Fibonacci Trading Strategy: Anticipating Market Movements

BY Janne Muta

|มีนาคม 14, 2567Discover the power of the Fibonacci Trading Strategy, a sophisticated technique that blends the mathematical precision of the Fibonacci sequence with market analysis. Rooted in the pioneering work of Leonardo of Pisa, this strategy offers traders a unique lens to identify support and resistance levels, anticipate market movements, and make informed decisions.

This article delves into the essence of the Fibonacci sequence, its practical applications in trading, and how to leverage its principles to navigate the volatile terrain of financial markets.

Whether you're a novice eager to learn or an experienced trader looking to refine your strategy, this article provides valuable insights into the art of Fibonacci trading.

So without any further delay, lets get started.

Embracing the Fibonacci Trading Strategy

The Fibonacci trading strategy, harnesses the mathematical elegance of the Fibonacci sequence to forecast key levels of support and resistance within market trends. This methodology was brought to the forefront by Leonardo of Pisa, also known as Fibonacci. His introduction of the sequence in the early 13th century marked a pivotal moment, not only in mathematics but also in its multifaceted applications across various fields, including trading.

The Fibonacci sequence's relevance extends beyond its original academic intentions, intertwining with the golden ratio to offer a unique perspective on market movements. This strategy illuminates potential reversal points in price trends, guiding traders in making informed decisions.

In this article, we will cover the theoretical underpinnings and practical applications of the Fibonacci trading strategy. Beginning with an exploration of the Fibonacci sequence and the golden ratio, we will delve into the mechanics of Fibonacci trading, including retracements and extensions. Following this, we provide a detailed guide on applying these concepts in trading strategies, accompanied by practical tips and insights into common pitfalls. Additionally, we will critically examine the limitations and future perspectives of Fibonacci trading, ensuring traders are well-equipped to integrate this technique into a comprehensive trading plan.

As we journey through the segments of this article, readers will gain a holistic understanding of the Fibonacci trading strategy and its practical utility in today's dynamic financial markets.

The Essence of the Fibonacci Sequence and Its Golden Proportion

At the heart of the Fibonacci trading strategy lies the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones, starting from 0 and 1. This sequence, seemingly simple at its inception, spirals into a complex array of numbers that have fascinated mathematicians and scientists for centuries. The golden ratio, denoted as φ (phi), approximately equal to 1.618, emerges from this sequence as a constant factor. When a number in the sequence is divided by its immediate predecessor, the quotient approaches φ, a proportion renowned for its aesthetic and harmonious properties.

A Journey Through Time: The Historical Significance of Fibonacci

The sequence's discovery by Leonardo of Pisa, known as Fibonacci, in the 13th century, was a substantial leap in the understanding of mathematics. Fibonacci's work, "Liber Abaci," introduced the sequence to the Western world, showcasing its application in various problems, from practical arithmetic to sophisticated mathematical puzzles. Beyond its mathematical allure, the sequence and the golden ratio have been identified in nature, architecture, art, and music, reflecting a universal language of harmony and balance.

Fibonacci in the Financial Markets: A Mathematical Foundation

The Fibonacci trading strategy employs two primary tools derived from this sequence: retracements and extensions. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the market continues in the original direction.

Extensions, on the other hand, are used to predict where the price might go following a retracement. These tools rest on the mathematical foundation of the sequence and the golden ratio, offering traders a lens through which to view market movements and potential turn-around points.

The integration of the Fibonacci sequence and the golden ratio into trading exemplifies the blend of mathematical theory and practical application. Traders utilise these tools to gauge market sentiment, align their strategies with the underlying rhythms of the financial markets, and make more informed decisions. The Fibonacci trading strategy, with its deep roots in history and mathematics, offers a way to analyse the market trends, demonstrating the timeless relevance of Fibonacci's discovery in contemporary trading practices.

Decoding Fibonacci Retracements in Trading

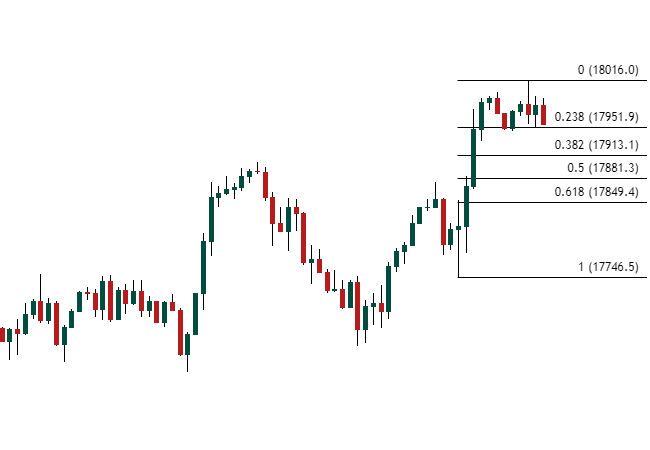

Fibonacci retracements offer traders a means of identifying potential reversal points in the market. This technique revolves around the identification of swing highs and lows - pivotal points that mark the extremities of a market move. By drawing a line connecting these two points, traders can then apply Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%) to delineate levels of potential support and resistance. These levels, informed by the natural order underpinning the Fibonacci sequence, serve as indicators where the market could pause or reverse.

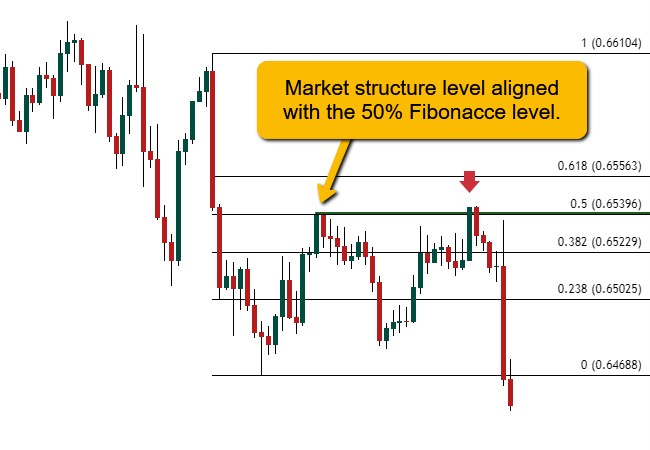

How to combine the Fibonacci retracement levels and market structure analysis?

If the Fibonacci retracement levels coincide with important market structure levels it is more likely that traders will pay attention these levels. Some traders use only Fibonacci retracement levels while others use only market structure or support and resistance level analysis. Therefore, by employing both approaches it is more likely that we choose levels of higher importance (levels that more traders pay attention to). Traders that focus on the most important price levels are likely to limit their trading to high quality trading opportunities compared to those that engage the market at each Fibonacci retracement level.

Uptrend Example: AUDUSD Daily Chart Analysis

Note that sometimes the Fibonacci retracement levels are penetrated before the market moves higher (lower) from them. There are times though when the market in question turns on a dime after a Fibonacci retracement level is reached.

Consider the Australian Dollar against the US Dollar (AUDUSD) on a daily chart, where a significant upward trend is evident. By marking a prominent point in the trend as the swing low and the peak of the trend as the swing high, we can draw the Fibonacci retracement levels. These levels often highlight areas where the price may retrace before resuming the uptrend, offering strategic points for entry or adjustment of positions.

In this example it was the 38.2% retracement level that reversed the corrective move and helped the market to resume the uptrend. Here the market penetrated the 38. 2% level only slightly before continuing to trend higher.

Downtrend Example: EURUSD 4-Hour Chart Analysis

Conversely, examining the Euro against the US Dollar (EURUSD) on a 4-hour chart during a downtrend illustrates the inverse application. A prominent swing high (1.1276) is the peak before the decline, and the latest swing low (1.0912) is the most recent bottom of that decline. The retracement levels then provide potential resistance levels that the price may test during a pullback before continuing its descent. In this example the penetration of the 38.2% level was slightly more pronounced.

Implementing the Fibonacci Trading Strategy: A Step-by-Step Approach

Integrating the Fibonacci trading strategy into your trading approach requires a methodical application of Fibonacci retracements, a tool crucial for identifying potential reversal points in the market. Here's how to use Fibonacci retracements effectively:

1. Identifying Significant Price Movements: The first step involves pinpointing major price movements in the market, distinguishing between uptrends and downtrends. This phase is critical for setting the stage for accurate Fibonacci level plotting and traders can use for instance moving averages in identifying trending periods. If the e.g. 50 period SMA points higher and the market trades above it making higher highs and higher lows it is quite likely trending. The opposite is true for down trending markets.

2. Plotting Fibonacci Levels: Once a significant price movement has been identified, the next step is to draw Fibonacci retracement levels. For an uptrend, connect the swing low to the swing high with a Fibonacci retracement tool. For a downtrend, reverse this process, connecting the swing high to the swing low. This action generates a series of horizontal lines on the chart, representing potential support (in an uptrend) or resistance (in a downtrend) levels.

3. Making Trading Decisions: With the Fibonacci levels plotted, traders should observe the price's reaction to these levels closely. A retracement level that coincides with other market signals, such as candlestick patterns or moving averages, may serve as a robust entry point or a signal to adjust existing positions. Decisions should be based on the confluence of signals, with Fibonacci levels acting as a key factor in the overall analysis. In the above EURUSD 2 minute chart, it provides a reversal signal at a 38.2% Fibonacci retracement level.

Enhancing Decision-Making with Combined Analytical Tools

The Fibonacci trading strategy could be combined with other technical analysis methods. For instance, integrating Fibonacci retracements with trend indicators (like moving averages) can offer a more comprehensive view of the market.

Traders might want to combine the Fibonacci levels with moving average indications. In the above example the 50% retracement level is roughly aligned with the SMA(50) while the SMA(30) is moving higher above the slower SMA. This combination of technical factors improves the odds of a long trade working when entered into at the 50% Fibonacci retracement level.

The Fibonacci trading strategy, with its robust mathematical foundation and versatile application across different markets, stands as a testament to the enduring relevance of Fibonacci's work. By meticulously applying Fibonacci tools and integrating them with a broad spectrum of technical analysis techniques, traders can navigate the complexities of the market with greater clarity and confidence, aligning their strategies with the inherent rhythms of price movements.

Maximizing the Effectiveness of the Fibonacci Trading Strategy

The Fibonacci trading strategy, when employed with precision and mindfulness, can significantly amplify a trader's analytical capabilities and decision-making process. To harness its full potential, consider these best practices:

1. Accurate Identification of Swing Points: The foundation of applying Fibonacci retracements effectively lies in the accurate identification of swing highs and lows. Misidentification can lead to incorrect placement of Fibonacci levels, thereby skewing potential entry and exit points.

2. Wait for Confirmation: While Fibonacci levels can indicate potential support and resistance areas, acting on these levels alone can be premature. Look for confirmation signals, such as candlestick patterns or convergence with other technical indicators, before making a trade.

3. Adjust to Market Context: The financial markets are dynamic, and flexibility in strategy application is crucial. Be prepared to adjust your analysis as the market evolves, incorporating new information and price movements into your Fibonacci trading strategy.

Steering Clear of Common Pitfalls

Even experienced traders can fall into traps when using Fibonacci levels. Awareness of these common mistakes can help in avoiding them:

1. Over reliance on Fibonacci Levels: While Fibonacci levels provide valuable insights, relying solely on them without considering the broader market context or other technical indicators can lead to misinformed decisions.

2. Ignoring Market Volatility: Market conditions can significantly impact the effectiveness of Fibonacci levels. High volatility periods may require adjustments in the interpretation of these levels, emphasizing the need for a flexible approach.

3. Setting Too Rigid Profit Targets: Fibonacci extensions are useful for setting profit targets, but market dynamics can shift rapidly. Be open to reevaluating your targets based on unfolding market conditions and not just the initial Fibonacci projections.

Integrating Fibonacci Retracements with Other Indicators

For a well-rounded trading strategy, combining Fibonacci retracements with other technical analysis tools is imperative. Indicators such as moving averages, RSI, and MACD can complement Fibonacci levels, offering a multi-layered analysis that considers trend direction, momentum, and volume. This integrative approach not only enhances the robustness of the Fibonacci trading strategy but also aligns with the principle of confluence in technical analysis, where multiple indicators converge to signal trading opportunities more reliably.

In summary, the effective application of the Fibonacci trading strategy requires a blend of accuracy, patience, and strategic integration with other analytical tools. By adhering to these best practices and avoiding common pitfalls, traders can leverage the timeless insights of Fibonacci analysis to navigate the complexities of the financial markets with greater confidence and precision.

The Fibonacci Trading Strategy: A Balanced Perspective

While the Fibonacci trading strategy is a valuable tool in a trader's arsenal, it's crucial to acknowledge its limitations and the controversies that surround its application. One of the primary critiques of Fibonacci trading revolves around its reliance on historical data and mathematical ratios, which may not always accurately predict future market movements. This predictive challenge underscores the importance of combining Fibonacci analysis with other forms of technical and fundamental analysis to form a more comprehensive market view.

The Psychological Dimension of Fibonacci Trading

A significant aspect of Fibonacci trading that invites scrutiny is the psychological impact it has on market participants. Some argue that the effectiveness of Fibonacci levels is partly due to a self-fulfilling prophecy, where enough traders adjust their positions around these levels, thereby influencing market movement in the anticipated direction. This psychological phenomenon highlights the role of trader sentiment and collective behaviour in the practical outcomes of using Fibonacci levels.

Recognising When Fibonacci May Falter

There are market conditions under which Fibonacci trading may not yield the expected results, such as during periods of high volatility or when unexpected economic events disrupt established patterns. In such scenarios, the precision of Fibonacci levels can be compromised, emphasizing the necessity of sound risk management practices. Effective risk management involves setting stop-loss orders, managing position sizes, and maintaining a balanced portfolio, ensuring that reliance on the Fibonacci trading strategy does not expose traders to undue risk.

In conclusion, while the Fibonacci trading strategy offers insightful perspectives on market trends and potential reversal points, traders must remain vigilant to its limitations and the broader market context. Embracing a holistic approach that integrates Fibonacci analysis with risk management and psychological awareness can enhance the resilience and adaptability of trading strategies in the face of market uncertainties.

Conclusion

The Fibonacci trading strategy stands as a testament to the enduring legacy of Leonardo of Pisa, providing traders with a mathematical framework to navigate the intricacies of financial markets. Through the strategic application of Fibonacci retracements and extensions, traders can identify key levels of support and resistance, offering insights into potential market reversals.

However, it's imperative to integrate this strategy within a broader analytical context, combining it with other technical and fundamental indicators to enhance decision-making and mitigate risks.

The psychological impact of Fibonacci levels, driven by collective trader sentiment, further underscores the necessity of a balanced and informed approach to trading.

While acknowledging its limitations, especially during periods of high volatility or unforeseen market shifts, the Fibonacci trading strategy, when applied judiciously and in harmony with comprehensive risk management practices, remains a valuable tool in the arsenal of both novice and experienced traders.

Embracing this strategy requires not only an understanding of its mathematical underpinnings but also an awareness of its practical applications and the psychological dynamics at play within the market, ensuring traders are well-prepared to face the complexities of today's financial landscapes with confidence and precision.

Would you like to try trading using a Fibonacci trading strategy. Register and create a demo account.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts