Trade with unlimited leverage & no margin requirements

BY TIOmarkets

|4 2, 2024The TIOmarkets Standard account herald a revolutionary approach to Forex trading, offering traders the opportunity to maximize their trading potential through an innovative “unlimited leverage” model without the conventional constraints of margin requirements.

This account type has been specifically enhanced for traders seeking the advantages of leverage to increase their trading capacity and flexibility, without the need to immobilize portions of their funds as collateral.

Keep reading to learn more about it.

Trade with unlimited leverage on TIOmarkets Standard account

The account operates with what is effectively described as "unlimited leverage," allowing traders to amplify their trading positions and maximize their lot sizes beyond the typical limitations imposed by standard leverage ratios.

No margin requirements (margin-free trading)

The Standard Account is designed to maximize your trading potential by allowing you to use your entire capital for trading purposes, without any of it being withheld as margin to open or maintain positions. This flexibility ensures that you have full access to your funds for trading, and provides greater freedom in executing trades.

How trading with unlimited leverage works

The maximum size of a trade is directly linked to the account’s equity, ensuring that you cannot open a position with a pip value that would exceed the account’s equity from a single pip movement in price. This is the practical limit of unlimited leverage and aligns the maximum leverage with your account’s ability to absorb risk.

So, the account equity dictates the extent of trading leverage, empowering you with the option to leverage up to the maximum your equity can support. This risk management principle also ensures that exposure is limited to the available equity, with additional negative balance protection to ensure you can’t lose more than your original deposit.

In Forex trading, capital, leverage, risk management and strategy are key elements that can significantly impact profitability. Let's explore two distinct scenarios that highlight the differences between trading with a traditional margin and leverage account versus an unlimited leverage account without margin requirements.

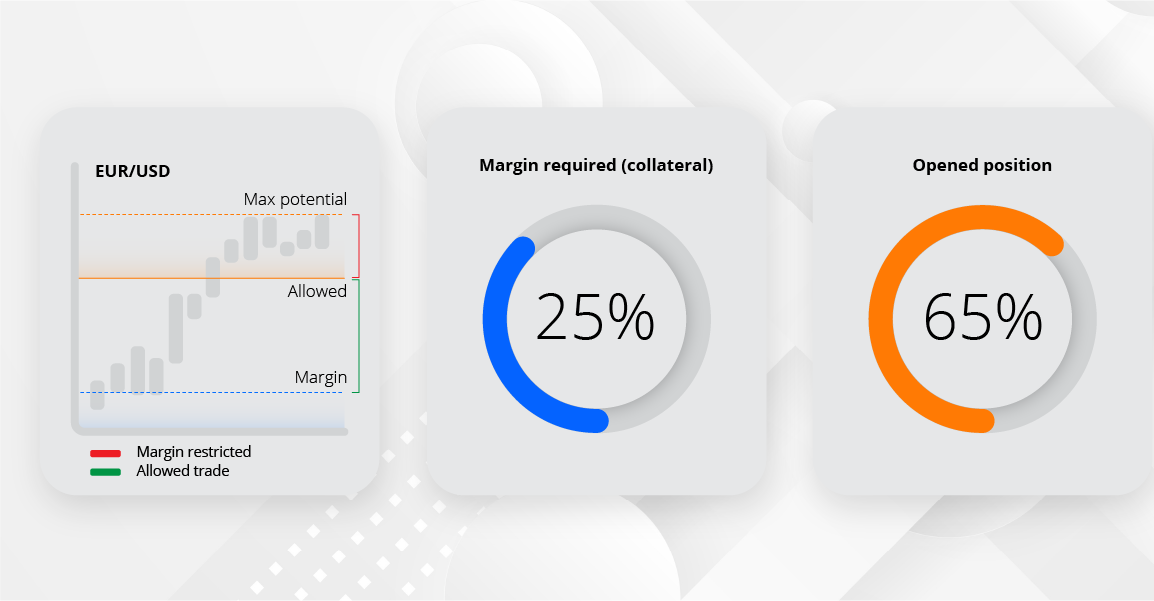

Example 1: Traditional leverage and margin trading account

In a traditional leverage and margin trading account, traders are constrained by leverage and margin ratios, which is typically capped at 30:1 with most brokers. This means for every $1 in their account, traders can control a position worth up to $30. However, leverage also comes with another requirement. That is to set aside a portion of their capital as margin to open and maintain positions. For example, if a trader wants to open a $30,000 position, they must have at least $1,000 in their account as margin. This significantly limits the lot size and number of positions a trader can open to $30,000. As additional positions beyond this lot size also increases the margin requirement and there would be insufficient margin available to open more trades.

Additionally, if the market moves against the trader’s position, they may face margin calls and margin stop-outs. Requiring them to deposit more funds to be used as equity or start closing positions at a loss to increase free-margin. This model, while offering increased exposure to the market, puts a cap on trading flexibility and potential profitability. Traders are often forced to limit the number of positions they can open, potentially resulting in missed opportunities and a need to deposit more funds to trade larger lot sizes or to open more positions.

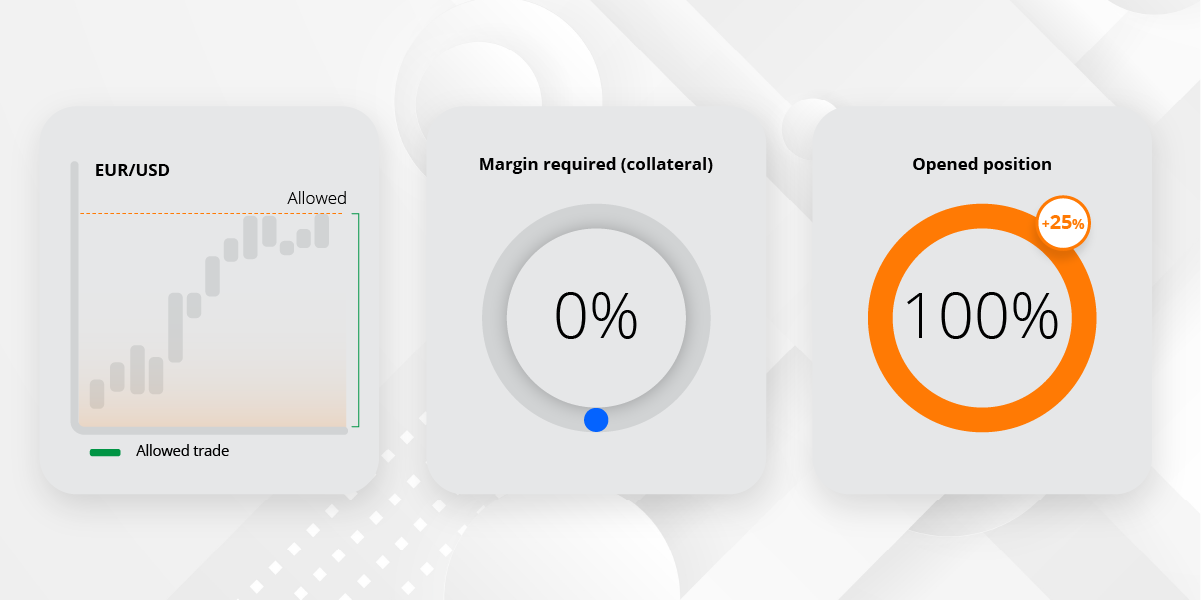

Example 2: Unlimited leverage, no margin trading account

Contrasting this with “unlimited leverage” and no margin requirements on the TIOmarkets Standard account. This introduces a paradigm shift in forex trading by removing the traditional leverage and margin ratio model. Replacing it with the ability to link the practical limit of lot size with the available equity in the trader’s account. For example, with this model, a trader could theoretically open a position with a lot size that has an equivalent pip value, up to the available equity in the account. So, if a trader has $500 as equity in their account, they could trade up to $500 per pip. Although this would not be a wise thing to do, it illustrates the most extreme case of available leverage. This does not take spreads and commissions into account.

With that said, this model provides unparalleled flexibility, and maximum potential profitability (or loss). It also allows traders to hold multiple long and short positions simultaneously without the fear of running out of margin or receiving a margin stop-out before having the option to use all their available funds. For instance, a trader can take advantage of various market movements across different currency pairs at the same time, creating a web of non-correlated positions that can hedge against each other. The risk in this scenario is managed by determining the combined pip value of all open trades to the account’s equity. As well as how many pips of adverse price movement this would allow given the accounts equity.

The absence of margin requirements frees up the trader’s entire capital for trading, enabling them to fully utilize their balance and maximize their potential returns.

The pros and cons of using unlimited leverage

The unlimited leverage account offers an enticing avenue for traders to amplify their trading positions without the traditional constraints of margin trading. However, this freedom comes with its own set of risks that necessitate meticulous risk management strategies. One primary concern is the temptation to over-leverage. While traders can theoretically open unlimited positions, each trade amplifies the total exposure, increasing the potential for significant losses. The absence of conventional margin requirements means traders could potentially invest a substantial portion of their capital into high-risk positions, underestimating the market's volatility.

To mitigate these risks, the account incorporates safety mechanisms such as linking trade size to account equity, ensuring that traders cannot expose themselves to losses greater than their equity. This mechanism serves as a critical risk management tool, aligning the leverage level with the trader's risk tolerance and capacity to absorb losses. Moreover, traders must employ robust risk management strategies, including setting stop-loss orders to limit potential losses and closely monitor market conditions to make informed trading decisions.

The introduction of negative balance protection is another safeguard, preventing traders from losing more than their initial deposit. Nonetheless, the onus remains on traders to understand the intricacies of the unlimited leverage model and to trade responsibly, recognizing that the high reward potential is matched by equally high risks.

Pros of unlimited leverage

- Maximize your capital: No margin will be withheld as collateral against your open deals.

- Capital efficiency: Allows you to fully utilize your capital for trading.

- Maximize buying power: Margin-free trading allows you to trade larger lot sizes.

- Maximized potential returns: You have the opportunity to realize significantly higher profits.

- Trading flexibility: You can adjust your effective leverage for each trade.

Cons of unlimited leverage

- Amplified potential losses: Just as profits can be magnified, losses can also be exponentially greater.

- Over-leveraging risk: It’s important to practice prudent risk management

- Stress: Trading with high leverage involves higher risk, which can increase stress levels and lead to poor decision-making if not managed properly.

Risk management strategies for trading with unlimited leverage

When utilizing unlimited leverage, some traders may opt for a high risk and high potential reward strategy. Risk management is a key component to any trading strategy and it becomes even more crucial here .

Here are five essential risk management tips traders should employ to manage their risks:

1. Use of stop loss orders

Implementing stop loss orders is vital to limit potential losses on each trade. With TIOmarkets Standard account, the value of a position cannot exceed the trader’s equity and the account comes with negative account balance protection but it is still imperative to set a stop loss at a level that prevents oversized losses and protects the account balance.

2. Appropriate lot sizing

Determine the lot size of each trade based on a predefined amount that you are willing to risk. A common strategy is to risk no more than 1-2% of your account on any single trade. Lot sizing should take into account the volatility of the asset being traded, the value of each pip and the distance to the stop loss. To ensure that even if a loss occurs, it is an acceptable amount.

3. Regular monitoring and trade management

Market conditions can change rapidly, necessitating frequent adjustments to existing positions. This includes moving stop losses to break even when possible, taking partial profits at predetermined levels, reducing exposure and closing out positions manually if the market sentiment shifts.

4. Diversification and hedging

While unlimited leverage can tempt traders to concentrate on high-stakes trading in a single market or asset, diversification and hedging is a tool to help mitigate some risk. You can spread your capital across different markets to reduce the impact of loss in any single trade. This approach helps manage the overall risk exposure by ensuring that potential losses in one market can potentially be offset by gains in another.

An edge to separate you from the rest

The TIOmarkets Standard account offer a unique blend of trading flexibility and opportunity, making it a great choice for traders aiming to navigate the Forex market efficiently, with the power of unlimited leverage.

With that said, it does come with some limitations, which includes a tiered leverage model based on account balance. The practical limits of trading with unlimited leverage also depend on the available liquidity in the market. In order to minimize the effects of slippage, some leverage restrictions must apply, especially when trading at certain times of the day and with larger amounts.

Please ensure you read the terms and conditions for the unlimited leverage account

| Balance in USD | Leverage |

| $0 - $999 | Unlimited |

| $1000 - $2499 | 1:2000 |

| $2500 - $4999 | 1:1000 |

| $5000 - $19,999 | 1:500 |

| $20,000 + | 1:200 |

Conclusion

The TIOmarkets Standard account embodies a revolutionary step in Forex trading. Providing traders with the means to fully realize their trading potential in a way that was not previously possible. Through this innovative approach to leverage and margin-free trading, it offers new possibilities to traders. Underscoring the importance of strategic insight and risk management to help achieve favorable outcomes.

So are you ready to step into the financial markets with a broker that can exponentially amplify your profit potential? Where the limitations of your account balance and leverage restrictions don't dictate your market impact?

Then try trading on TIOmarkets Standard account today.

This is how to get started

Step 1. Begin by registering and completing your profile to access your secure client area. Or log in if you already have an account.

Step 2. Open a live trading account,

- Choose Standard account.

- Select the MT5 trading platform.

- Select 'unlimited leverage' from the available leverage options.

Step 3. Download the MT5 trading platform

Step 4. Fund your account, and transfer funds to the MT5 Standard account

Step 5. Log in to the trading platform and start trading.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Behind every blog post lies the combined experience of the people working at TIOmarkets. We are a team of dedicated industry professionals and financial markets enthusiasts committed to providing you with trading education and financial markets commentary. Our goal is to help empower you with the knowledge you need to trade in the markets effectively.