Weak ISM dragged the dollar lower

BY Janne Muta

|April 4, 2023The weak ISM manufacturing index softened bids in the dollar yesterday. The Institute of Supply Management (ISM) reported that the index of business activity in the US manufacturing sector fell to its lowest level since May 2020 with all major components below the 50 level. This boosted EURUSD and Gold while equities reacted lower at first before recovering again. Nasdaq and FTSE are strong and look like could trade higher.

The T-Bond market seems to be moderately bullish. This indicates the markets believe the Fed will step back and not tighten as much as previously feared. Rate expectations might, however, change though in the coming months if the OPEC production cuts drive the price of oil significantly higher. Higher oil prices will show in inflation statistics and could move the Fed to hike rates again.

Gold

XAUUSD remains bullish above 1944 but the market is trading sideways inside a triangle formation and has now reached a descending trendline so the bulls might want to be a little careful now. When a market is trading in a range it makes sense to look for long trade signals near the range low (at support levels) and prepare to sell near resistance levels. And, if we see signs of weakness near the range high we can consider short trades. The nearest key support and resistance levels for gold are 1944, 1949, 1990 and 2001.80.

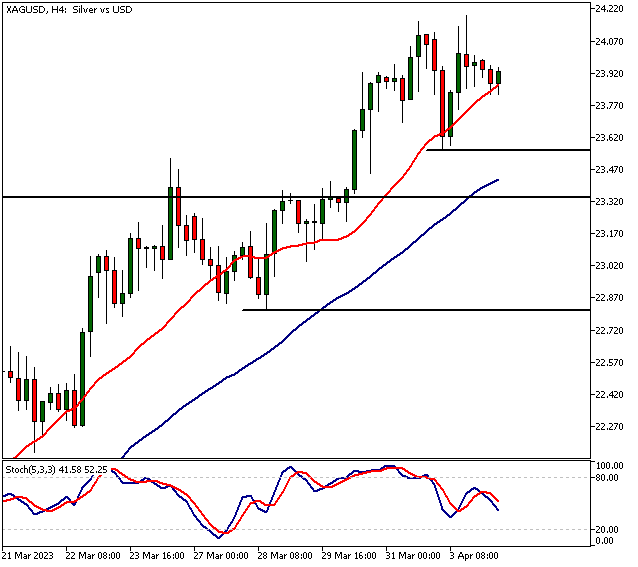

Silver

Silver is trending higher and remains bullish above 23.56. However, the market created a top-heavy candle yesterday in the daily timeframe chart and there’s some weakness (rejection candle) in the 4h chart at the time of writing this. If the 23.56 support breaks, look for a move to 23.40 or so and to 23.00 in extension.

Nasdaq

The Nasdaq uptrend remains in force above 12 820 where the rising trend channel low currently is. Should the market break below the channel low it’d be likely to trade down to 12 630 or so. However, there are a couple of support levels above the 12 820 level: 12 850 and 13 033.

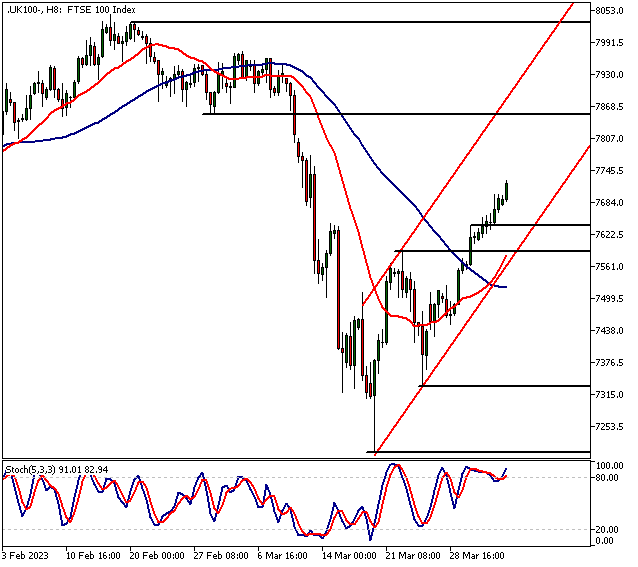

FTSE

UK 100 is bullish above 7638. Below the level, the market could trade down to the 7500 support level. Above 7638 the market is likely to trade to 7780 or so and then to 7850 on extension.

The Next Main Risk Events

- USD JOLTS Job Openings

- NZD Official Cash Rate

- NZD RBNZ Rate Statement

- AUD RBA Gov Lowe Speaks

- USD ADP Non-Farm Employment Change

- USD ISM Services PMI

- CAD Employment Change

- CAD Unemployment Rate

- USD Unemployment Claims

- CAD Ivey PMI

- USD Average Hourly Earnings m/m

- USD Non-Farm Employment Change

- USD Unemployment Rate

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets.com

DISCLAIMER TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval. FX and CFDs are leveraged products. They are not suitable for every investor, as they carry a high risk of losing your capital. Please ensure you fully understand the risks involved. All the prices in this report are CFD prices based on price charts provided by TIOmarkets unless otherwise stated.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.