Swaps

Créditos o débitos para trasladar posiciones al siguiente día de negociación

Permutas nocturnas

Símbolo

Oferta

Preguntar

Spread

Swaps

*Los precios de esta página son orientativos. Los precios de los instrumentos con menor liquidez, como, entre otros, pares de divisas, acciones e índices exóticos, no se actualizan con tanta frecuencia como los instrumentos negociados habitualmente. Consulte dentro de su plataforma MT4/MT5 para conocer los últimos precios en vivo

Qué son los swaps en el trading

El swap es una comisión que se abona o adeuda en sus operaciones abiertas por trasladarlas al día siguiente de negociación. Al trasladar una posición al día siguiente, ganará o pagará una comisión por swap.

Cuándo se aplican los swaps

Toda operación abierta que se traslade al día siguiente de negociación puede dar lugar a una comisión de swap. Se considera que el cierre del día de negociación se produce al cierre de las operaciones, hora de Nueva York, o a las 22:00 GMT (hora de Londres). Las operaciones abiertas seguirán acumulando swaps hasta que se cierren.

Cómo se calcula el swap

Los bancos centrales aumentan o disminuyen los costes de financiación de acuerdo con su política monetaria. Cada divisa tiene su propio tipo de interés fijado por el banco central respectivo. Al comprar o vender divisas o activos, el swap se calcula en función del diferencial de tipos de interés entre los activos del símbolo. Los swaps se calculan en pips o puntos en función del diferencial de tipos de interés entre estos activos.

Por ejemplo, supongamos que la Reserva Federal de EE.UU. (la Fed) establece un tipo de interés del 5% anual, mientras que el Banco de Japón (BOJ) decide un tipo de interés del 0%. Esto significa que el dólar estadounidense devengaría un 5% de interés cada año, mientras que el yen japonés no devengaría nada. Tomar prestados dólares estadounidenses generaría un tipo de interés del 5%, mientras que tomar prestados yenes japoneses no generaría ningún interés anual. Así pues, al vender simultáneamente el yen japonés para comprar dólares estadounidenses, se incurriría en un diferencial swap positivo.

El diferencial anual del swap se divide entonces por el número de días del año y se convierte al equivalente en pips o puntos, y se aplica diariamente a las operaciones abiertas.

Cómo afectan los swaps a sus operaciones

Dependiendo de la dirección de la operación y del diferencial de tipos de interés entre los dos activos del símbolo, puede ganar o pagar swaps. Si la divisa o activo que compró tiene un tipo de interés más alto que la divisa o activo que vendió, recibirá el swap (swap positivo). Si el tipo de interés es inferior, pagará el swap (swap negativo). Los swaps afectan a los beneficios o pérdidas no realizados de las operaciones abiertas mientras permanezcan abiertas y se trasladen de un día para otro al siguiente día de negociación.

¿Varían los swaps de un mercado a otro?

Los bancos centrales fijan los tipos de interés para sus respectivos países, y estos tipos pueden diferir considerablemente. Los swaps, especialmente en el comercio de divisas, dependen del diferencial de tipos de interés entre las dos divisas de un par de divisas. Así pues, la variación de los tipos de interés en los distintos países contribuye a que los swaps sean diferentes en los distintos mercados.

Cómo encontrar los swaps de cada símbolo

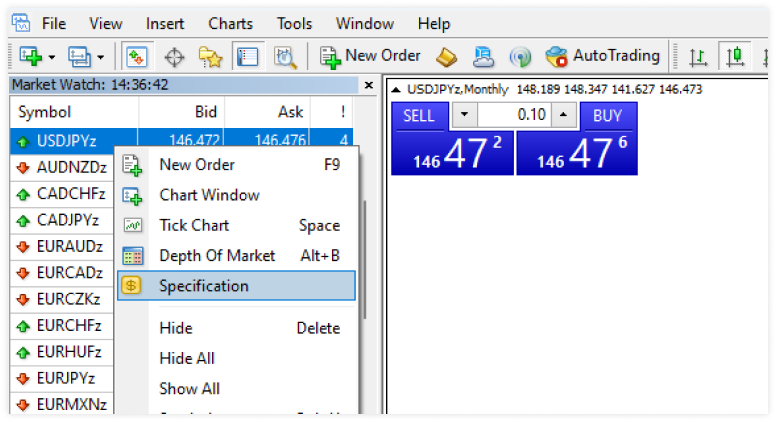

1. Vaya a la ventana de Observación del Mercado en las plataformas de negociación MT4 o MT5. MT4 o MT5 plataformas de negociación.

2. Haga clic con el botón derecho del ratón en el instrumento financiero (símbolo) del que desee ver los tipos de swap.

3. Seleccione Especificación en el menú que aparece.

4. Se abrirá la ventana de descripción del símbolo, donde encontrará los tipos de swap en Swap long (para posiciones compradoras) y Swap Short (para posiciones vendedoras).

Elige la cuenta de trading que mejor se adapte a ti

Todos los estilos y estrategias de negociación son bienvenidos

Standard

Una cuenta de trading con spread variable y cero comisiones.

1.1

$0

Hasta ilimitado

$20

Raw

Opere con spreads variables en bruto y comisiones bajas.

0.0

$6

Hasta 1:500

$250

VIP Black

Opere con spreads variables bajos y cero comisiones.

0.3

$0

Hasta 1:500

$1,000

El trading conlleva riesgos

Empezar es rápido y sencillo

Solo toma unos minutos. Así es como funciona

PASO 1

Registrarse

Completa tu perfil y crea tu cuenta, solo toma unos minutos

PASO 2

Verificar

Carga tu comprobante de identidad y domicilio, esto es obligatorio antes de retirar

PASO 3

Depositar fondos

Elige entre nuestros cómodos métodos locales e internacionales y deposita al instante

PASO 4

Operar

Descarga la plataforma, transfiere fondos a tu cuenta, inicia sesión y comienza a operar

Deposita y retira con confianza

Transferir fondos a tu cuenta es cómodo y seguro

Los depósitos instantáneos y sin costo están disponibles en métodos seleccionados. Los tiempos de procesamiento pueden variar según el país y el método. Las solicitudes de retiro generalmente se procesan en el plazo de un día hábil y se devuelven mediante el método de depósito original.