Negociar CFDs de acções

Vá long ou short em mais de 170 ações com baixas taxas

O trading envolve riscos

NEGOCIE A PARTIR DE

0.01 DIFERENÇA DE PONTOS

NEGOCIE A PARTIR DE

$0 COMISSÃO

ATÉ

1: ALAVANCAGEM 20 VEZES

+

170 AÇÕES

NEGOCIE A PARTIR DE

0.01 DIFERENÇA DE PONTOS

NEGOCIE A PARTIR DE

$0 COMISSÃO

ATÉ

1: ALAVANCAGEM 20 VEZES

+

170 AÇÕES

Negociar acções de grandes empresas

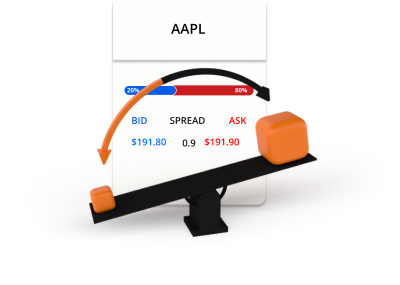

Símbolo

Lance

Perguntar

Spread

*Os preços nesta página são indicativos. Os preços dos instrumentos com menor liquidez, tais como, entre outros, pares de moedas exóticas, ações e índices, não são atualizados com tanta frequência como os instrumentos normalmente negociados. Verifique em sua plataforma MT4/MT5 os preços ao vivo mais recentes

O que são acções?

As acções, também conhecidas como acções ou títulos de capital, representam uma participação no capital de uma empresa. Quando compra as acções de uma empresa, está a adquirir uma pequena parte dessa empresa, incluindo o direito a uma parte dos lucros da empresa. As acções são emitidas por empresas para angariar capital de modo a fazer crescer o negócio e podem ser compradas e vendidas. No entanto, com a negociação de CFDs de acções, permite-lhe especular sobre o movimento dos preços sem precisar de possuir as acções reais.

Como funciona a negociação de CFDs de acções

A negociação de CFDs de acções permite-lhe especular sobre os movimentos de preços das acções de uma empresa sem possuir as acções reais. Se pensa que o preço das acções é suscetível de subir, pode simplesmente comprá-las. Se pensa que o preço das acções é suscetível de descer, pode vendê-las.

Preços de compra e venda

Assuma posições longas ou curtas

As acções são transaccionadas em lotes

A negociação de acções implica alavancagem e margem

Exemplo de negociação de acções

Decide comprar 0,1 lotes de Apple (AAPL) a $200 usando uma alavancagem de 20:1.

0,1 lotes = 10 CFDs de acções da AAPL

CFDs de 10 acções x $200 = $2.000

$2,000 / 20 = $100

Agora abriu uma posição longa na AAPL no valor de $2.000. Como os CFDs de acções são negociados usando alavancagem, apenas $100 foram usados como margem da sua conta de negociação. Passado algum tempo, o preço da AAPL move-se e decide vender.

Cenário 1 1

AAPL sobe de $200 para $250 e decide vender.

É assim que se calcula o lucro ou a perda da transação.

P/L = (Preço atual - Preço inicial) x Quantidade

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Cenário 1 2

AAPL desce de $200 para $150 e decide vender.

É assim que se calcula o lucro ou a perda da transação.

P/L = (Preço atual - Preço inicial) x Quantidade

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Trading de excelente valor com um serviço premium

É por esse motivo que pessoas como você escolhem a TIOmarkets

Spreads a partir de 0.0 pips

Negocie com spreads variáveis brutos na conta Raw

Trading sem comissões

Negocie a partir de $0 por lote nas nossas contas VIP Black ou Standard

MT4 & MT5

Plataformas de trading avançadas para desktop, web e dispositivos móveis

Execução rápida de ordens

Processamento de ordens estável e eficiente em milissegundos

Leverage ilimitado.

Negocie com alavancagem ilimitada na conta Standard

Bônus de fidelidade de 30%

Receba um bônus a cada depósito na nossa conta Standard

Negocie nas plataformas MT4 ou MT5

Do seu computador, navegador ou dispositivo móvel

Comece a fazer trading em minutos

É assim que funciona

PASSO 1

Registro

Complete seu perfil e crie sua conta, leva apenas alguns minutos

PASSO 2

Verificação

Envie seu comprovante de identidade e endereço (obrigatório antes de sacar fundos)

PASSO 3

Depósito

Selecione entre métodos locais e internacionais convenientes e deposite instantaneamente

PASSO 4

Trading

Baixe a plataforma, transfira fundos para sua conta, inicie sessão e comece a operar

O trading envolve riscos