Trade Stock CFDs

Go long or short 170+ stocks with low fees

Trading is risky

TRADE FROM

0.01 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1: 20 LEVERAGE

+

170 STOCKS

TRADE FROM

0.01 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1: 20 LEVERAGE

+

170 STOCKS

Trade stocks of major companies

Symbol

Bid

Ask

Spread

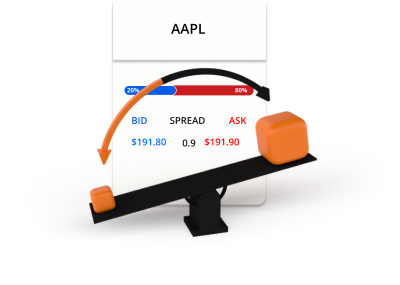

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4/MT5 platform for latest live prices

What are stocks?

Stocks, also known as shares or equities, represent ownership interest in a company. When you buy a company's stock, you're purchasing a small piece of that company, including the right to a portion of the company's earnings. Stocks are issued by companies to raise capital in order to grow the business and they can be bought and sold. However, with stock CFD trading, it allows you to speculate on the price movement without needing to own the actual stocks.

How stock CFD trading works

Trading in stock CFDs allows you to speculate on the price movements of company stock without owning the actual shares. If you think the share price is likely to rise, you can simply buy it. If you think the price of the shares is likely to fall, you can sell it.

Bid and ask prices

Go long or short

Stocks are traded in lots

Stock trading involves leverage and margin

Stock trading example

You decide to buy 0.1 lots of Apple (AAPL) at $200 using 20:1 leverage.

0.1 lots = 10 share CFDs of AAPL

10 share CFDs x $200 = $2,000

$2,000 / 20 = $100

Now you have opened a long position in AAPL worth $2,000. Since stock CFDs are traded using leverage, only $100 was used as margin from your trading account. After some time, the price of AAPL moves and you decide to sell.

Scenario 1

AAPL moves up from $200 to $250 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Scenario 2

AAPL moves down from $200 to $150 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Great value trading with a premium service

This is why people like you choose TIOmarkets

Spreads from 0.0 pips

Trade with raw variable spreads on our Raw account

Commission-free trading

Trade from $0 per lot on our VIP Black or Standard trading accounts

MT4 & MT5

Advanced trading platforms for desktop, web and mobile

Fast order execution

Efficient and reliable order processing in milliseconds

Unlimited leverage

Trade with up to unlimited leverage on our Standard account

30% Loyalty bonus

Get a bonus on every deposit to our Standard account

Trade on the MT4 or MT5 trading platforms

From your desktop, internet browser or mobile

Start trading in minutes

This is how it works

STEP 1

Register

Complete your profile and create your account, it only takes a few minutes

STEP 2

Verify

Upload your proof of identity and address, this is required before withdrawal

STEP 3

Fund

Choose from convenient local and international methods and deposit instantly

STEP 4

Trade

Download the platform, transfer funds to your account, log in and start trading

Trading is risky