Échanges

Crédits ou débits pour le report de positions au jour de négociation suivant

Swaps à un jour

Symbole

Offre

Demander

Spread

Swaps

*Les prix sur cette page sont indicatifs. Les prix des instruments avec une liquidité plus faible tels que, mais sans s'y limiter, les paires de devises exotiques, les actions et les indices ne sont pas mis à jour aussi fréquemment que les instruments couramment échangés. Veuillez consulter votre plateforme MT4 / MT5 pour les derniers prix en direct.

Qu'est-ce qu'un swap ?

Le swap est une commission créditée ou débitée sur vos transactions ouvertes pour les reporter au jour de négociation suivant. Lorsque vous reportez une position au jour de négociation suivant, vous gagnez ou payez des frais de swap.

Quand les swaps s'appliquent-ils ?

Toute opération en cours reportée au jour de négociation suivant peut donner lieu à des frais de swap. La clôture de la journée de négociation est considérée comme étant à la fermeture des bureaux, heure de New York, ou à 22h00 GMT (heure de Londres). Les transactions ouvertes continueront à accumuler des swaps jusqu'à ce qu'elles soient clôturées.

Comment le swap est-il calculé ?

Les banques centrales augmentent ou diminuent les coûts d'emprunt en fonction de leur politique monétaire. Chaque devise a son propre taux d'intérêt fixé par la banque centrale concernée. Lorsque vous achetez ou vendez des devises ou des actifs, le swap est calculé sur la base du différentiel de taux d'intérêt entre les actifs du symbole. Les swaps sont calculés en pips ou en points sur la base du différentiel de taux d'intérêt entre ces actifs.

Par exemple, supposons que la Réserve fédérale américaine (la Fed) fixe un taux d'intérêt de 5 % par an, tandis que la Banque du Japon (BOJ) décide d'un taux d'intérêt de 0 %. Cela signifie que le dollar américain rapporterait 5 % d’intérêt chaque année, tandis que le yen japonais ne rapporterait rien. Emprunter des dollars américains entraînerait un taux d'intérêt de 5 %, tandis qu'emprunter du yen japonais n'entraînerait aucun intérêt annuel. Ainsi, en vendant simultanément du yen japonais pour acheter des dollars américains, cela entraînerait un différentiel de swap positif de 5 % par an. Cependant, en vendant simultanément des dollars américains pour acheter des yens japonais, cela entraînerait un swap négatif de 5 % par an.

Le différentiel de swap annuel est ensuite divisé par le nombre de jours dans l'année et converti en pip ou équivalent en points et est appliqué quotidiennement aux transactions ouvertes.

Comment les swaps affectent vos transactions

En fonction de la direction de la transaction et du différentiel de taux d'intérêt entre les deux actifs représentés dans le symbole, vous pouvez soit gagner, soit payer des swaps. Si la devise ou l'actif que vous avez acheté a un taux d'intérêt plus élevé que la devise ou l'actif que vous avez vendu, vous recevrez le swap (swap positif). Si le taux d’intérêt est inférieur, vous paierez le swap (swap négatif). Les swaps affectent le profit ou la perte non réalisé des transactions ouvertes aussi longtemps qu'elles restent ouvertes et sont reportées du jour au lendemain jusqu'au jour de bourse suivant.

Les swaps varient-ils selon les marchés ?

Les banques centrales fixent les taux d’intérêt pour leurs pays respectifs, et ces taux peuvent différer considérablement. Les swaps, notamment dans le trading du Forex, dépendent du différentiel de taux d'intérêt entre les deux devises d'une paire de devises. Ainsi, les taux d’intérêt variables selon les pays contribuent à différents swaps sur différents marchés.

Comment trouver les swaps pour chaque symbole

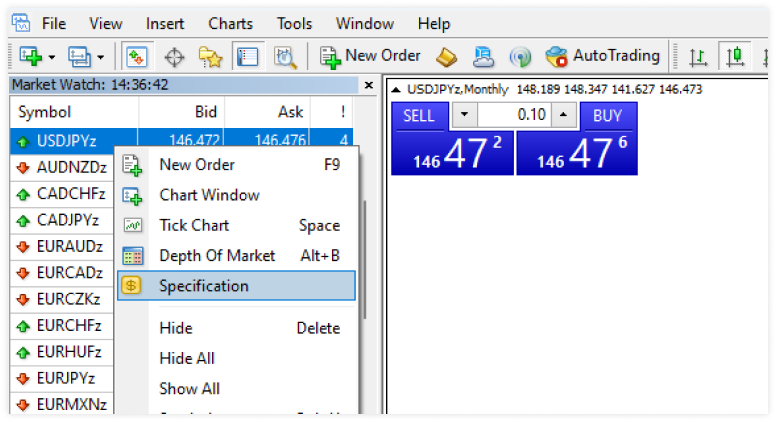

1. Accédez à la fenêtre Market Watch dans les plateformes de trading MT4 ou MT5. MT4 ou MT5 plateformes de trading.

2. Faites un clic droit sur l'instrument financier (symbole) dont vous souhaitez afficher les taux de swap.

3. Sélectionnez Spécification dans le menu qui apparaît.

4. La fenêtre de description du symbole s'ouvrira où vous pourrez trouver les taux de swap sous Swap long (pour les positions d'achat) et Swap Short (pour les positions courtes)

Choisissez un compte de trading qui vous convient

Tous les styles et stratégies de trading sont les bienvenus

Standard

Un compte de trading à spread variable sans commission

1.1

$0

Jusqu'à illimité

$20

Raw

Tradez avec des spreads variables bruts et une faible commission

0.0

$6

jusqu'à 1:500

$250

VIP Black

Tradez avec des spreads variables bas et zéro commission

0.3

$0

jusqu'à 1:500

$1,000

Le trading comporte des risques

La mise en route est simple et rapide

Cela ne prend que quelques minutes, voici comment cela fonctionne

ÉTAPE 1

S’inscrire

Complétez votre profil et créez votre compte, cela ne prend que quelques minutes

ÉTAPE 2

Vérifier

Téléversez votre justificatif d’identité et de domicile, requis avant tout retrait

ÉTAPE 3

Approvisionner

Choisissez parmi des méthodes locales et internationales pratiques et déposez instantanément

ÉTAPE 4

Trader

Téléchargez la plateforme, transférez des fonds vers votre compte, connectez-vous et commencez à trader

Déposez et retirez en toute confiance

L'approvisionnement de votre compte est pratique et sécurisé

Un approvisionnement instantané et gratuit est disponible pour certaines méthodes. Les délais de traitement peuvent varier selon le pays et la méthode. Les demandes de retrait sont généralement traitées dans un délai d'un jour ouvrable et renvoyées en utilisant la méthode de dépôt d'origine.