Forex Micro Account | A Guide For Micro Lot Trading

BY Chris Andreou

|November 20, 2023A Forex micro account is the absolute entry-level live trading account with most brokers. This account type allows you to trade in the Forex market with a small deposit and very little lot sizes.

Most Forex brokers don't refer to Forex micro accounts as such. They might choose to use different names to refer to their account types. However, the real essence here is whether the account type allows you to trade micro lots or not.

In this article, I will be talking all about Forex micro accounts and micro lot trading. How they may differ from other Forex trading account types and why having the ability for micro lot trading is important.

Keep reading if you are interested in elevating your understanding about Forex micro accounts and micro lot trading.

So without any further delay, let's jump straight into it.

What is a Forex micro account?

A Forex micro account is a low initial deposit and low volume trading account. This account type allows traders to start Forex trading from as little as $10 and trade in the smallest available lot size increments.

The benefit of opening a Forex micro account is that it allows you to begin trading without having to risk much money.

How does a Forex micro account work?

A Forex micro account is a trading account that allows you to trade in the currency markets without needing to deposit large amounts of capital.

Some brokers offer Forex micro accounts as an option, while others will not but still allow you to trade micro lots. However, the essence of the micro account is that it provides traders with the ability to trade micro lots. Currencies are traded in lots and a micro lot is typically the lowest minimum amount you can trade on most Forex brokers platforms.

So whether the account type is referred to as a micro account or not is just semantics. What the name aims to imply is that you have the ability to trade with micro lots. The idea then is that, once you've gained some experience trading with small amounts on a micro account. You can upgrade the account by depositing larger sums of money to trade with larger lot sizes.

How does a Forex micro account differ from a mini or standard account?

Forex micro accounts may differ to other account types in several ways. For example, the minimum deposit, minimum lot size, spreads, fees and leverage available may not be as favorable as other account types. Especially those account types that have benefits such as lower trading fees or reductions in spread. Where you would be required to deposit large sums of money or increase your lot size.

You need to check what account types are available with the broker because the trading conditions can differ between them. Typically, a standard account will require a larger deposit than a mini account. Purely because a higher margin would be required to trade in larger lot sizes. A mini account would probably require a larger deposit than a micro account and a nano account would probably require less than all of them. Further to this, the trading conditions will usually be more favorable depending on the size of the account.

Here is an example of how the micro, mini and standard account types might differ.

| Micro Account | Mini Account | Standard Account | |

| Minimum lot size | 0.01 | 0.10 | 1.00 |

| Minimum value / pip | $0.10 | $1.00 | $10.00 |

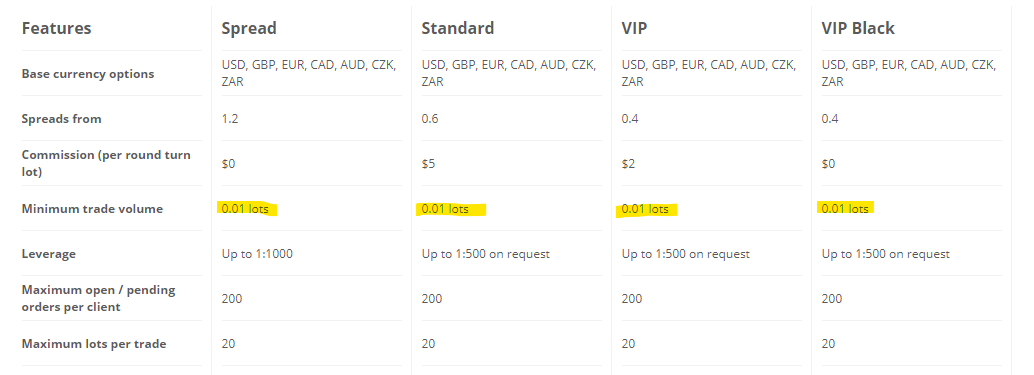

In comparison to this, TIOmarkets provides nano accounts, spread, standard, VIP and the VIP Black trading account. Where you have the ability to trade as little as one micro lot on all these account types. Without having to upgrade to trade in larger lot sizes. The minor differences here are that the trading conditions improve depending on account type. For example, the trading fees are highest on the spread account but you can start with only $10. The VIP Black trading account has the most competitive trading conditions and the minimum deposit requirement is $3,000. With that being said, check the current promotions page for a promo code. There may be an offer there to get the VIP Black account for less than the usual amount.

The advantages of a forex micro account

When it comes to online Forex trading, next to a demo account, a Forex micro account is considered an entry-level account type. You can get started with as little as $10 and trading in smaller amounts means you will be able to build up your confidence and gradually increase your exposure by trading in larger lot sizes.

Trading micro lots at TIOmarkets, you can still get access to most of the same trading tools and features as any other type account. It just depends on your deposit amount because micro lot trading is not dependent on the account type. All trading accounts from TIOmarkets provide you with the ability to trade micro lots.

One of the best advantages of being able to trade with micro lots is that it allows you to trade in increments of $1000 units. Which means you can be more precise with the amounts being risked.

The disadvantages of a micro Forex trading account

The main disadvantage of a Forex micro account or trading with micro lots is that you will not be able to open many trades if you start with a very small amount of money.

Given the leverage restriction in some jurisdictions and for some instruments, it is possible that you will not have enough margin to open a trade in some asset classes.

If you want to trade some of the stock markets or exotic currency pairs, then you should be looking at starting with more than just the minimum.

Another disadvantage of trading with micro lots is that the profit potential from trading will be smaller and limited. Trading with very small amounts also means it will take longer to grow your account.

Further to this, the trading spreads and commission might be higher because of the lower trading volume and small deposit. Brokers tend to provide more favorable trading conditions depending on trading volume and deposit size.

Who should use a Forex micro account?

Forex micro accounts or micro lot trading can be used by anyone.

Beginners or traders with low account balances

People that are looking to start trading with a small amount or traders that have small balances will benefit greatly from trading micro lots.

Beginners can get a feel for real trading conditions with less money at risk. As a beginner, the primary aim should be to grasp the nitty-gritty of the Forex market, without the fear of losing much money.

The small initial investment required for a micro account is also beneficial for people who are reluctant or unable to invest large sums. Micro lot trading is a great way to practice and develop your trading strategy under real market conditions.

Traders that want precise and efficient with risk management

Micro lots give you more control over your trades. You can trade in larger lot sizes while maintaining the ability to fine-tune your positions to achieve optimal risk management. For example, your risk management strategy might require that you open a lot size equivalent to $22.50 per pip. Without the ability to select lot sizes down to a micro lot, you would have to round up or down to the nearest $1.

That might not sound like a big deal but if you round down by 50 cents it's the equivalent of $50 per 100 pips. If you have a trading strategy that nets on average 400 pips per month, that would be the equivalent of $200 of potential profit left on the table. Over a long enough time horizon, it really does add up.

Forex micro account FAQs

Here are some common questions and answers related to Forex micro accounts and micro lot trading.

1. Can I open a Forex Micro Account with any broker?

Not all brokers offer the Forex Micro Account. You must verify with the broker or check their account types page on their website. Brokers may not refer to any of their trading accounts as micro accounts but they typically allow micro lot trading as standard.

2. What is the minimum deposit for a Forex micro account?

The minimum deposit varies between brokers. Some brokers, like TIOmarkets allow you to open an account with as little as $10 but this may not necessarily be the best amount to start trading with.

3. Can I use leverages with a Forex micro account?

Yes, most Forex Micro Accounts offer leverage. The leverage ratio varies between brokers and can range anywhere from 1:30 to as high as 1:1000. If you are looking to start with a small amount, like $50 or $100, you will have to use leverage when trading. Since a Forex micro lot has a notional value of $1,000.

6. Can I switch between lot sizes in my Forex micro account?

You can with TIOmarkets, the minimum trade volume is one micro lot and the maximum number of lots you can trade is probably more than you will ever need. The lot size that you can open depends on how much you have available as margin and the leverage set on your account.

7. What are the trading costs in a Forex micro account?

Trading costs depend on the broker's fee structure, which may involve spreads, commissions, or both. Often, spreads might be wider in a Micro Account compared to a Standard Account.

9. How can I manage risk when trading with a Forex micro account?

The risk in a micro account can be managed by setting stop-loss orders to limit potential losses, limiting the use of leverage, and following a disciplined trading plan.

10. Are demo accounts and micro accounts the same?

No, they're not the same. While they're both used for beginner practice, demo accounts use fake money, whereas micro accounts deal with real money, albeit small amounts.

How to get started with a Forex micro account

If you are looking for a Forex micro account you can get started with micro lot trading on any of TIOmarkets' account types. Just follow these simple steps to create your account and start trading.

1. Register your trading account

Register your account with TIOmarkets, it only takes a few minutes and this will take you to your secure client portal.

2. Open a demo or live account

Create your demo or live micro lot trading account and configure it to your liking. Choose your account base currency, account type and leverage. The login credentials will be sent to you by email.

3. Download the trading platform

Download the MT4 or MT5 trading platform to your computer or mobile phone. What platform you use will depend on what you selected in the previous step.

4. Deposit funds

Go to deposit, select your deposit method and enter your preferred amount. You can start trading with TIOmarkets from $10.

5. Transfer funds from your wallet to your trading account

Once you have made a successful deposit, go to manage funds and transfer the funds from your TIOmarkets wallet to the trading account created in the previous step.

6. Log in to the trading platform

Log in to the trading platform with the credentials sent to you in the previous step. Once logged in, you should notice your balance reflects your deposit.

Now you are ready to start trading on a Forex micro lot account.

The best way to trade with a Forex micro account

If you are new to trading, the first step is to learn the basics. We have a complete course for beginners that will teach you how to trade. Then you can apply that knowledge to start trading or check out some of the other educational articles and videos on our blog.

You might also find this article useful if you are interested in learning more about Forex trading strategies.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Experienced independent trader

Related Posts