Trade in the Forex market

Buy and sell major, minor or exotic currency pairs

Trading is risky

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

TRADE FROM

0.4 PIPS SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:1000 LEVERAGE

70+

CURRENCY PAIRS

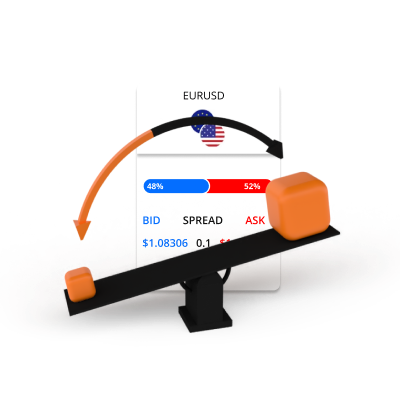

Trade 70+ currency pairs in the Forex market

Go long or short the majors, minors and exotics

Bid

Ask

Spread

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4/MT5 platform for latest live prices

What is the Forex market?

The Forex market, or the foreign exchange market, is a global marketplace for exchanging national currencies. It stands as the world's largest and most liquid market with an average daily trading volume of $7.5 trillion.

The Forex market is open 24 hours a day, 5 days per week and is split into 3 major trading sessions. Offering unparalleled opportunities and access to traders across the globe.

Forex trading primarily happens over a decentralised electronic banking network and plays a crucial role in the global economy. Serving as an essential medium to facilitate international trade and investments.

How Forex trading works

Forex trading involves the simultaneous buying of one currency and selling of another. For example, if you believe that the value of the Euro will rise against the US Dollar due to strong economic growth in the EU, you might choose to buy the EUR/USD currency pair.

Bid and ask prices

Go long or short

Forex is traded in lots

Forex trading involves leverage and margin

Forex trading example

You decide to buy 0.1 lots of EURUSD at 1.0800 using 200:1 Leverage. The two currencies involved in the trade are the EUR and the USD.

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

Now you have opened a EUR 10,000 long position in the EURUSD by simultaneously selling USD 10,800. Since forex is traded using leverage, only $54 was used as margin from your trading account. After some time, the rate of exchange between the EURUSD moves and you decide to sell.

Scenario 1

The exchange rate moves up from EURUSD 1.0800 to 1.0850.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0850 - 1.0800) x 10,000) / 1.0850

P/L = (0.0050 x 10,000) / 1.0850

P/L = 46.08 USD

Scenario 2

The exchange rate moves down from EURUSD 1.0800 to 1.0750.

This is how the profit or loss on the trade would be calculated.

P/L = ((Current exchange rate - Initial exchange rate)

x Position value) / Current exchange rate

P/L = ((1.0750 - 1.0800) x 10,000) / 1.0750

P/L = (0.0050 x 10,000) / 1.0750

P/L = -46.51 USD

Great value trading with a premium service

This is why people like you choose TIOmarkets

Spreads from 0.4 pips

Our aggregated liquidity keeps spreads low, most of the time

Zero commission

Trade from $0 per lot on our VIP Black or spread-only trading accounts

Low starting amount

Open your account from just $10 to start trading

24/7 customer support

We are here to help, with 3 seconds average response time on live chat

Fast order execution

Trades are executed in milliseconds, with low slippage, most of the time

300+ Symbols

Trade forex, stocks, indices and commodity markets from anywhere, anytime

Reliable platforms

Trade global financial markets on the MT4 & MT5 desktop or mobile trading platforms

Micro lot trading

Trade from $0.10 per pip, ideal for small accounts and to better manage your risk

Metatrader 4

MT4 was designed and developed for forex and futures trading. To enable traders to analyze and trade financial markets, back test trading strategies, develop trading robots and copy other traders.

Metatrader 5

MT5 is a multi-asset trading platform that includes everything you will find in MT4. Plus more capabilities and technical analysis tools than its predecessor. Including more order types and a built-in economic calendar.

Getting started is quick and simple

It only takes a few minutes, this is how it works

Register

Complete your profile and create your account

Fund

Deposit instantly with our convenient funding methods

Trade

Log in to the trading platform and place your trade

Trading is risky

Learn more about trading with TIOmarkets

undefined