Best Stocks for Day Trading

BY Janne Muta

|มีนาคม 7, 2567Day trading in the stock market is an exhilarating venture that demands both skill and strategic planning. At its core, day trading involves buying and selling stocks within the same trading day, capitalizing on short-term market fluctuations. The allure of day trading lies in its potential for rapid gains, but it comes with the caveat of increased risk. Thus, the cornerstone of successful day trading is the meticulous selection of the best stocks for day trading. These stocks are typically characterized by high liquidity, volatility, and volume, ensuring traders can enter and exit positions swiftly without significantly affecting the stock's price.

In this article, we cover the essential criteria for selecting the best stocks for day trading, including insights into liquidity, volatility, and volume, and how these factors contribute to a stock's suitability for day trading. We delve into specific strategies for identifying stocks that offer substantial daily movements and provide a predictable pattern that can be leveraged for profit. Moreover, we explore examples of stocks that exemplify these criteria, such as AAPL and AMZN, and their distinct advantages for day traders. Through expert analysis and strategic advice, this article equips traders with the knowledge to optimize their day trading strategies, maximize their profits, and navigate the inherent risks of the stock market with confidence. And, to get started with day trading stocks, visit our account opening page.

Selecting the Best Stocks for Day Trading

For traders aiming to thrive in the fast-paced world of day trading, understanding the criteria for choosing the best stocks for day trading is paramount. These stocks not only offer substantial daily movements but also provide predictable patterns that can be leveraged for profit. High daily movement and volume ensure that a stock has enough interest and activity, making it a prime candidate for day trading. This selection process is critical in maximizing profit while mitigating the inherent risks of day trading.

Criteria for Excellence in Day Trading Stocks

Beyond the allure of immediate gains, the selection of stocks for day trading requires a keen eye for detail and a deep understanding of market dynamics. Traders must evaluate stocks based on liquidity, daily price volatility, and the overall market environment. This evaluation helps in identifying stocks that not only promise substantial intraday price movements but also align with the trader's individual risk tolerance and trading strategy. By focusing on these criteria, traders can better navigate the complexities of the stock market, making informed decisions that enhance their chances of success in day trading.

Understanding Day Trading and Its Goals

Day trading is a strategic approach in the stock market, focusing on buying and selling stocks within the same trading day. The primary goal is to exploit short-term price movements to secure a profit. This method contrasts with long-term investment strategies by emphasizing quick, tactical decisions and movements within the market. Success in day trading is not just about making rapid trades; it's about making smart, informed decisions.

Choosing the Best Stocks for Day Trading

The key to day trading success lies in the careful selection of stocks. Opting for the best stocks for day trading involves identifying those with significant liquidity, volatility, and trading volume. These characteristics ensure that a stock can be bought or sold quickly, is likely to experience meaningful price changes within a single trading day, and has enough interest from the market to provide predictable patterns. This precise selection process is crucial, as it directly impacts the trader's ability to capitalize on market movements and ultimately determines the profitability of their day trading endeavours.

Qualifiers for Selecting the Best Stocks for Day Trading

In day trading, success hinges on the ability to swiftly identify and act upon the best stocks for day trading. These stocks possess unique characteristics that not only enhance the potential for profit but also align with the rapid-fire nature of day trading. Understanding these qualifiers is crucial for traders aiming to navigate the stock market effectively.

High Daily Movement: The Gateway to Profitability

The essence of day trading lies in leveraging stocks that exhibit significant daily movements, either in percentage or dollar terms. This volatility is a double-edged sword; it presents both opportunities for high returns and risks of substantial losses. Therefore, selecting stocks with a notable daily movement is pivotal. It ensures that traders have the potential to capitalise on fluctuations within the trading day, making it a foundational criterion for identifying the best stocks for day trading.

Volume: The Indicator of Liquidity

Volume, or the number of shares traded in a given timeframe, is a vital indicator of a stock's liquidity. High average daily volume suggests that a stock can be bought or sold quickly without causing a substantial impact on its price. This liquidity is essential for day traders who need to execute fast, efficient trades. It allows for smoother entry and exit strategies, minimising the risk of slippage and enhancing the potential for profit.

Consistent Movers: Predictability in Volatility

Consistent movers are stocks known for their reliable daily movements, providing a predictable pattern that traders can exploit. This consistency reduces the uncertainty inherent in day trading, allowing traders to develop strategies based on historical performance. By focusing on consistent movers, traders can more accurately forecast potential movements, making these stocks among the best for day trading.

Price Range: Seeking High-Percentage Movers

Stocks within a specific price range, typically between $10 and $100, often exhibit higher percentage movements. This attribute makes them attractive to day traders, who prefer stocks that offer significant intraday range without the need for substantial capital outlay. The preference for high-percentage movers in this price range underscores the importance of affordability and movement potential in selecting the best stocks for day trading.

Intraday Range: Maximising Trading Opportunities

The intraday range, or the difference between a stock's high and low prices within a single trading day, is a critical factor for day traders. Stocks with substantial intraday ranges offer more opportunities for profit, as traders can capitalise on both upward and downward movements. This variability is a key attribute of the best stocks for day trading, as it allows traders to leverage short-term price changes effectively.

Incorporating these qualifiers into the selection process enables traders to identify the best stocks for day trading, aligning with the goal of maximising profit while managing risk in the dynamic environment of the stock market.

Implementing Day Trading Strategies with the Best Stocks

The journey towards becoming a proficient day trader involves not just the selection of the best stocks for day trading but also the strategic application of various trading methodologies. The qualifiers detailed previously—such as high daily movement, volume, and consistent movers—play a pivotal role in determining the suitability of stocks for specific day trading strategies. These strategies, including range trading and volume trading require a nuanced understanding of market dynamics and the ability to swiftly identify stocks that align with these methods.

Range Trading: Leveraging Volatility and Liquidity

Range trading is a strategy that thrives on volatility and liquidity, making it essential to choose stocks that exhibit significant intraday price movements and high trading volume. The best stocks for day trading, in this context, are those that move within a predictable range throughout the day. Traders exploit these price movements by buying at the lower end of the range and selling at the higher end, capitalizing on the stock's volatility. Selecting stocks with high daily movement and volume ensures that there are ample opportunities for profit within the trading day.

Volume Trading: Identifying Market Sentiment

Volume trading focuses on stocks with unusually high trading volumes, indicating strong market interest. This strategy benefits from the liquidity and movement potential of stocks that meet the high volume qualifier, allowing traders to enter and exit positions with ease. The best stocks for day trading, from a volume perspective, signal shifts in market sentiment, offering traders the chance to ride the momentum for profitable trades.

Examples of the Best Stocks for Day Trading

When exploring the best stocks for day trading, it's essential to consider both the Average Daily Range (ADR) and the spread as a percentage of the stock price. These metrics are crucial for understanding potential intraday movements and the cost of executing trades. The ADR highlights the average high-low price movement within a single trading day, offering insight into volatility and potential profit margins. A higher ADR signifies more significant price movements, making a stock more attractive for day trading. Conversely, the spread as a percentage of the stock price reflects the trading cost, where a lower spread indicates a cost-efficient trading environment.

Volatility and Cost Efficiency: Key to Day Trading Success

For day traders, aligning with stocks that exhibit high volatility and low trading costs can pave the way to success. The ratio of the spread to ADR serves as a critical indicator, revealing which stocks present the best opportunities for profit in relation to their trading costs. By prioritizing stocks with a low spread-to-ADR ratio, traders can maximize their potential for gains while minimizing costs, thereby effectively tapping into the dynamic world of day trading.

Apple (AAPL), A Cost-Effective Choice for Day Traders

For traders exploring cost-effective stocks, AAPL offers notable advantages. With a spread to ADR ratio of 0.0846, it stands as one the most economical stocks for day trading. This low ratio highlights AAPL's efficiency, where the trading cost is minimal in comparison to its average daily price range. AAPL's annualized volatility of 0.283, combined with an ADR of 2.82, reflects a balance between manageable volatility and sufficient daily price movement, positioning it as a strategic pick for traders prioritizing both cost efficiency and potential for intraday gains.

Amazon (AMZN), The Next Best Choice

AMZN emerges as a compelling pick for day trading, underscored by its favourable metrics on the trading efficiency scale. It boasts a low ratio of spread to ADR at just 0.0906, which is indicative of lower trading costs relative to the average intraday price range. This efficiency is amplified by its annualized volatility of 0.324, which is 1.9 times that of the SPY index, suggesting a more moderate level of risk while still offering sufficient price movement for profit opportunities. The ADR of 3.02 points to the potential for reasonable intraday swings, and a tight spread of just 0.03% of the stock price further enhances its attractiveness. These factors combine to make AMZN a strong candidate for day traders seeking to optimize their trades with a stock that offers a balanced blend of volatility, cost-effectiveness, and trading action.

Maximizing Day Trading Strategies with META

In the quest for the best stocks for day trading, META stands out due to its relatively low ratio of spread to Average Daily Range (ADR), which is at 0.5796. While this ratio indicates a higher cost of trade relative to its daily price movements compared to some other stocks, META's broader daily price range, with an ADR of 8.28, alongside an annualized volatility of 0.404, makes it an intriguing choice. This combination suggests that META could offer substantial intraday trading opportunities, even with a slightly higher cost. For traders focused on leveraging volatility to maximize returns, META provides a blend of moderate volatility and trading volume, making it a compelling option for those looking to capitalize on day-to-day price fluctuations.

Leveraging High Volatility with NVDA for Day Trading

For traders pinpointing the best stocks for day trading, NVDA exhibits a ratio of spread to ADR at 0.9264, indicating a slightly higher trading cost in relation to its daily price movement. Despite this, NVDA's substantial ADR of 15.44, paired with an annualized volatility of 0.443, positions it as a prime candidate for day trading. This profile suggests NVDA can offer significant intraday price movements, providing ample opportunity for profit. Its higher volatility and ADR mean that NVDA is suited for traders who are adept at navigating larger price swings and who can leverage these characteristics to their advantage. For those seeking to exploit volatility, NVDA presents an engaging option, blending the thrill of high volatility with the potential for substantial intraday gains.

Exploring Intraday Trading Opportunities with NFLX

NFLX distinguishes itself with a unique blend of characteristics. It has a ratio of spread to ADR of 0.6696, which, while higher than some peers, is balanced by its impressive ADR of 11.16. This notable ADR, coupled with an annualized volatility of 0.507, makes NFLX a compelling choice for traders seeking significant intraday movements. The stock’s ability to present broad daily price ranges offers lucrative opportunities for traders to capitalize on. Despite the relatively higher cost implied by its spread to ADR ratio, NFLX's volatility and price movement potential cater well to day traders looking for dynamic stocks. Its profile suggests a beneficial mix for those aiming to navigate and profit from the day’s volatility, making NFLX a standout option in the day trading arena.

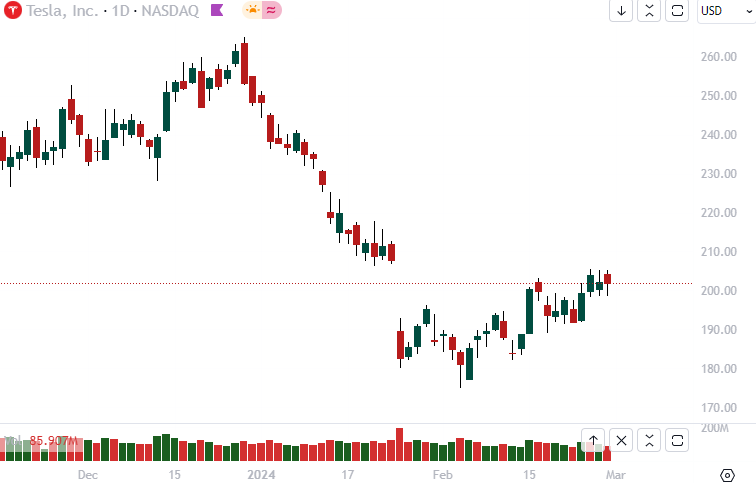

Capitalizing on TSLA's Dynamic Market Movements for Day Trading

TSLA stands out for its day trading environment. With a ratio of spread to ADR at 0.5322, TSLA presents a higher cost in relation to its daily price movements. However, this is counterbalanced by an impressive ADR of 8.87, showcasing the stock's potential for wide intraday swings. Paired with an annualized volatility of 0.564, TSLA becomes an attractive proposition for traders who thrive on significant price fluctuations. This combination of high volatility and extensive daily range offers traders ample opportunity to execute profitable trades within the day. For those adept at managing risk and capturing momentum, TSLA’s profile provides a fertile ground for leveraging its volatility, making it a good candidate among the best stocks for day trading.

Navigating AMD's High Volatility for Profitable Day Trading

Among the top choices for day traders, AMD has the highest annualized volatility of 0.577 among the seven stocks introduced in this article. This volatility signifies the potential for substantial intraday and weekly price fluctuations, offering traders opportunities to convert intraday trades into swing trades with significant potential. Therefore, AMD's blend of considerable daily ranges and high volatility suits traders looking for stocks that can provide significant movement. For those skilled in fast-paced trading environments, AMD offers a compelling mix of challenge and opportunity, making it an essential consideration for anyone seeking to capitalize on the best stocks for day trading.

Maximizing Profits

Success in day trading hinges not just on selecting the best stocks for day trading but also on employing effective strategies to maximize profits and minimize risks. The volatile nature of day trading can offer significant returns, but without a disciplined approach, it's easy to succumb to losses. Here, we explore key strategies that can help traders make the most of their day trading endeavours, focusing on the importance of a disciplined trading plan and the value of continuous learning.

Conclusion

In wrapping up, navigating the complexities of day trading demands a strategic approach, especially when identifying and leveraging the best stocks for day trading. This article has delved into the essence of day trading, highlighting the paramount importance of selecting stocks that not only promise substantial daily movements but also embody the liquidity and volatility essential for swift trades. Strategies such as momentum trading, scalping, and the use of technical indicators have been showcased as pivotal in maximizing profits while keeping risks at bay. Furthermore, the significance of continuous learning and adapting to market dynamics cannot be overstated. For traders aiming to excel, focusing on the best stocks for day trading, armed with a disciplined trading plan and an unwavering commitment to risk management, is the cornerstone of success. As we conclude, remember that the journey to day trading proficiency is ongoing, with each trade providing a new opportunity to refine your strategy and enhance your trading acumen. Now the next step is to visit our account opening page to get started.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts