NFP Trading Strategy: Capturing NFP Momentum

BY Janne Muta

|กุมภาพันธ์ 12, 2567NFP trading strategy that actually works when trading the Non-Farm Payrolls (NFP) report is what most Forex traders seek after. In this article we will provide you with a strategy that has significant potential and as such provides a great starting point for further research and strategy fine tuning.

Once you are ready visit our account opening page to get started.

Brief overview of Non-Farm Payrolls

The Non-Farm Payrolls report issued by the US Bureau of Labour Statistics, stands as a crucial economic indicator for Forex, equity and bond traders. This comprehensive data release, which excludes farm-related employment but includes government, private sector, and non-profit positions, serves as a barometer for the US economy's vitality.

Its significance is multifaceted, impacting not only currency values but also shaping investor sentiment and monetary policy direction.

The three key takeaways from this NFP trading strategy article

- The article presents a robust trading strategy specifically designed for the volatility seen during Non-Farm Payroll (NFP) releases, which includes placing pending orders before the report is published to exploit the expected market movements.

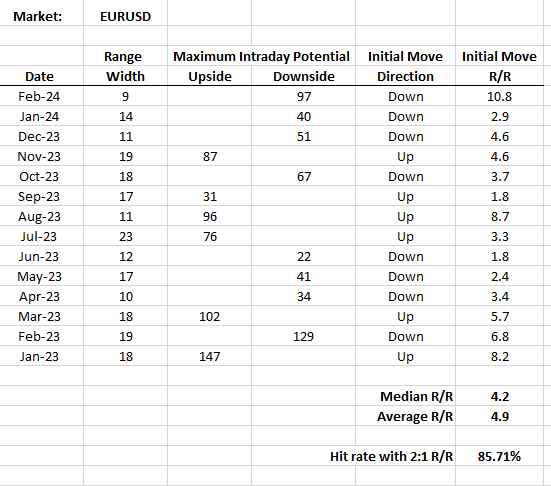

- Throughout the test period from January 2023 to February 2024, our NFP trading strategy was applied to 14 NFP reports and demonstrated a high hit rate of 85.71%, indicating a high level of consistency in achieving the desired outcomes when utilising this trading approach.

- The strategy emphasises setting take-profit targets based on a 2:1 reward-to-risk ratio, which is supported by back-tested results, showing the range of maximum intraday reward-to-risk values recorded on NFP Fridays. The discussion of these results provides valuable insights into the potential profitability and effectiveness of the strategy.

Economic Indicators and Forex Dynamics

Forex markets are particularly sensitive to the NFP figures due to their implications on interest rates, which are directly influenced by economic health indicators. A strong NFP report, indicating robust employment growth, suggests a thriving economy.

This often leads to speculation about potential interest rate hikes by the Federal Reserve to curb inflation, which can result in a stronger US dollar. Conversely, weak employment growth can signal an economic slowdown, prompting the Fed to lower interest rates to stimulate spending and investment, which might weaken the dollar against other currencies.

Market participants around globe employ an NFP trading strategy or strategies at the time of the monthly NFP release, as it can precipitate significant volatility in the markets. Rapid adjustments in currency pairs, particularly those involving the US dollar, are common in the aftermath of the report.

Thus, understanding and interpreting NFP data is essential for forex traders, who must gauge how variations in employment figures affect currency trends, investor confidence, and economic forecasts.

The NFP report also offers insights into sectoral employment changes, providing traders with a detailed understanding of which sectors are expanding or contracting. This information can guide trading decisions, as traders align their strategies with the broader economic narrative revealed by the NFP data.

Pre-NFP Release Analysis

Pre-NFP release analysis is crucial for traders aiming to navigate the forex market effectively. This process involves a detailed examination of market expectations and forecasts related to the Non-Farm Payroll (NFP) data. By analysing historical NFP figures and their subsequent impact on the market, those trading an NFP trading strategy can gain insights into potential market movements following the upcoming release.

Implications of Strong Employment Numbers

Employment numbers could have different interpretation among traders and investors depending on the central bank rate cycle. Strong employment numbers and high earnings signal robust economic growth and potentially rising inflation. Traders scrutinize these indicators for their likely influence on Federal Reserve policies.

When the economy exhibits signs of overheating, marked by high employment and wage increases, the Fed may opt to raise interest rates to curb inflation. Such actions generally result in a weaker bond market, evidenced by higher yields, which can concurrently bolster the US dollar while exerting downward pressure on the stock market.

Response to Weak Job Growth

Conversely, weaker job growth and lower earnings suggest a cooling economy, potentially eliminating the need for rate hikes. In scenarios where the Fed is focused on stimulating the economy, such as during periods of quantitative easing, lower employment growth could prompt further monetary easing measures.

This, in turn, strengthens the bond market through lower yields, leading to a softer USD and a buoyant stock market.

Some NFP trading strategies hinge on interpreting these economic indicators. In this article, however, we focus on price action strategies that take advantage of volatility increases right after the NFP numbers are out. Therefore, the interpretation of the employment data is not important as the strategy relies on volatility expansion that usually happens following the data release.

NFP Trading Strategy

Intraday traders leverage various strategies and patterns to capitalise on market movements during NFP releases, known for their volatility and potential to generate significant price swings. Some traders employ moving averages while others try to spot market reversals. In the following, we, however, study a range breakout strategy, one of the most reliable NFP trading strategies as it benefits from the sudden volatility increase that follows the release of the US employment report.

Range Breakout Strategy for EURUSD

This strategy involves preparing for the NFP release by analysing the price action prior to the NFP release. Just before the employment numbers are released (during the preceding 10 minutes), focus on the 90-minute price range (starting at noon GMT and ending at 1:30 GMT) before the news and draw horizontal lines on both ends of the range.

In this NFP trading strategy we place pending orders on the EURUSD chart, a buy-stop order above the range high (range high plus one pip) and a sell-stop order below the range low (range low minus one pip). These stop orders are used to open new trades at the time of volatility expansion that follows the NFP release. This approach therefore, is the opposite of mean reversion trading as it capitalises on volatility breakouts.

Protective Stop Loss Placement

Remember to also place protective stop loss orders at the opposite end of the 90-minute range. So, using the above chart as an example, the protective stop for the long entry buy stop is placed below the range (where the short entry stop is). Conversely, the protective stop for the short entry stop is placed above the range (where the long entry stop is).

Risk Management Considerations

Note that you should adjust the trade size of your NFP trading strategy to the distance between the trade entry stops and the protective stops to keep the risk per trade in line with your risk management plan. New traders should be conservative with their risk exposure until their trading statistics justify higher risk per trade.

Managing Slippage and Risk

The market tends to move fast right after the NFP release so prepared to see some slippage when you run this NFP trading strategy and take this into account when deciding how much to risk per trade. The wider the stop (the distance from the actual trade entry price to the protective stop order) the smaller the trade size should be.

Remember that trading is never about getting rich quickly. Instead, it's about playing the odds within strict risk parameters set by the trading plan and finding a repeatable business model (a set of strategies that have positive expectancy). The risk parameters, providing they are appropriate (e.g. max 2% risk per trade relative to the account size), make sure no oversized losses occur that would threaten the trader's survival.

Therefore, it's better to err on the side of risk aversion until your trading statistics prove that you are an excellent trader capable of running a profitable trading business.

Executing Orders Efficiently

You have to be relatively fast when placing the orders during the last couple of minutes before the NFP data comes out at 1.30 pm GMT. Here's a tip that helps you to act fast.

If you have the orders ready (complete with trade entry stops, protective stops and take profit targets) on your chart but removed away from the price action, you can quickly adjust them by dragging the orders to the range high and low during the last minutes preceding the NFP data release.

Setting Take-Profit Targets

The take-profit targets of this NFP trading strategy should be at least twice as big as the stops giving your strategy at least a 2:1 reward-to-risk ratio. However, you can study historical charts to define the optimal strategy parameters as there have been occasions when EURUSD has moved as much as 16 times the 90-period range that preceded the NFP announcement.

Such a move was last seen on February 2, 2024, as the US employment numbers exceeded the analyst consensus expectation by a wide margin. This rallied the dollar as the rate cut expectations had to be rolled back.

The following charts provide you with several examples of how the strategy has performed recently.

January 2024 Employment Report

On February 5, EURUSD ranged between 1.0877 and 1.0886 before the news event. This nine-pip range was resolved to the downside after the Non-Farm Employment Change came in at 353K, massively above the 187K analyst consensus had predicted. The market moved 85 pips to 1.0792 during the first 30 minutes.

That's 9.4 times the range width that preceded the NPF release. Our NFP trading strategy aims for 2:1 reward to risk ratio but you should test how different R/R targets impact the strategy performance.

December 2023 Employment Report

On January 5th, EURUSD was moving inside a 1.0914 - 1.0928 range before the NFP release. Once the numbers were released the market first moved down by 37 pips and then reversed. As a result, another trade was triggered (this time long) on the other side of the range and moved 84 pips.

This time the deviation between the actual number and the market expectation was not as big as in February, resulting in more moderate moves and market whipsawing on both sides of the pre-NFP range.

While the initial move did not provide a 2:1 reward-to-risk ratio trade, the second breakout move to the upside did. The first move might have been stopped at breakeven, depending on your risk management strategy. As you can see there are several ways to fine-tune our NFP trading strategy. Just remember to do proper back testing with historical data to assess the impact of these changes to the trade results.

November 2023 Employment Report

In December 2023 the NFP release came out on Friday the 8th and moved EURUSD by 51pips after the market had traded inside an 11-pip range before the data release. Again the market provided more than 2:1 reward to risk ratio (R/R ratio) trade. Note that slippage will have an impact on the R/R ratio. Greater slippage results in a smaller R/R ratio.

NFP Trading Strategy Back Test

We studied all the NFP releases between January 2023 to the time of writing this article (February 2024) and found that this strategy performed well during the test period. Our research didn't factor in slippage so traders are advised to test the strategy either using a demo account or small trade sizes to avoid oversized losses.

Assessing Reward-to-Risk Ratios

The average reward-to-risk (R/R) ratio during the test period stands at a commendable 4.9, hinting at the strategy's potential to deliver substantial returns against the risk undertaken for each trade. Nevertheless, the mean R/R ratio doesn't shed light on the full spectrum of outcomes, especially the presence of any potential anomalies that might skew the average.

To really understand the potential of this NFP trading strategy it's crucial to examine both the median R/R ratio, which is 4.2, and the win-loss ratio to acquire a more solid evaluation of the strategy's efficacy. However, these statistics assume the trader would be able to catch the maximum potential each trade which obviously is not possible.

Hit rate and slippage

Therefore, it makes sense give more weight on success rate with a two to one reward to risk ratio. With a target of a 2:1 R/R, the strategy hit the target on 12 out of 14 trades during the test, resulting in a success rate of 85.71%.

This is a very high success rate but traders should factor in slippage which this test ignores. It is likely that the actual results for this NFP trading strategy are less favourable due to slippage.

Slippage can be a considerable factor during high-volatility events like the NFP release. Since slippage can markedly impact the anticipated R/R ratio, it should be factored into the risk analysis. Simulating live trading conditions, inclusive of slippage, would yield a more accurate assessment of the strategy's true performance.

Extending the Back Test Period

While the backtest spans an entire year, this duration might not suffice to authenticate the strategy across diverse market conditions. Market reactions to the NFP figures could vary due to economic cycles and shifts in central bank policies.

Therefore, it's advisable to extend the backtest of any NFP trading strategy to cover a range of economic conditions for a thorough appraisal of the strategy's durability.

Additionally, it's worth noting that this test accounted solely for the initial movement following the NFP data release. Further research is recommended to determine if there are benefits to be gained from also trading the secondary breakout move in the opposite direction, which could potentially enhance a trader's outcomes.

Conclusion

To conclude, the NFP trading strategy detailed in this article, with its focus on capitalising on the heightened volatility post-NFP announcement, has shown promising backtest results with an impressive average reward to risk ratio.

We hope this gives you a framework to formulate your own NFP trading strategy. To get started on your path to success with mean reversion trading, simply visit our account opening page to open your trading account with us.

Traders are encouraged to extend their analysis to cover a broader span of market conditions and to incorporate the effects of slippage into their strategy back testing and evaluation. By doing so, you can increase the robustness of this NFP trading strategy and get to know the strengths and weaknesses of this particular trading strategy.

Ultimately, the strategy's success hinges on disciplined risk management and traders ability to run the strategy within his or her risk parameters. Thorough back testing that has revealed both the weakness and strengths of the strategy is paramount in laying the groundwork for this ability.

Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Never deposit more than you are prepared to lose. Professional client’s losses can exceed their deposit. Please see our risk warning policy and seek independent professional advice if you do not fully understand. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions including, but not limited to, USA & OFAC. The Company holds the right to alter the aforementioned list of countries at its own discretion.

Join us on social media

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.