada dagangan terbuka anda untuk membawanya semalaman ke hari dagangan berikutnya. Apabila anda melancarkan kedudukan ke hari dagangan seterusnya, anda sama ada akan memperoleh atau membayar yuran swap.

Apabila pertukaran berlaku

Sebarang dagangan terbuka yang dibawa ke hari dagangan berikutnya mungkin dikenakan yuran swap. Penutupan hari dagangan dianggap pada penutupan waktu New York, atau 22:00 GMT (waktu London). Dagangan terbuka akan terus mengakru swap sehingga ia ditutup.

Bagaimana swap dikira

Bank pusat menambah atau mengurangkan kos pinjaman selaras dengan dasar monetari mereka. Setiap mata wang mempunyai kadar faedah sendiri yang ditetapkan oleh bank pusat masing-masing. Apabila anda membeli atau menjual mata wang atau aset, swap dikira berdasarkan perbezaan kadar faedah antara aset dalam simbol. Swap dikira dalam pip atau mata berdasarkan perbezaan kadar faedah antara aset ini.

Sebagai contoh, katakan Rizab Persekutuan AS (Fed) menetapkan kadar faedah sebanyak 5% setiap tahun, manakala Bank of Japan (BOJ) memutuskan kadar faedah 0%. Ini bermakna bahawa Dolar AS akan menghasilkan faedah 5% setiap tahun, manakala Yen Jepun tidak akan menghasilkan apa-apa. Meminjam Dolar AS akan dikenakan kadar faedah 5% manakala meminjam Yen Jepun tidak akan dikenakan sebarang faedah tahunan. Jadi dengan menjual Yen Jepun secara serentak untuk membeli Dolar AS, ia akan mengalami perbezaan swap positif sebanyak 5% setahun. Walau bagaimanapun, dengan menjual dolar AS secara serentak untuk membeli Yen Jepun, ia akan mengalami swap negatif sebanyak 5% setahun.

Perbezaan swap tahunan kemudiannya dibahagikan dengan bilangan hari dalam tahun dan ditukar kepada pip atau mata yang setara dan digunakan untuk membuka dagangan setiap hari.

Bagaimana swap mempengaruhi dagangan anda

Bergantung pada arah perdagangan dan perbezaan kadar faedah antara kedua-dua aset dalam simbol, anda mungkin sama ada memperoleh atau membayar swap. Jika mata wang atau aset yang anda beli mempunyai kadar faedah yang lebih tinggi daripada mata wang atau aset yang anda jual, anda akan menerima swap (pertukaran positif). Jika kadar faedah lebih rendah, anda akan membayar swap (negative swap). Swap menjejaskan keuntungan atau kerugian tidak direalisasi bagi dagangan terbuka selagi ia masih dibuka dan dibawa semalaman ke hari dagangan berikutnya.

Adakah pertukaran berbeza antara pasaran?

Bank pusat menetapkan kadar faedah untuk negara masing-masing, dan kadar ini boleh berbeza dengan ketara. Swap, terutamanya dalam dagangan forex, bergantung pada perbezaan kadar faedah antara dua mata wang dalam pasangan mata wang. Jadi kadar faedah yang berbeza-beza merentas negara menyumbang kepada pertukaran yang berbeza dalam pasaran yang berbeza.

Bagaimana untuk mencari swap untuk setiap simbol

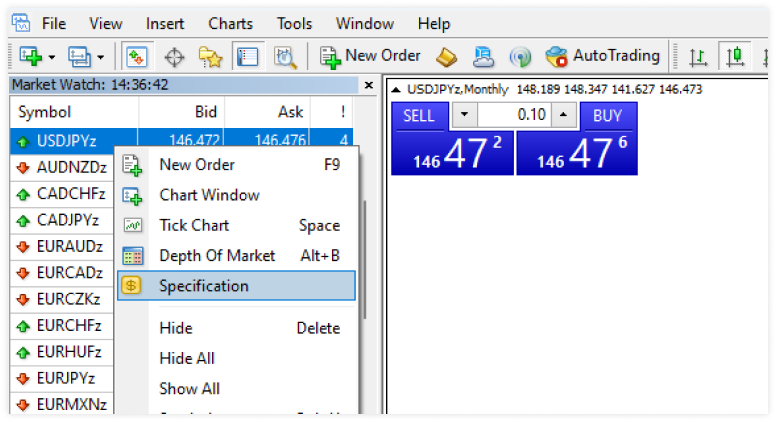

1. Pergi ke tetingkap Market Watch dalam platform dagangan MT4 atau MT5. MT4 atau MT5 platform dagangan.

2. Klik kanan pada instrumen kewangan (simbol) yang anda mahu lihat kadar swap.

3. Pilih Spesifikasi daripada menu yang muncul.

4. Tetingkap penerangan simbol akan dibuka di mana anda boleh menemui kadar swap di bawah Tukar panjang (untuk kedudukan beli) dan Tukar Pendek (untuk kedudukan jual)

Pilih akaun trading yang sesuai untuk anda

Semua gaya dan strategi dagangan dialu-alukan

Standard

Akaun dagangan spread berubah dengan komisen sifar

1.1

$0

Sehingga tanpa had

$20

Raw

Berdagang dengan spread pembolehubah mentah dan komisen yang rendah

0.0

$6

Sehingga 1:500

$250

VIP Black

Berdagang dengan spread berubah yang rendah dan sifar komisen

0.3

$0

Sehingga 1:500

$1,000

Perdagangan berisiko

Bermula adalah pantas dan mudah

Ia hanya mengambil masa beberapa minit, ini adalah cara ia berfungsi

LANGKAH 1

Daftar

Lengkapkan profil anda dan cipta akaun anda, hanya mengambil masa beberapa minit

LANGKAH 2

Sahkan

Muat naik bukti identiti dan alamat anda, ini diperlukan sebelum pengeluaran

LANGKAH 3

Masukkan Dana

Pilih daripada kaedah tempatan dan antarabangsa yang mudah dan deposit serta-merta

LANGKAH 4

Berdagang

Muat turun platform, pindahkan dana ke akaun anda, log masuk dan mula berdagang

Deposit dan keluarkan dengan yakin

Membiayai akaun anda adalah mudah dan selamat

Pembiayaan segera dan percuma tersedia pada kaedah terpilih. Masa pemprosesan mungkin berbeza mengikut negara dan kaedah. Permintaan pengeluaran biasanya diproses dalam satu hari bekerja dan dipulangkan menggunakan kaedah deposit asal.