TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

STOCKS

TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

STOCKS

TRADE FROM

1 TICK SPREAD

TRADE FROM

$0 COMMISSION

UP TO

1:20 LEVERAGE

170+

STOCKS

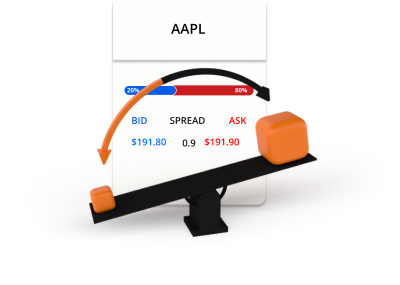

Trade stocks of major companies

Bid

Ask

Spread

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4/MT5 platform for latest live prices

What are stocks?

Stocks, also known as shares or equities, represent ownership interest in a company. When you buy a company's stock, you're purchasing a small piece of that company, including the right to a portion of the company's earnings. Stocks are issued by companies to raise capital in order to grow the business and they can be bought and sold. However, with stock CFD trading, it allows you to speculate on the price movement without needing to own the actual stocks.

How stock CFD trading works

Trading in stock CFDs allows you to speculate on the price movements of company stock without owning the actual shares. If you think the share price is likely to rise, you can simply buy it. If you think the price of the shares is likely to fall, you can sell it.

Bid and ask prices

Go long or short

Stocks are traded in lots

Stock trading involves leverage and margin

Stock trading example

You decide to buy 0.1 lots of Apple (AAPL) at $200 using 20:1 leverage.

0.1 lots = 10 share CFDs of AAPL

10 share CFDs x $200 = $2,000

$2,000 / 20 = $100

Now you have opened a long position in AAPL worth $2,000. Since stock CFDs are traded using leverage, only $100 was used as margin from your trading account. After some time, the price of AAPL moves and you decide to sell.

Scenario 1

AAPL moves up from $200 to $250 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($250 - $200) x 10

P/L = $50 x 10

P/L = $500

Scenario 2

AAPL moves down from $200 to $150 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($150 - $200) x 10

P/L = -$50 x 10

P/L = - $500

Great value trading with a premium service

This is why people like you choose TIOmarkets

Spreads from 0.4 pips

Our aggregated liquidity keeps spreads low, most of the time

Zero commission

Trade from $0 per lot on our VIP Black or spread-only trading accounts

Low starting amount

Open your account from just $20 to start trading

24/7 customer support

We are here to help, with 3 seconds average response time on live chat

Fast order execution

Trades are executed in milliseconds, with low slippage, most of the time

300+ Symbols

Trade forex, stocks, indices and commodity markets from anywhere, anytime

Reliable platforms

Trade global financial markets on the MT4 & MT5 desktop or mobile trading platforms

Micro lot trading

Trade from $0.10 per pip, ideal for small accounts and to better manage your risk

Learn more about trading with TIOmarkets

undefined