EURUSD Technical Analysis | The market rallies as US bond yields drop

BY Janne Muta

|November 23, 2023EURUSD Technical Analysis - The EURUSD has rallied over 4,7% since the US bond yields started moving lower after peaking in October. Futures traders bet that the Fed might enact four rate reductions starting as early as May 2024. Presently Fed Funds Futures point to an approximately 45% chance of Fed initiating rate cuts in May.

Yesterday, US unemployment claims dropped to 209K, indicating a more robust labour market, as evidenced by the declining four-week average. This positive trend is offset by a stagnation in core durable goods orders and a significant 5.4% reduction in total durable goods orders, suggesting a cautious approach to business investment and possible slowdowns in manufacturing.

At the same time, a marginal increase in consumer sentiment to 61.3 points towards a growing confidence among consumers, which could positively impact consumer expenditure.

Here in Europe, the slight rise in the German composite PMI release earlier today suggests a deceleration in economic contraction, but both Services and Manufacturing PMIs below 50 highlight continued challenges.

Positive signs include stabilized service sector staffing and less decline in new work, but manufacturing remains weak. Inflation remains a concern, with increases in charges for goods and services and rising input costs.

The data may increase speculation that the ECB may remain hawkish. The central bank is committed to returning inflation to its 2% target, maintaining high interest rates for an extended period until this goal is achieved.

Summary of This EURUSD Technical Analysis Report:

- The EURUSD currency pair has rallied over 470 pips since the October low. This move has taken the market to a key technical confluence area, marked by a rising trend line resistance and a market structure level at 1.0945. Last week, the upside momentum was strong, but this week, after moving to this confluence area, EURUSD rally has slowed down.

- EURUSD has lost some of its earlier upside momentum, but the market has still created two higher lows at 1.0825 and 1.0852, indicating that the bulls are still trying to push the market higher. Therefore, as long as renewed buying comes in at or above the 1.0825 level, the EURUSD bias remains bullish. Below 1.0825, look for a move to 1.0788. If EURUSD can rally decisively above 1.0965, a move to 1.1065 could be likely.

- The recent strength in EURUSD is attributed to anticipated Fed rate cuts from May 2024. In contrast, Europe shows signs of economic stabilization, despite ongoing challenges. The ECB's firm stance on high interest rates to control inflation has strengthened the EURUSD.

Read the full EURUSD technical analysis report below.

EURUSD Technical Analysis

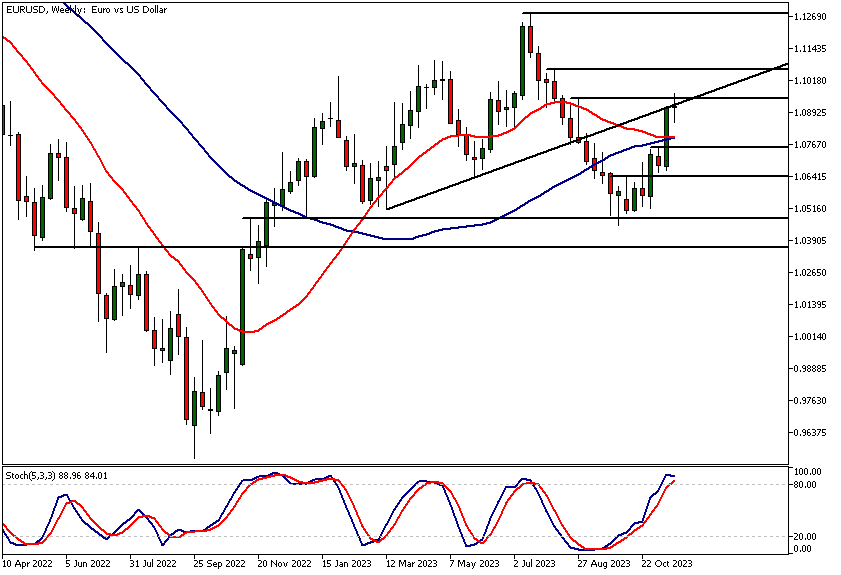

Weekly EURUSD Technical Analysis

The EURUSD currency pair has rallied over 470 pips since the October low. This move has taken the market to a key technical confluence area, marked by a rising trend line resistance and a market structure level at 1.0945. Last week, the upside momentum was strong, but this week, after moving to this confluence area, EURUSD rally has slowed down.

Indicator-based EURUSD technical analysis suggests that the market is overbought, with the stochastic oscillator currently at 89.22. Note, however, that the recent upside momentum in the market, together with the expectation that the Fed is likely to cut rates next year, suggests that EURUSD could remain bullish.

Potential counter trend moves

This doesn't mean counter-trend retracements won't happen. Instead, as we know, all trends consist of directional moves and retracements. Therefore, the market might retrace some of the earlier upward move, but in the current context, we could see renewed buying at key support levels. Hence, price action analysis remains the key to understanding the market direction.

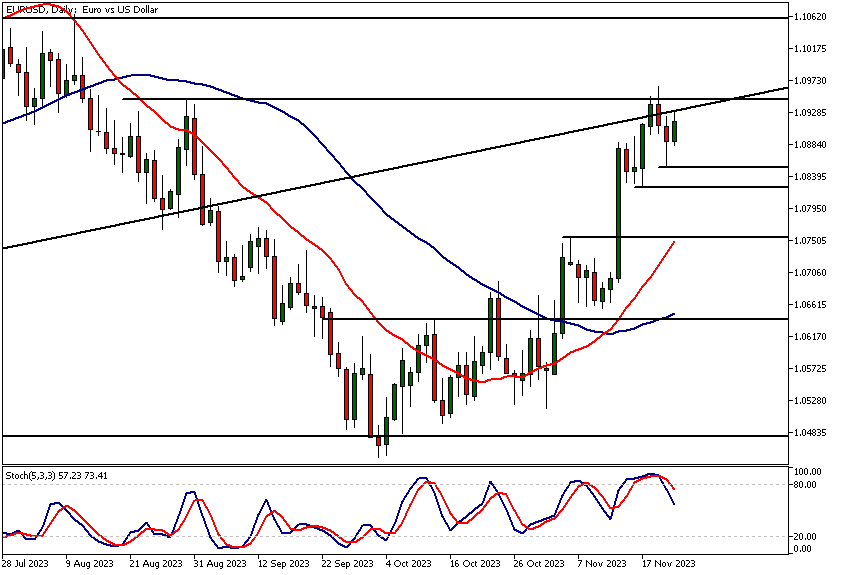

Daily EURUSD Technical Analysis

EURUSD has lost some of its earlier upside momentum, but the market has still created two higher lows at 1.0825 and 1.0852, indicating that the bulls are still trying to push the market higher.

Therefore, as long as renewed buying comes in at or above the 1.0825 level, the EURUSD bias remains bullish. Below 1.0825, look for a move to 1.0788. If EURUSD can rally decisively above 1.0965, a move to 1.1065 could be likely.

Bullish indicators

According to indicator-oriented EURUSD technical analysis the market remains bullish, even though the stochastic oscillator is currently in the overbought zone. The 20-period moving average is above the 50-period SMA, and both moving averages are pointing higher.

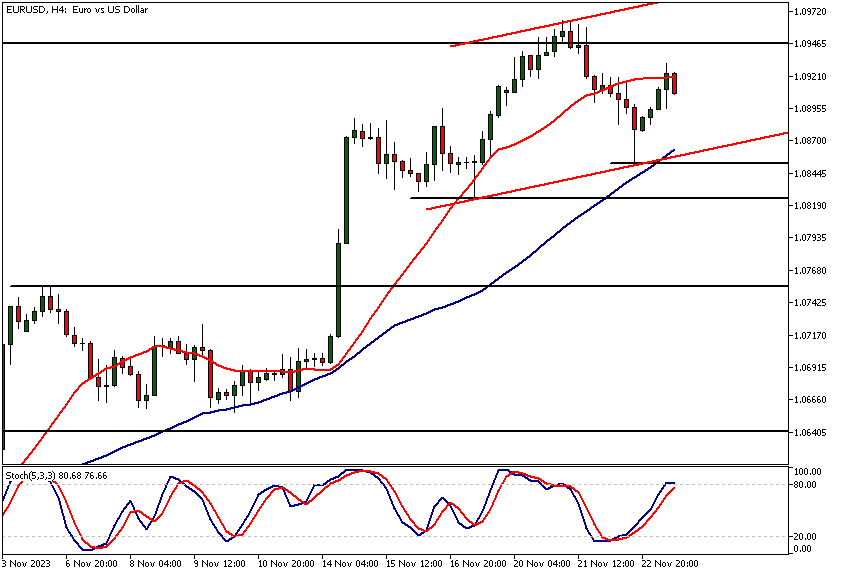

EURUSD Technical Analysis, 4h Chart

In the 4-hour chart, EURUSD is clearly in an uptrend with two consecutive higher lows at 1.0825 and 1.0852. These two swing points create the lower end of the ascending trend channel, with the 50-period moving average aligning with it.

Indicator-based EURUSD technical analysis suggests that the market is trending higher with healthy momentum, as the 20-period moving average is well above the 50 SMA, even though the stochastic oscillator is in the overbought territory.

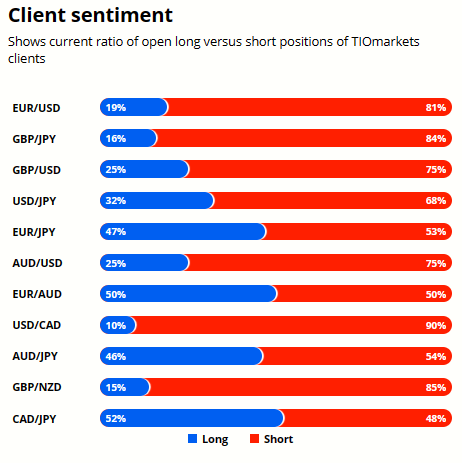

Client sentiment analysis

TIOmarkets' clientele are very bearish on EURUSD , with 81% of clients holding short positions and only 19% favouring the long side.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market:

- USD - New Home Sales

- USD - S&P/CS Composite-20 HPI

- USD - CB Consumer Confidence

- USD - Richmond Manufacturing Index

- USD - FOMC Member Waller Speaks

- EUR - German Prelim CPI

- EUR - Spanish Flash CPI

- USD - Prelim GDP

- USD - Prelim GDP Price Index

- EUR - Core CPI Flash Estimate

- EUR - CPI Flash Estimate

- USD - Core PCE Price Index

- USD - Unemployment Claims

- USD - Chicago PMI

- USD - Pending Home Sales

- USD - ISM Manufacturing PMI

- USD - ISM Manufacturing Prices

- USD - Fed Chair Powell Speaks

Potential EURUSD Market Moves

EURUSD has lost some of its earlier upside momentum, but the market has still created two higher lows at 1.0825 and 1.0852, indicating that the bulls are still trying to push the market higher.

Therefore, as long as renewed buying comes in at or above the 1.0825 level, the EURUSD bias remains bullish. Below 1.0825, look for a move to 1.0788. If EURUSD can rally decisively above 1.0965, a move to 1.1065 could be likely.

How would you trade the EURUSD today?

I hope this EURUSD technical analysis report helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Related Posts

Trade responsibly: CFDs are complex instruments and come with a high risk of losing all your invested capital due to leverage.