EURUSD Technical Analysis | Schnabel says ECB rate hike is unlikely

BY Janne Muta

|December 7, 2023EURUSD Technical Analysis - EURUSD traded lower earlier this week as ECB hawk Schnabel suggests the central bank might pause the rate hikes. At the same time traders focus on US employment data and the NFP release tomorrow. The US labour market has showed signs of cooling this week. Unemployment claims rose to 220K, nearing the forecast of 222K and marking the second-highest figure since September.

This, along with the ADP employment change report, which fell short of expectations with only 103K new jobs in November, indicates a slowdown. The service sector remains strong, however, contributing 117K new positions.

There was also a notable drop in job openings to 8.733 million, the lowest since March 2021, and a 1.2% decrease in Q3 Unit Labor Costs further support this trend. The probability of a Federal Reserve rate cut in March is now 60%, with expectations of five cuts in 2024.

In contrast, the Eurozone's economic outlook is mixed. October saw a modest 0.1% increase in retail sales, boosted by Germany's surprising 1.1% rise. Yet, Germany's factory orders in October plummeted by 3.7%, underscoring weaknesses in the industrial sector.

Despite a surge in transport equipment orders, machinery and equipment orders fell by 13.5%. These mixed signals might lead the European Central Bank to consider an early rate cut, especially in light of lower-than-expected CPI and weak overall economic data. ECB member Isabel Schnabel hinted that a rate hike seems unlikely under current conditions.

Summary of This EURUSD Technical Analysis Report:

- EURUSD has traded lower this week after last week the USD became oversold and started to rally. This decline has taken the market to a key market structure level at 1.0756, where the decline paused today.

- If this support level is strong enough to trigger a bounce, we could see a move to the 1.0830 - 1.0850 range. Alternatively, if the price falls below 1.0756, a move to 1.0706 could become likely.

- EURUSD has broken out of a bearish 4-hour trend channel, suggesting that the downside momentum may be slowing down. However, for the market to reverse the downtrend in this timeframe, it needs to decisively breach the 1.0804 market structure level.

Read the full EURUSD technical analysis report below.

EURUSD Technical Analysis

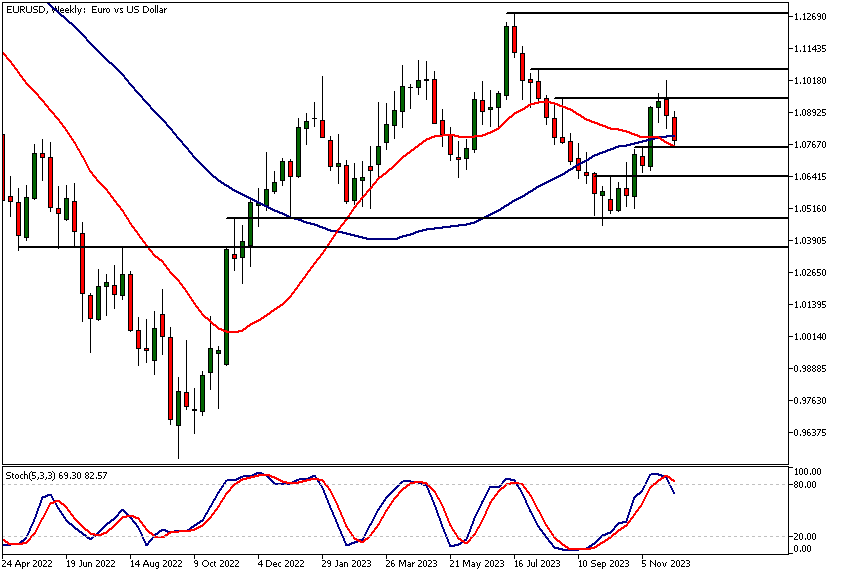

Weekly EURUSD Technical Analysis

EURUSD has traded lower this week after last week the USD became oversold and started to rally. This decline has taken the market to a key market structure level at 1.0756, where the decline paused today.

If this support level is strong enough to trigger a bounce, we could see a move to the 1.0830 - 1.0850 range. Alternatively, if the price falls below 1.0756, a move to 1.0706 could become likely. Indicator-oriented EURUSD technical analysis provides mixed signals, with moving averages pointing in different directions and the stochastic oscillator in the overbought area.

Daily EURUSD Technical Analysis

In the daily timeframe chart, EURUSD had been trading lower for six days before responding with an upward movement from the critical 1.0756 support level today.

Indicator-based EURUSD technical analysis on the daily timeframe suggests that the market remains bullish. Both moving averages are trending higher, with the 20-period moving average positioned above the 50-period SMA.

However, it's essential to exercise caution and consider the recent significant downward movement when interpreting these indications. The stochastic oscillator indicates that the market is deeply oversold, with the stochastic value currently at 7.32.

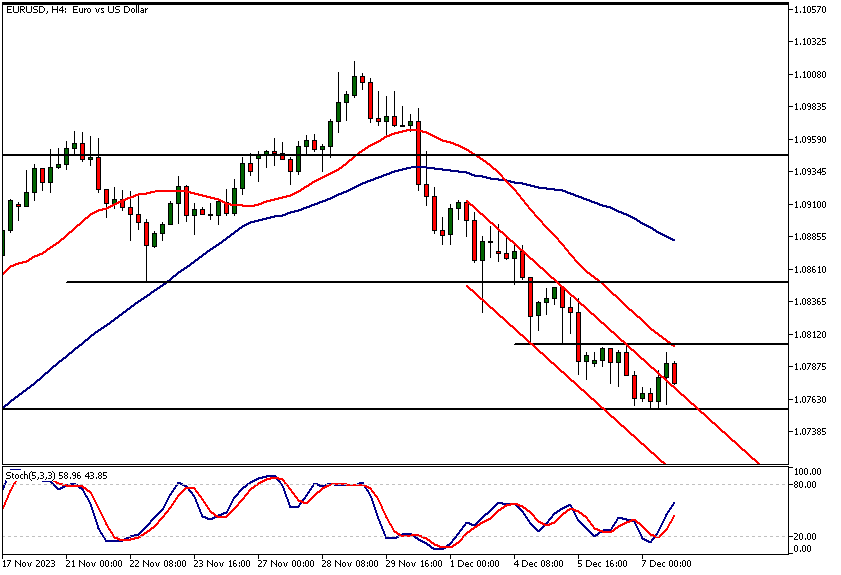

EURUSD Technical Analysis, 4h Chart

EURUSD has broken out of a bearish 4-hour trend channel, suggesting that the downside momentum may be slowing down. However, for the market to reverse the downtrend in this timeframe, it needs to decisively breach the 1.0804 market structure level.

Technical confluence

This level closely aligns with the 20-period moving average and could therefore be a significant price level in this timeframe. A decisive rally above 1.0804 could lead to the market trading at 1.0898 and possibly extending to 1.0912.

On the other hand, a decisive break below the 1.0757 support level could push the market down to the 1.0706 level mentioned in the weekly EURUSD technical analysis section above.

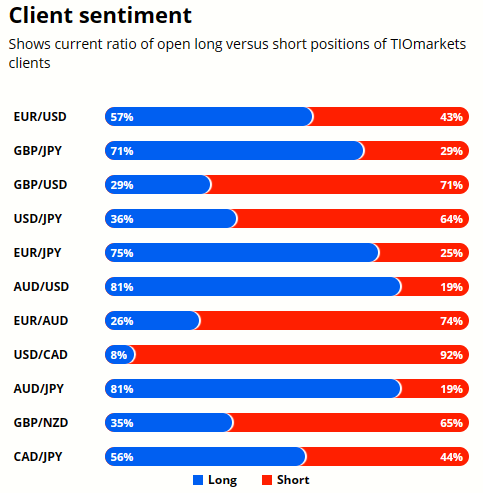

Client sentiment analysis

TIOmarkets' clientele are slightly bullish on EURUSD , with 57% of clients holding long positions and only 43% favouring the short side.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market:

- USD - Average Hourly Earnings

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- USD - Prelim UoM Consumer Sentiment

- USD - Prelim UoM Inflation Expectations

Potential EURUSD Market Moves

EURUSD has traded lower this week after last week the USD became oversold and started to rally. This decline has taken the market to a key market structure level at 1.0756, where the decline paused today.

If this support level is strong enough to trigger a bounce, we could see a move to the 1.0830 - 1.0850 range. Alternatively, if the price falls below 1.0756, a move to 1.0706 could become likely.

How would you trade the EURUSD today?

I hope this EURUSD technical analysis report helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.