How To Trade USDCAD | A step-by-step guide to start trading USDCAD

BY Chris Andreou

|มิถุนายน 10, 2565Follow along with this step-by-step guide and learn how to trade USDCAD on MT4 or MT5 with TIOmarkets. Including signing up for an account, downloading the trading platform and placing your first trade on the USDCAD.

The advantage to trading the USDCAD with TIOmarkets is that you can start from just $10. The minimum lot size is also low, allowing you to trade the currency pair from just $0.10 per pip.

You can also use this information to trade any other instrument on the platform. So keep reading to learn how to trade USDCAD from start to finish and why you should start trading USDCAD with TIOmarkets.

Let’s get started.

How to trade USDCAD

The first thing you need to do is create a trading account. Follow these simple steps to register and download the trading platform to get started.

1. Register your profile

This only takes a few minutes, once you have gone through the process, you will be in your secure client area.

Register your account with TIOmarkets now.

2. Create a demo or live trading account

Create your demo or live account from your secure client area and choose the trading platform you want when setting it up. You will receive the login credentials to your trading account by email. Keep these safe as you will need them later on.

3. Download the trading platform

From your secure client area, navigate to the download center and download the trading platform to your computer or smartphone.

4. Deposit funds

Now navigate to deposit or deposit funds, choose your deposit method and your desired amount. You can start trading with TIOmarkets from just $10 but you might want to start with a little more to make things worthwhile.

5. Transfer your funds to the trading platform

Once you have made a successful deposit, you now have to transfer the money from your TIOmarkets wallet to the trading account. So go to manage funds and transfer the funds from your TIOmarkets wallet to the account created in the previous step.

6. Log in to the trading platform and start trading

Now, log in to the trading platform and you should notice your balance reflects your deposit.

You’re done and all set to start trading USDCAD but keep reading for more useful information and trading tips.

What is USDCAD?

USDCAD is the acronym for the US Dollar (USD) versus the Canadian Dollar (CAD) currency pair. It shows us the exchange rate between these two currencies or how much CAD we can buy for one USD.

The US Dollar (USD) and the Canadian Dollar (CAD) are both North American currencies. They are one of the most heavily traded pairs on the Forex market due to the high cross border trade between the US and Canada. The former is considered to be a major currency and the world’s reserve currency. While the latter is considered to be a commodity currency, because the CAD is heavily influenced by oil prices.

This currency pair is very liquid, meaning that you can buy and sell with ease at any time, making it a good choice for all trading styles.

How to start trading USDCAD on MT4 or MT5

If you want to trade USDCAD on MT4 or MT5, find the “USDCAD” symbol in the market watch window. If it isn’t visible, you will need to add it first. To do that, right-click anywhere in the market watch window and select show all from the pop-up menu that appears.

You should now see all the symbols available for trading on the MT4 trading platform. Scroll down the list of symbols until you find “USDCAD”.

How to place your first USDCAD trade on MT4 or MT5

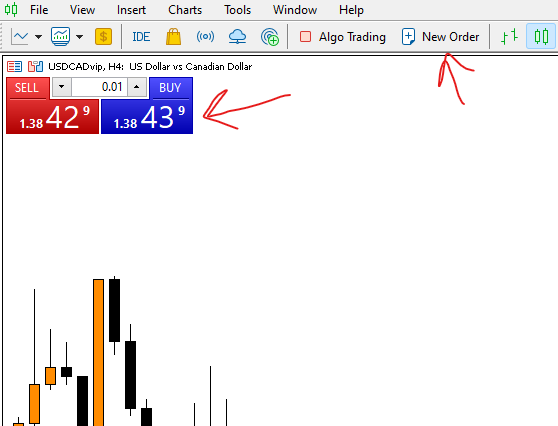

What you can do now, is open a price chart to analyze the historical performance of the USDCAD currency pair or open the new order window to place your trade. To do this, right-click on the “USDCAD” symbol in the market watch window and either select the chart window or new order option from the menu that appears. The former will allow you to view the chart before placing your trade, and you can also click the new order button in the toolbar to place your trade.

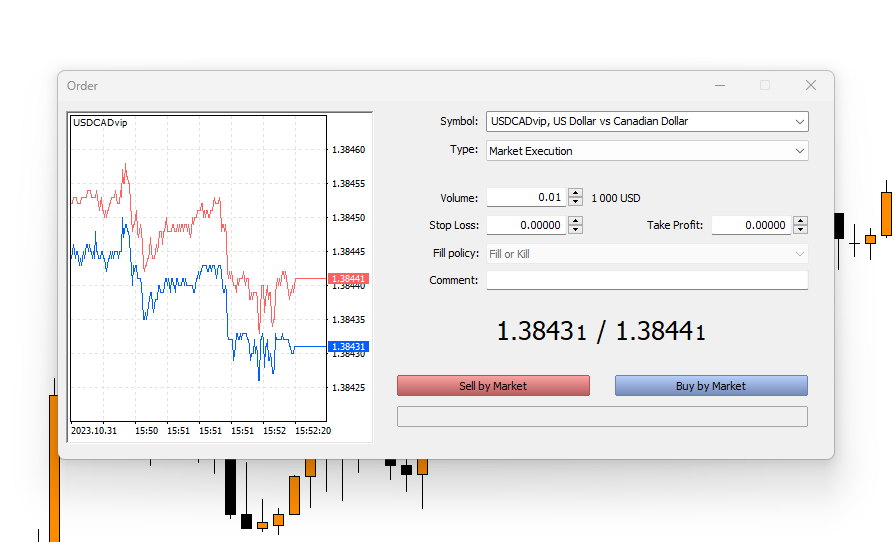

When you select new order, another window will appear so you can execute your trade on the USDCAD. Before you actually place your trade, make sure the symbol is correct as shown at the top.

By clicking buy by market, you can potentially benefit from rising prices in the USDCAD. If you want to potentially benefit from falling prices, click sell by market.

When prices are rising, it means that the USD is appreciating in value relative to the CAD. Conversely, falling prices mean the CAD is appreciating in value relative to the USD.

With that being said, MT4 and MT5 also allows you to execute trades using different order types. This provides you with some flexibility in how you place your trades and also allows you to change the parameters of your entry.

Trade USDCAD with pending orders

To change the order type, select pending order from the drop-down menu from the order window.

You will be presented with four pending order options, two for buying scenarios and two more for selling scenarios. I will explain what each one means and which one to use and when.

Buy Limit – Use this pending order to buy at a price below the current market price. It is a resting order below the current market price that will trigger if the price falls to it.

Sell Limit – A sell limit is a pending order to sell at a price above the current market price. It is a resting order above the current market price that will trigger if the price rises to it.

Buy Stop – The buy stop pending order is an order to buy at a price above the current market price. It is a resting order above the current market price that will trigger as the price moves up.

Sell Stop – This is a pending order that rests below the current market price to sell as the price falls. It is a resting order below the current market price that will trigger as the price moves down.

Check out this infographic to get a better idea about when to use the different pending orders.

How much money do you need to trade USDCAD?

You can get started with TIOmarkets from just $10, but you need less than that to trade the USDCAD. This is because you have the ability to trade using leverage and margin. Leverage allows you to buy assets of a much larger value than the amount deposited in your trading account. And margin is the amount required by the broker as a deposit against the trade in order to open it.

The specifics for this information can be obtained from viewing the contract specification. It would be a good idea to check this and the best place to do that is from within the trading platform.

Just right-click on the USDCAD symbol in the market watch window and select specification from the pop-up menu that appears.

Here it is below and I will highlight the important parts and explain what you should be aware of before trading the USDCAD, or any instrument for that matter.

From top to bottom, the contract size of 100,000 means that 1 lot is the equivalent of buying or selling 100,000 units. To buy or sell 100,000 units (USD) in USDCAD, select a lot size of 1.0 in the volume field before placing your order.

The margin rate shows how much you need as free margin (available balance) in your account to open the trade. So to open 100,000 units in the USDCAD, you would need 100 times less. Which is about $1,000 at the time of writing.

When 100,000 units of the USDCAD are traded, each pip movement in the price is going to be worth $10. So if the price moves up by 50 pips from 1.25500 to 1.26000, the equivalent profit or loss will be $500.

You can trade fewer contracts if you prefer and the minimum volume is 0.01 lots. This means you can buy or sell from as little as 1/100th of the contract size (100,000 units) for better risk management. This means you can trade 1,000 units, the margin requirement would only be about $10 and each pip movement in price would be worth $0.10. So the equivalent 50 pip move from the scenario above, when trading 0.01 lots would mean a $5 profit or loss on the trade.

When you roll a position over to the next trading day, you will either earn or pay a swap at 10 GMT Monday to Friday. These swaps will continue to accrue on your open positions until the trade is closed. In this example for the USDCAD, and at the time of publishing this article, the swap is -4.8048 points for short positions in this currency pair. The swap for long positions in the USDCAD is -0.616 points.

In other words, you will incur 0.616 pips in swaps when going long (buy) and 0.48048 pips in swaps when going short (sell). How much each pip is worth depends on the trading volume. Swaps are subject to change and depend on the interest rates set by the respective central banks. In this case, it is the FED in the United States and The Bank of Canada respectively

Then lastly, the session trade times above indicate when the market for this currency pair is open.

It might be a good idea to practice opening deals in a simulated environment to see how it all works. You can create a demo account to learn how to trade USDCAD on MT4 or MT5 without risk.

Factors affecting the USDCAD exchange rate

If you are currently trading or planning to get involved in the Forex market, it’s essential to know what makes currency prices move. Before you place any trades, you should decide whether the USDCAD is likely to rise or fall and what your risk tolerance is. Exchange rates are affected and influenced by many different factors that include but are not limited to;

- Economic data

- Central bank policy

- Speculation by big investors and commercials

- Political and geopolitical events

- Sentiment and price trends

Not that surprisingly, the health of a country’s economy has a positive or negative affect on the national currency relative to others. So it would be a good idea to monitor economic and political developments in the US and Canada.

You can read this article to learn more about the factors affecting the Forex market, which goes into more detail.

Technical analysis is also a popular method used by nearly all traders to help them identify trading opportunities. The process involves examining charts and predicting future prices by analysing historical price trends and chart patterns.

Why trade USDCAD with TIOmarkets?

TIOmarkets is a fast growing, award winning online broker with a reliable trading platform. Clients receive a superb trading experience, competitive trading conditions and hassle free withdrawals.

If you want to learn how to trade the USDCAD, practice on a demo account or go live from as little as $10. TIOmarkets has account types to suit all budgets.

You don’t need much to start trading USDCAD, because you can start trading from just $0.10 per pips. Which makes it even more affordable to get involved, so start small and increase your lot size as your confidence and experience grows.

Now you should know how to trade USDCAD.

Learn more about Forex trading with TIOmarkets

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Experienced independent trader