掉期

持倉滾存至下一個交易日的貸方或借方記錄

隔夜掉期

符號

出價

問

點差

Swaps

*本頁價格僅供參考。流動性較低的工具,如但不限於外來貨幣對、股票和指數,其價格不像一般交易工具那樣經常更新。請查看您的MT4/MT5平台內的最新即時價格

什麼是掉期交易

隔夜利息是您的未平倉交易因隔夜結轉至下一個交易日而產生的費用。當您將持倉轉入下一個交易日時,您將賺取或支付掉期費用。

何時適用掉期

任何結轉至下一個交易日的未平倉交易可能會產生掉期費用。交易日的結束時間被視為紐約時間營業時間結束時,或格林威治標準時間 22:00(倫敦時間)。未平倉交易將繼續累計掉期費用,直至平倉為止。

如何計算掉期

中央銀行根據其貨幣政策增加或減少借貸成本。每種貨幣都有各自中央銀行設定的利率。當您買入或賣出貨幣或資產時,掉期會根據符號中資產間的利率差來計算。掉期是根據這些資產之間的利率差,以點數或點子來計算。

例如,假設美國聯邦儲備局 (Fed) 設定的年利率為 5%,而日本央行 (BOJ) 決定的利率為 0%。這表示美元每年將產生 5% 的利息,而日圓則沒有任何收益。借入美元會產生 5% 的利息,而借入日圓則不會產生任何年息。因此,同時賣出日圓買入美元,會產生每年 5%的正掉期差。然而,同時賣出美元買入日圓,則會產生每年 5%的負掉期差。

然後,年度掉期差額除以一年中的天數,並轉換為等值點或點,並應用於每日未平倉交易。

掉期如何影響您的交易

根據交易方向和符號中兩種資產之間的利率差異,您可以賺取或支付掉期。如果您購買的貨幣或資產的利率高於您出售的貨幣或資產的利率,您將收到隔夜利息(正隔夜利息)。如果利率較低,您將支付隔夜利息(負隔夜利息)。只要未平倉交易保持開放並隔夜結轉到下一個交易日,掉期就會影響其未實現利潤或損失。

不同市場之間的掉期是否有所不同?

中央銀行為各自國家設定利率,這些利率可能有很大差異。掉期,特別是在外匯交易中,取決於貨幣對中兩種貨幣之間的利率差異。因此,不同國家的不同利率會導致不同市場的不同互換。

如何找出每個交易品種的掉期

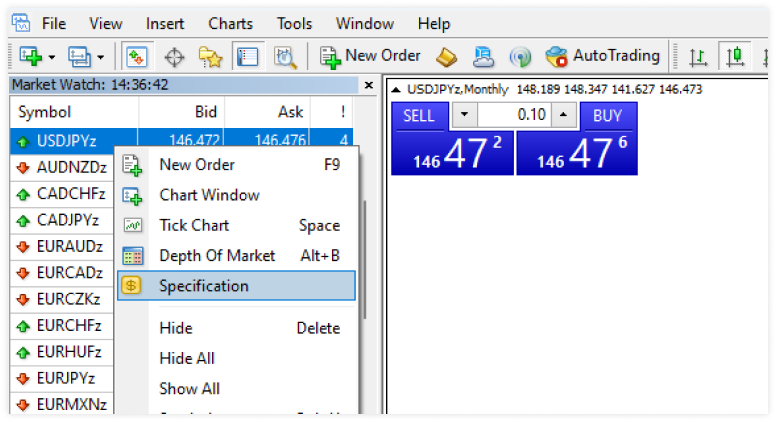

1. 進入 MT4 或 MT5 交易平台的市集報價視窗。 MT4或MT5 交易平台。

2. 右鍵點選您要查看掉期利率的金融工具(符號)。

3. 從出現的選單中選擇規格。

4. 交易品種描述視窗將打開,您可以在掉期多頭(買入頭寸)和掉期空頭(空頭頭寸)下找到掉期利率

選擇適合您的交易帳戶

歡迎所有的交易風格和策略

Standard

零佣金的可變價差交易帳戶

1.1

$0

最高可達無上限

$20

Raw

以原始可變差價和低佣金進行交易

0.0

$6

高達 1:500

$250

VIP Black

以低浮動點差和零佣金進行交易

0.3

$0

高達 1:500

$1,000

交易涉及風險

快速簡單上手

只需要幾分鐘,它是這樣工作的

步驟 1

註冊

填寫基本個人資料並建立帳戶,只需幾分鐘

步驟 2

驗證

上傳身分與地址證明,提款前必須完成

步驟 3

注資

選擇便利的本地或國際方式並完成入金

步驟 4

交易

下載交易平台、登入帳戶並開始交易